Five Star Bancorp (NASDAQ:FSBC) Pays A US$0.20 Dividend In Just Four Days

Five Star Bancorp (NASDAQ:FSBC) Pays A US$0.20 Dividend In Just Four Days

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Five Star Bancorp (NASDAQ:FSBC) is about to trade ex-dividend in the next four days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Accordingly, Five Star Bancorp investors that purchase the stock on or after the 4th of November will not receive the dividend, which will be paid on the 12th of November.

常規讀者會知道,我們在Simply Wall St非常喜愛我們的分紅派息,這就是爲什麼看到Five Star Bancorp(納斯達克:FSBC)將在接下來的四天內進行分紅除權交易令人興奮。分紅除淨日通常設定在股權登記日之前一個工作日,股權登記日是你必須登記爲該公司的股東以便獲得分紅的截止日期。分紅除淨日很重要,因爲任何股票交易都必須在股權登記日之前結算,才有資格獲得分紅。因此,凡是於11月4日或之後購買該股的五星銀行股東將不會獲得分紅,分紅將於11月12日支付。

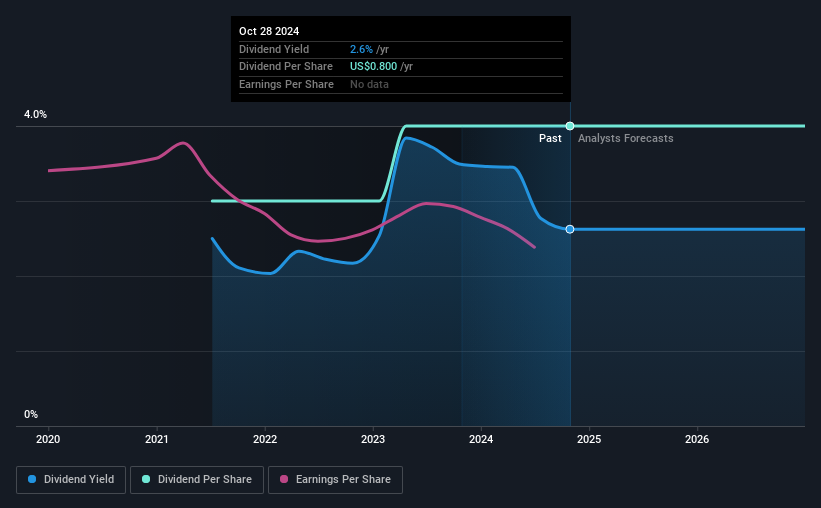

The company's upcoming dividend is US$0.20 a share, following on from the last 12 months, when the company distributed a total of US$0.80 per share to shareholders. Based on the last year's worth of payments, Five Star Bancorp stock has a trailing yield of around 2.7% on the current share price of US$30.10. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

公司即將分紅派息0.20美元/股,繼續自上一年12個月以來,當時公司總共每股派息0.80美元給股東。根據過去一年的付款情況,根據當前30.10美元的股價,Five Star Bancorp股票的滾動收益率約爲2.7%。分紅派息對許多股東來說是重要的收入來源,但業務的健康對於維持這些分紅是至關重要的。因此,我們需要檢查分紅支付是否得到覆蓋,以及收益是否在增長。

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Five Star Bancorp is paying out just 8.9% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events.

分紅派息通常來自公司盈利。如果一家公司支付的分紅超過了其利潤,那麼分紅可能就是不可持續的。Five Star Bancorp只支付了其稅後利潤的8.9%,這是相當低的,而且在不利事件發生時還有很大的餘地。

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

當一家公司支付的分紅派息比其盈利少時,通常意味着其分紅派息是可負擔的。支付的盈利比例越低,如果企業進入經濟衰退,分紅派息的安全餘地就越大。

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

點擊此處查看公司的支付比率以及未來分紅的分析師預期。

Have Earnings And Dividends Been Growing?

收益和股息一直在增長嗎?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Readers will understand then, why we're concerned to see Five Star Bancorp's earnings per share have dropped 9.9% a year over the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

收益下滑的公司對分紅股東來說風險更高。如果企業進入下行期並削減分紅,公司價值可能急劇下跌。讀者會理解我們之所以擔心看到五星銀行股票每股收益在過去五年內下降了9.9%。當每股收益下降時,可以支付的分紅最大金額也會下降。

Five Star Bancorp also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

五星銀行在過去一年中還發行了超過其市值5%的新股,我們認爲這可能會長期損害其分紅前景。在發行大量新股的同時試圖增加分紅,讓我們想起古希臘的西西弗斯傳說——永遠向上推着一塊巨石。

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Five Star Bancorp has delivered 10% dividend growth per year on average over the past three years.

許多投資者將通過評估分紅支付的變化來評估公司的分紅業績。五星銀行過去三年平均每年實現10%的分紅增長。

The Bottom Line

最終結論

Is Five Star Bancorp an attractive dividend stock, or better left on the shelf? Five Star Bancorp's earnings per share are down over the past five years, although it has the cushion of a low payout ratio, which would suggest a cut to the dividend is relatively unlikely. At best we would put it on a watch-list to see if business conditions improve, as it doesn't look like a clear opportunity right now.

五星銀行是一家有吸引力的股息股票,還是最好放在貨架上? 五星銀行的每股收益在過去五年下降,儘管具有較低的派息比率的保障,這表明減少股息的可能性相對較小。 充其量,我們會將其列入觀察名單,以看業務狀況是否改善,因爲目前看起來並不是一個明顯的機會。

So if you want to do more digging on Five Star Bancorp, you'll find it worthwhile knowing the risks that this stock faces. Every company has risks, and we've spotted 3 warning signs for Five Star Bancorp you should know about.

因此,如果您想更深入了解五星銀行,了解該股面臨的風險將是值得的。 每家公司都有風險,我們已經發現了五星銀行需要了解的3個警示信號。

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

如果你在尋找強勁的股息支付者,我們建議查看我們的頂級股息股票選擇。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the