On Oct 30, major Wall Street analysts update their ratings for $Corning (GLW.US)$, with price targets ranging from $53 to $60.

J.P. Morgan analyst Samik Chatterjee maintains with a buy rating, and sets the target price at $60.

BofA Securities analyst Wamsi Mohan maintains with a buy rating, and adjusts the target price from $51 to $56.

Citi analyst Asiya Merchant maintains with a buy rating.

Citi analyst Asiya Merchant maintains with a buy rating.

Barclays analyst Tim Long maintains with a hold rating, and maintains the target price at $53.

Deutsche Bank analyst Matthew Niknam maintains with a buy rating, and adjusts the target price from $49 to $54.

Furthermore, according to the comprehensive report, the opinions of $Corning (GLW.US)$'s main analysts recently are as follows:

Corning is beginning to reap the rewards of increased Optical growth and the utilization of its pricing power in Display, which contributed to strong Q3 outcomes and the projection of better than typical results for Q4.

Following Corning's robust third-quarter outcomes and a promising fourth-quarter forecast, expectations have been elevated. The company is reaping advantages from a variety of long-term and short-term favorable conditions within its principal sectors, which positions it for an anticipated mid-teens yearly core earnings expansion over the upcoming three years.

The company's Optical segment was the primary contributor to the third-quarter performance, and it is anticipated to continue its exceptional performance, thus diverging from the typical fourth-quarter seasonality. Additionally, the company's Display segment has begun to reflect pricing actions within the financial model, with anticipated double-digit price increases.

Analysts observed that Corning delivered robust third-quarter results, with revenues amounting to $3.7 billion and earnings per share at 54 cents, primarily driven by the sustained uptake of optical connectivity products suitable for GenAI. Looking ahead to the fourth quarter, there is an anticipation of an upward trajectory in the Optical and Hemlock segments, while a downward trend is expected in the remaining sectors.

Corning's third quarter core sales and EPS were reported to surpass expectations, with figures coming in at $3.73B and $0.54 respectively, compared to the anticipated $3.72B and $0.53. The fourth quarter guidance suggests an anticipated revenue growth of 15% and a 41% increase in EPS on a year-over-year basis. These favorable outcomes, including the guidance, are largely attributed to the performance of the Optical segment.

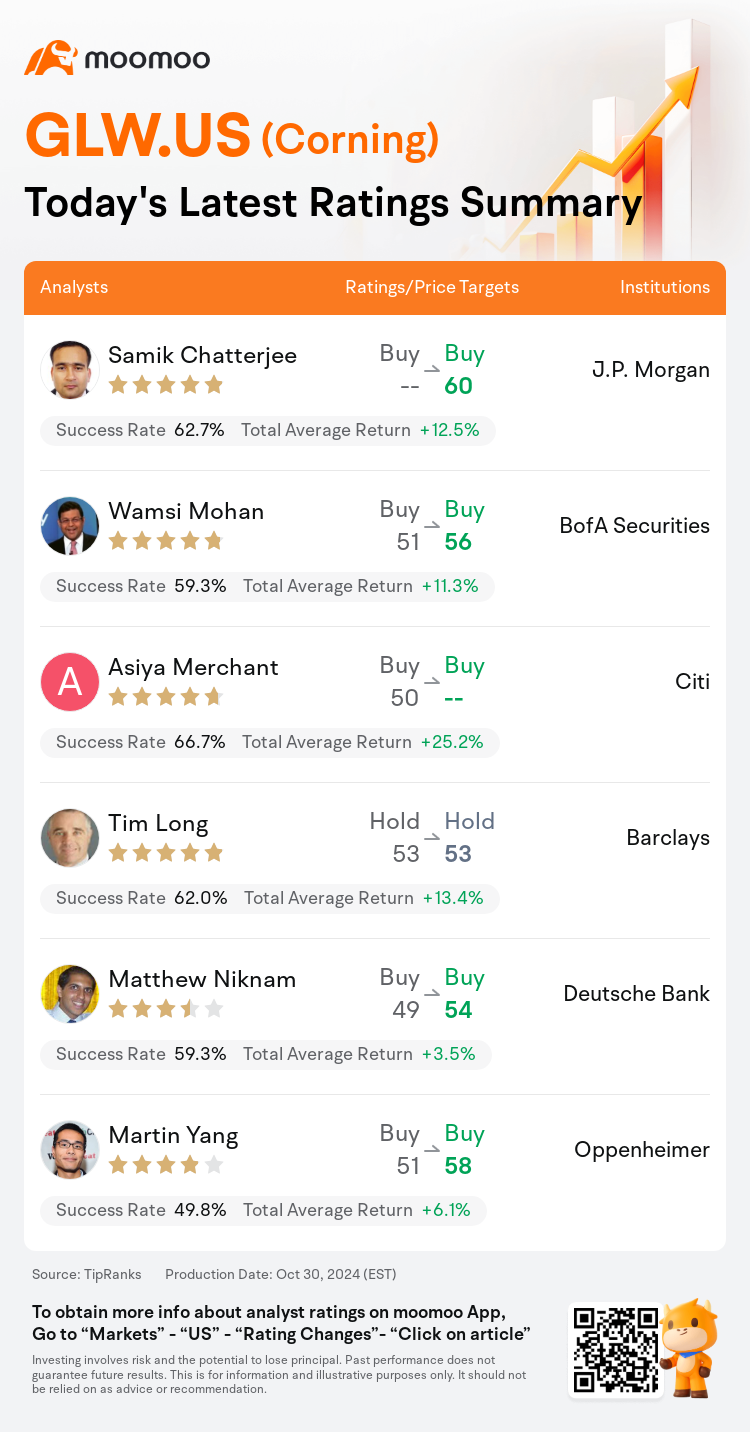

Here are the latest investment ratings and price targets for $Corning (GLW.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月30日,多家華爾街大行更新了$康寧 (GLW.US)$的評級,目標價介於53美元至60美元。

摩根大通分析師Samik Chatterjee維持買入評級,目標價60美元。

美銀證券分析師Wamsi Mohan維持買入評級,並將目標價從51美元上調至56美元。

花旗分析師Asiya Merchant維持買入評級。

花旗分析師Asiya Merchant維持買入評級。

巴克萊銀行分析師Tim Long維持持有評級,維持目標價53美元。

德意志銀行分析師Matthew Niknam維持買入評級,並將目標價從49美元上調至54美元。

此外,綜合報道,$康寧 (GLW.US)$近期主要分析師觀點如下:

康寧正開始從蘋果-顯示屏的光學增長和定價權的利用中獲益,這有助於強勁的第三季度業績和對第四季度超出典型結果的預期。

在康寧強勁的第三季度業績和有前途的第四季度預期後,市場預期已經提高。公司正在從其主要領域內多種長期和短期有利條件中獲益,這使其躋身預期未來三年年均核心收益增長可達中等十幾位數的位置。

該公司的光學部門是第三季度業績的主要貢獻者,預計將繼續其出色表現,從而偏離典型的第四季度季節性。此外,公司的顯示屏部門已開始在財務模型中反映價格行動,預計將出現兩位數的價格上漲。

分析師們注意到,康寧交出了強勁的第三季度業績,營業收入達到37億美元,每股收益爲54美分,主要受光學連接產品適用於GenAI的持續增長推動。展望第四季度,預計光學和Hemlock部門將呈上升趨勢,而其餘部門預期將出現下降趨勢。

康寧第三季度核心銷售額和每股收益報告超出預期,數據分別爲37.3億美元和0.54美元,而預期爲37.2億美元和0.53美元。第四季度指導預示預期收入增長15%,每股收益年同比增長41%。這些有利結果,包括指導,主要歸因於光學部門的表現。

以下爲今日6位分析師對$康寧 (GLW.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

花旗分析師Asiya Merchant維持買入評級。

花旗分析師Asiya Merchant維持買入評級。

Citi analyst Asiya Merchant maintains with a buy rating.

Citi analyst Asiya Merchant maintains with a buy rating.