Top 3 Consumer Stocks That May Rocket Higher In Q4

Top 3 Consumer Stocks That May Rocket Higher In Q4

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

消費不可或缺板塊中最被低估的公司股票出現了買入機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

Levi Strauss & Co (NYSE:LEVI)

李維斯特拉斯股份有限公司(NYSE:LEVI)

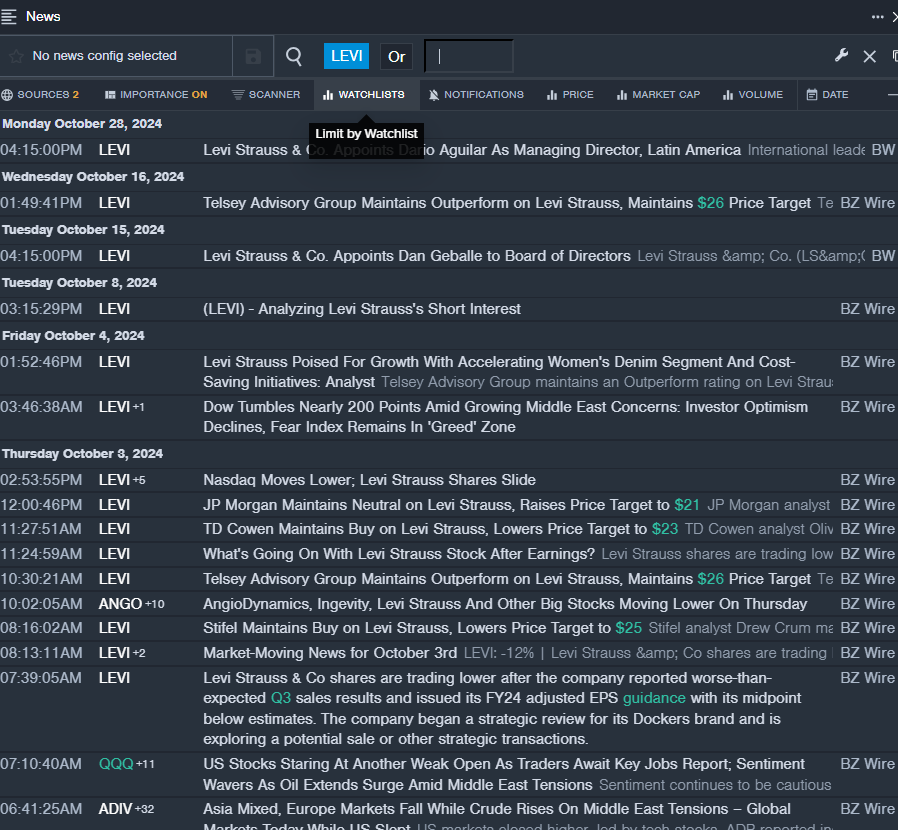

- On Oct. 28, Levi Strauss & Co. named Dario Aguilar as Managing Director, Latin America. The company's stock fell around 20% over the past month and has a 52-week low of $13.22.

- RSI Value: 29.15

- LEVI Price Action: Shares of Levi Strauss fell 0.8% to close at $17.39 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest LEVI news.

- 10月28日,李維斯特拉斯股份有限公司任命達里奧·阿基拉爲拉丁美洲董事總經理。公司股價在過去一個月下跌約20%,52周最低價爲13.22美元。

- RSI數值:29.15

- LEVI價格走勢:李維斯特拉斯股票週二下跌0.8%,收於17.39美元。

- Benzinga Pro的實時新聞提醒最新LEVI資訊。

Mohawk Industries Inc (NYSE:MHK)

莫霍克工業公司(紐交所:MHK)

- On Oct. 24, Mohawk Industries reported better-than-expected results for its third quarter. The company posted quarterly earnings of $2.90 per share which beat the analyst consensus estimate of $2.89 per share. The company reported quarterly sales of $2.719 billion which beat the analyst consensus estimate of $2.700 billion. The company's stock fell around 13% over the past five days and has a 52-week low of $76.35.

- RSI Value: 29.10

- MHK Price Action: Shares of Mohawk Industries gained 0.5% to close at $132.41 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in MHK stock.

- 莫霍克工業公司報告其第三季度的業績好於預期。該公司每股季度盈利爲2.90美元,超過了分析師的一致估計2.89美元。公司報告的季度銷售額爲27.19億美元,超過了分析師的一致估計27億美元。該公司股價在過去五天下跌約13%,52周最低價爲76.35美元。

- RSI數值:29.10

- 莫霍克工業公司股票價格走勢:週二,莫霍克工業公司的股票上漲了0.5%,收盤價爲132.41美元。

- Benzinga Pro的圖表工具幫助識別了MHK股票的趨勢。

Wayfair Inc (NYSE:W)

wayfair公司(紐交所:W)

- On Oct. 28, Wedbush analyst Seth Basham maintained Wayfair with an Outperform and lowered the price target from $60 to $50. The company's stock fell around 24% over the past month and has a 52-week low of $38.02.

- RSI Value: 29.10

- W Price Action: Shares of Wayfair fell 3.3% to close at $42.96 on Tuesday.

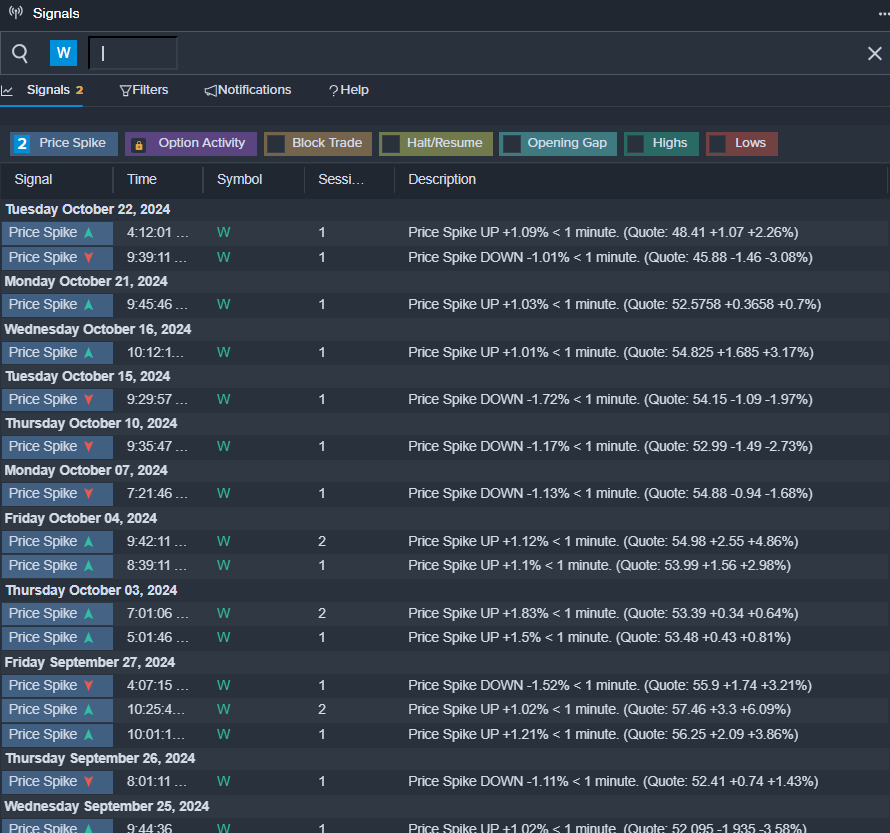

- Benzinga Pro's signals feature notified of a potential breakout in Wayfair shares.

- 在10月28日,Wedbush分析師Seth Basham維持了對wayfair的強勁表現評級,並將價格目標從60美元降至50美元。該公司股票在過去一個月內下跌了約24%,52周最低價爲38.02美元。

- RSI Value: 29.10

- wayfair股票價格走勢:週二下跌3.3%,收於42.96美元。

- Benzinga Pro的信號功能通知wayfair股票可能出現突破。

Read More:

閱讀更多:

- Top 3 Tech And Telecom Stocks Which Could Rescue Your Portfolio For October

- 十月份可能拯救您投資組合的前三家科技和電信股票