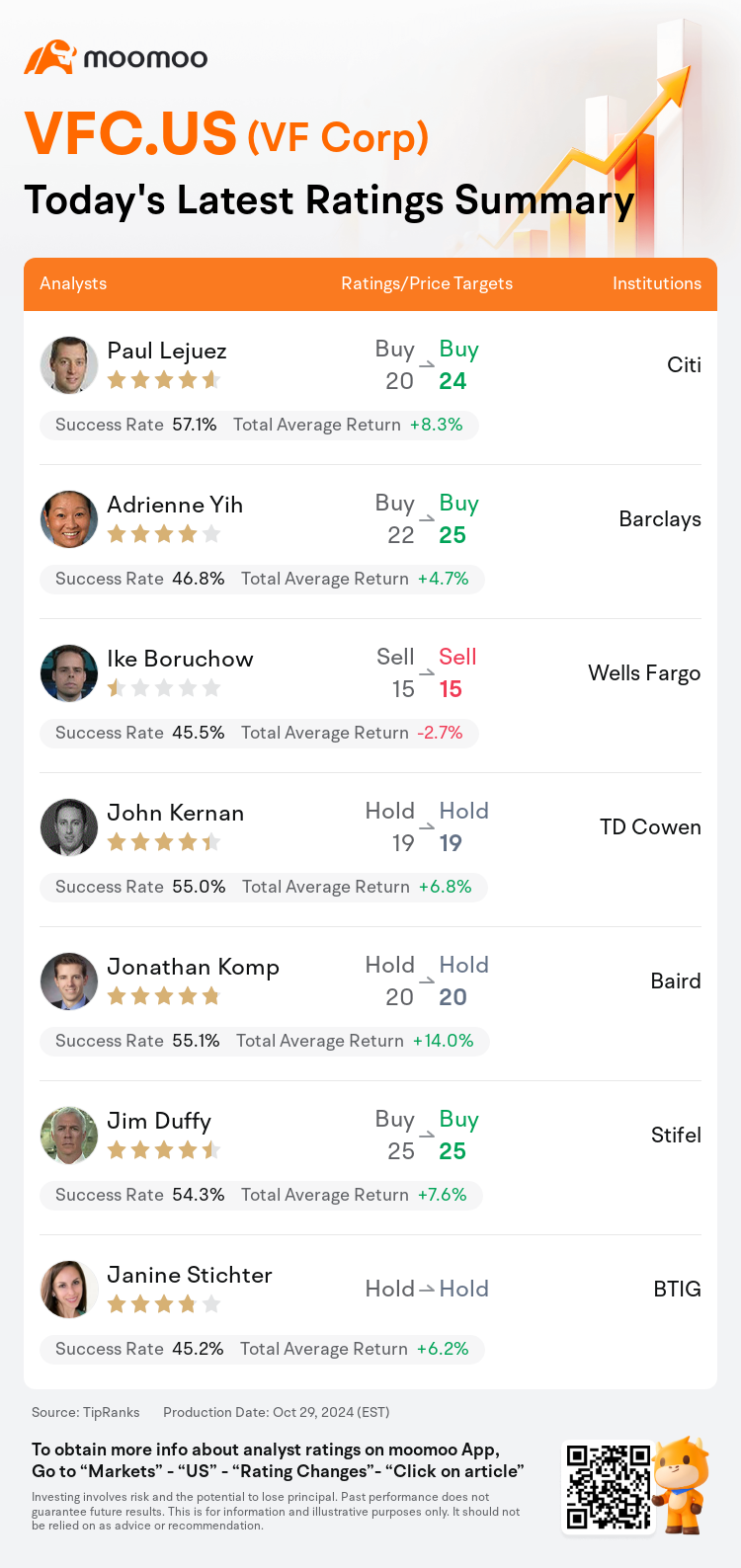

On Oct 29, major Wall Street analysts update their ratings for $VF Corp (VFC.US)$, with price targets ranging from $15 to $25.

Citi analyst Paul Lejuez maintains with a buy rating, and adjusts the target price from $20 to $24.

Barclays analyst Adrienne Yih maintains with a buy rating, and adjusts the target price from $22 to $25.

Wells Fargo analyst Ike Boruchow maintains with a sell rating, and maintains the target price at $15.

Wells Fargo analyst Ike Boruchow maintains with a sell rating, and maintains the target price at $15.

TD Cowen analyst John Kernan maintains with a hold rating, and maintains the target price at $19.

Baird analyst Jonathan Komp maintains with a hold rating, and maintains the target price at $20.

Furthermore, according to the comprehensive report, the opinions of $VF Corp (VFC.US)$'s main analysts recently are as follows:

VF Corp.'s earnings surpassed expectations, bolstered by enhanced sales, margin, and spending. Notably, the performance of Vans showed sequential improvement, which, despite not being particularly impressive, exceeded the anticipations of many investors who had braced for a less favorable outcome. The stock is anticipated to rise notably due to the prevailing negative sentiment.

VF Corp. reported a fiscal Q2 performance that surpassed expectations, yet the forecast for the second half's earnings is significantly below the consensus, as indicated in an analysis shared with investors.

VF Corp's fiscal second quarter exhibited advancement, outperforming in revenue, margin, and earnings while maintaining inventory control. The operating profit for the period fell short of the general market consensus due to an acceleration in investments aimed at propelling future growth.

VF Corp. shares experienced an upswing following the release of earnings per share that surpassed expectations along with the reinstatement of quarterly guidance. Indications from the third-quarter revenue guidance imply that there is a sequential improvement in trends moving into the second half of the year.

The firm observed that VF Corp.'s Q2 results surpassed expectations. They also acknowledged the company's guidance for revenue/EBIT in the third fiscal quarter was below consensus and adjusted their Free Cash Flow forecast for fiscal year 2025 to reflect an additional $50M in investments. Nonetheless, there was a sense of optimism regarding the company's ongoing progress.

Here are the latest investment ratings and price targets for $VF Corp (VFC.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月29日,多家華爾街大行更新了$威富集團 (VFC.US)$的評級,目標價介於15美元至25美元。

花旗分析師Paul Lejuez維持買入評級,並將目標價從20美元上調至24美元。

巴克萊銀行分析師Adrienne Yih維持買入評級,並將目標價從22美元上調至25美元。

富國集團分析師Ike Boruchow維持賣出評級,維持目標價15美元。

富國集團分析師Ike Boruchow維持賣出評級,維持目標價15美元。

TD Cowen分析師John Kernan維持持有評級,維持目標價19美元。

貝雅分析師Jonathan Komp維持持有評級,維持目標價20美元。

此外,綜合報道,$威富集團 (VFC.US)$近期主要分析師觀點如下:

威富集團的收益超出預期,得益於增強的銷售、利潤和支出。值得注意的是,Vans 的表現呈現出順序改善,儘管並不特別出色,卻超出了許多投資者的預期,這些投資者原本預計結果會不太令人滿意。由於當前普遍存在負面情緒,預計該股票將大幅上漲。

威富集團報告顯示,財政第二季度的表現超出預期,但下半年收益的預測明顯低於共識,這一點在與投資者分享的分析中有所體現。

威富集團的財政第二季度取得了進展,在營業收入、利潤和盈利方面表現優異,同時保持庫存控制。但是由於加大用於推動未來增長的投資,該時期的營業利潤未達到市場普遍共識。

威富集團股票在超出預期的每股收益公佈後經歷了上漲,此外還恢復了季度指引。從第三季度營收指引的跡象來看,暗示今年下半年趨勢將有所改善。

該公司注意到威富集團的第二季度業績超出預期。他們也承認公司對第三財季營收/EBIt 的指引低於共識,並調整了對 2025 財年自由現金流的預測,以反映額外的 5000萬美元投資。儘管如此,對公司持續進展存在樂觀態度。

以下爲今日7位分析師對$威富集團 (VFC.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師Ike Boruchow維持賣出評級,維持目標價15美元。

富國集團分析師Ike Boruchow維持賣出評級,維持目標價15美元。

Wells Fargo analyst Ike Boruchow maintains with a sell rating, and maintains the target price at $15.

Wells Fargo analyst Ike Boruchow maintains with a sell rating, and maintains the target price at $15.