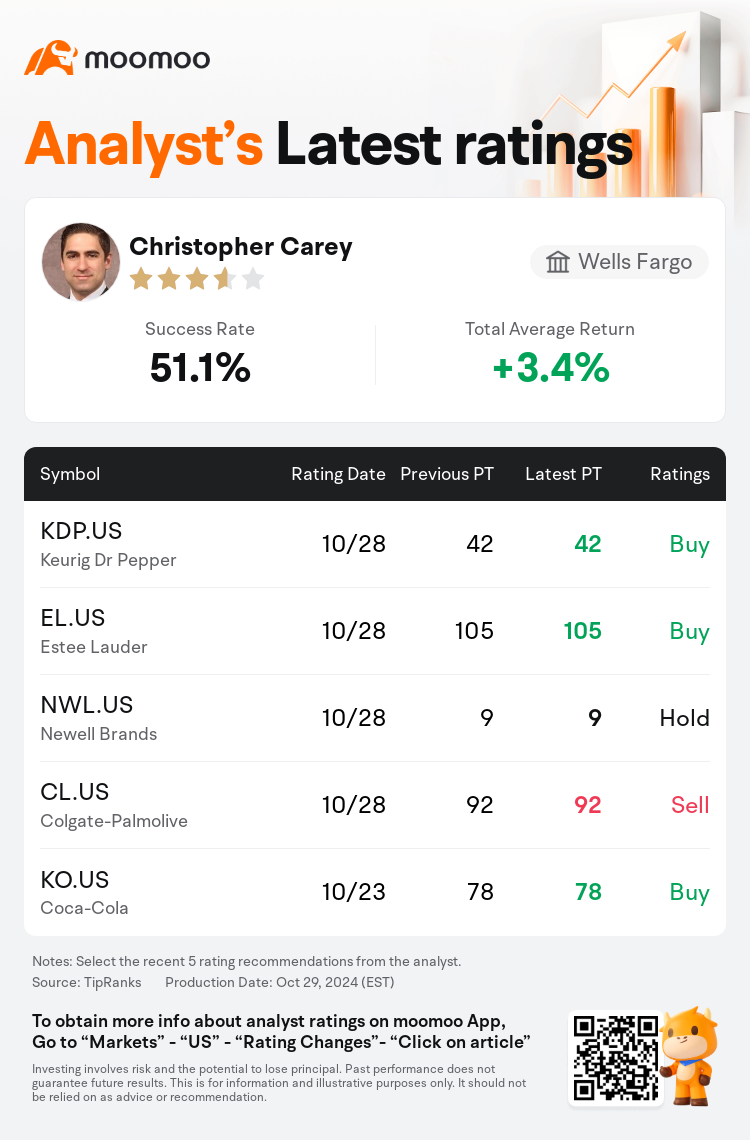

Wells Fargo analyst Christopher Carey maintains $Keurig Dr Pepper (KDP.US)$ with a buy rating, and maintains the target price at $42.

According to TipRanks data, the analyst has a success rate of 51.1% and a total average return of 3.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Keurig Dr Pepper (KDP.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Keurig Dr Pepper (KDP.US)$'s main analysts recently are as follows:

There were numerous details to consider following Keurig Dr Pepper's earnings update. Although there are still some unresolved questions, it's believed that the company is steadfast in achieving 7% earnings growth by 2025.

Keurig Dr Pepper experienced what was characterized as 'disappointing' Q3 outcomes within its U.S. coffee segment, falling short in terms of sales and profit despite a positive performance in U.S. refreshment beverages. The shortfall in the coffee business was largely due to unfavorable pricing, accompanied by less-than-expected coffee pod volumes. Nonetheless, the valuation of Keurig Dr Pepper is still considered appealing.

Keurig Dr Pepper's recent quarterly performance was less impressive, influenced by aggressive promotional activities in the coffee sector and international outcomes that fell marginally short of anticipations. Nonetheless, the company has seen an acceleration in total company volumes for the third successive quarter, and its earnings per share met expectations.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

富國集團分析師Christopher Carey維持$Keurig Dr Pepper (KDP.US)$買入評級,維持目標價42美元。

根據TipRanks數據顯示,該分析師近一年總勝率為51.1%,總平均回報率為3.4%。

此外,綜合報道,$Keurig Dr Pepper (KDP.US)$近期主要分析師觀點如下:

此外,綜合報道,$Keurig Dr Pepper (KDP.US)$近期主要分析師觀點如下:

在Keurig dr pepper的業績更新後,有許多細節需要考慮。儘管仍有一些未解答的問題,但人們相信該公司堅定地致力於到2025年實現7%的盈利增長。

Keurig dr pepper在其美國咖啡板塊經歷了被描述爲「令人失望」的第三季度成果,在銷售額和利潤方面表現不佳,儘管美國飲料部門表現良好。咖啡業務的不景氣主要是由於不利的定價,以及低於預期的咖啡豆容量。儘管如此,Keurig dr pepper的估值仍然被認爲具有吸引力。

Keurig dr pepper最近的季度業績並不十分令人印象深刻,受到咖啡領域激烈的促銷活動以及國際成果略低於預期的影響。儘管如此,該公司連續第三個季度看到全公司產量的加速增長,每股盈利達到預期。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Keurig Dr Pepper (KDP.US)$近期主要分析師觀點如下:

此外,綜合報道,$Keurig Dr Pepper (KDP.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of