Revenues Tell The Story For Zhejiang Chengchang Technology Co., Ltd. (SZSE:001270) As Its Stock Soars 34%

Revenues Tell The Story For Zhejiang Chengchang Technology Co., Ltd. (SZSE:001270) As Its Stock Soars 34%

Zhejiang Chengchang Technology Co., Ltd. (SZSE:001270) shares have had a really impressive month, gaining 34% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 36% over that time.

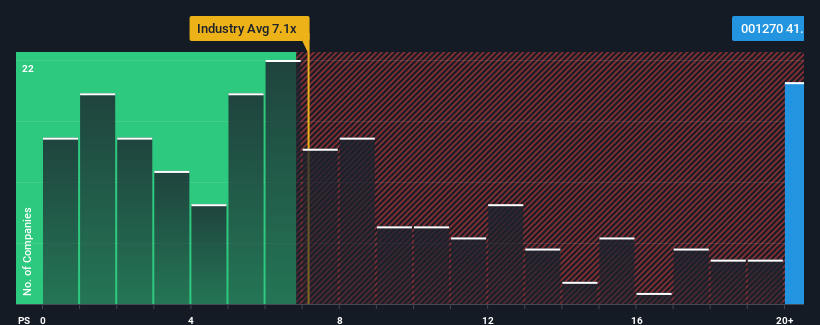

Since its price has surged higher, Zhejiang Chengchang Technology's price-to-sales (or "P/S") ratio of 41.4x might make it look like a strong sell right now compared to other companies in the Semiconductor industry in China, where around half of the companies have P/S ratios below 7.1x and even P/S below 3x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Zhejiang Chengchang Technology's Recent Performance Look Like?

Zhejiang Chengchang Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Zhejiang Chengchang Technology will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Zhejiang Chengchang Technology?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Zhejiang Chengchang Technology's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Zhejiang Chengchang Technology's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 126% over the next year. With the industry only predicted to deliver 38%, the company is positioned for a stronger revenue result.

With this information, we can see why Zhejiang Chengchang Technology is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Zhejiang Chengchang Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Zhejiang Chengchang Technology's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Zhejiang Chengchang Technology with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.