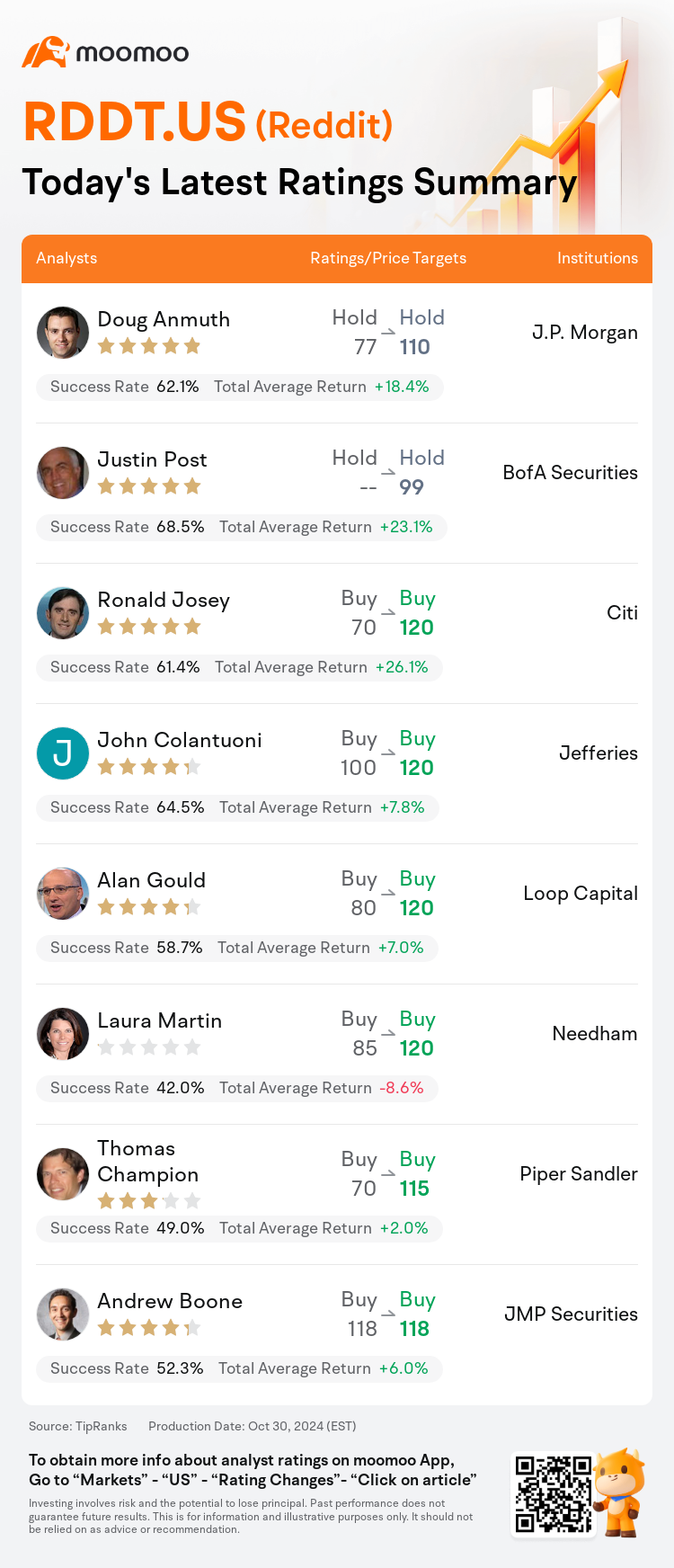

On Oct 30, major Wall Street analysts update their ratings for $Reddit (RDDT.US)$, with price targets ranging from $99 to $120.

J.P. Morgan analyst Doug Anmuth maintains with a hold rating, and adjusts the target price from $77 to $110.

BofA Securities analyst Justin Post maintains with a hold rating, and sets the target price at $99.

Citi analyst Ronald Josey maintains with a buy rating, and adjusts the target price from $70 to $120.

Citi analyst Ronald Josey maintains with a buy rating, and adjusts the target price from $70 to $120.

Jefferies analyst John Colantuoni maintains with a buy rating, and adjusts the target price from $100 to $120.

Loop Capital analyst Alan Gould maintains with a buy rating, and adjusts the target price from $80 to $120.

Furthermore, according to the comprehensive report, the opinions of $Reddit (RDDT.US)$'s main analysts recently are as follows:

Reddit's third-quarter performance surpassed expectations, and the company's fourth-quarter projections are robust. Structural enhancements are benefiting the company as it consistently executes its strategy, which spans product development, user engagement, and monetization efforts.

The firm has increased its estimates on Reddit following a robust Q3 performance and a Q4 forecast surpassing expectations. This adjustment accommodates an anticipated rise in advertising revenue, balanced by a slight dip in data revenue. The firm acknowledges the company's consistent strong ad business performance, yet notes that the current high valuation of the stock may imply limited potential for growth.

The company showcased robust third-quarter outcomes, with revenue surpassing consensus forecasts by 11% and EBITDA exceeding the top end of guidance by 57%. Highlighted within these results is the platform's sustained user base expansion and enhanced user engagement, with daily active users climbing to 97 million, marking a 47% increase on a year-over-year basis. This growth is partially credited to increased platform dialogue and the implementation of machine translation on a global scale. There is optimism that these trends will persist as the company introduces new advertising formats and begins to capitalize on additional features such as search, video, and shopping, thereby increasing the company's operating efficiency.

Reddit exhibited an even larger upside this quarter beyond its initial success post-IPO, achieving GAAP earnings positivity. This performance was propelled by a significant 56% increase in advertising revenue. The platform is still in the preliminary stages of enhancing user growth and advancing its monetization efforts.

Here are the latest investment ratings and price targets for $Reddit (RDDT.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

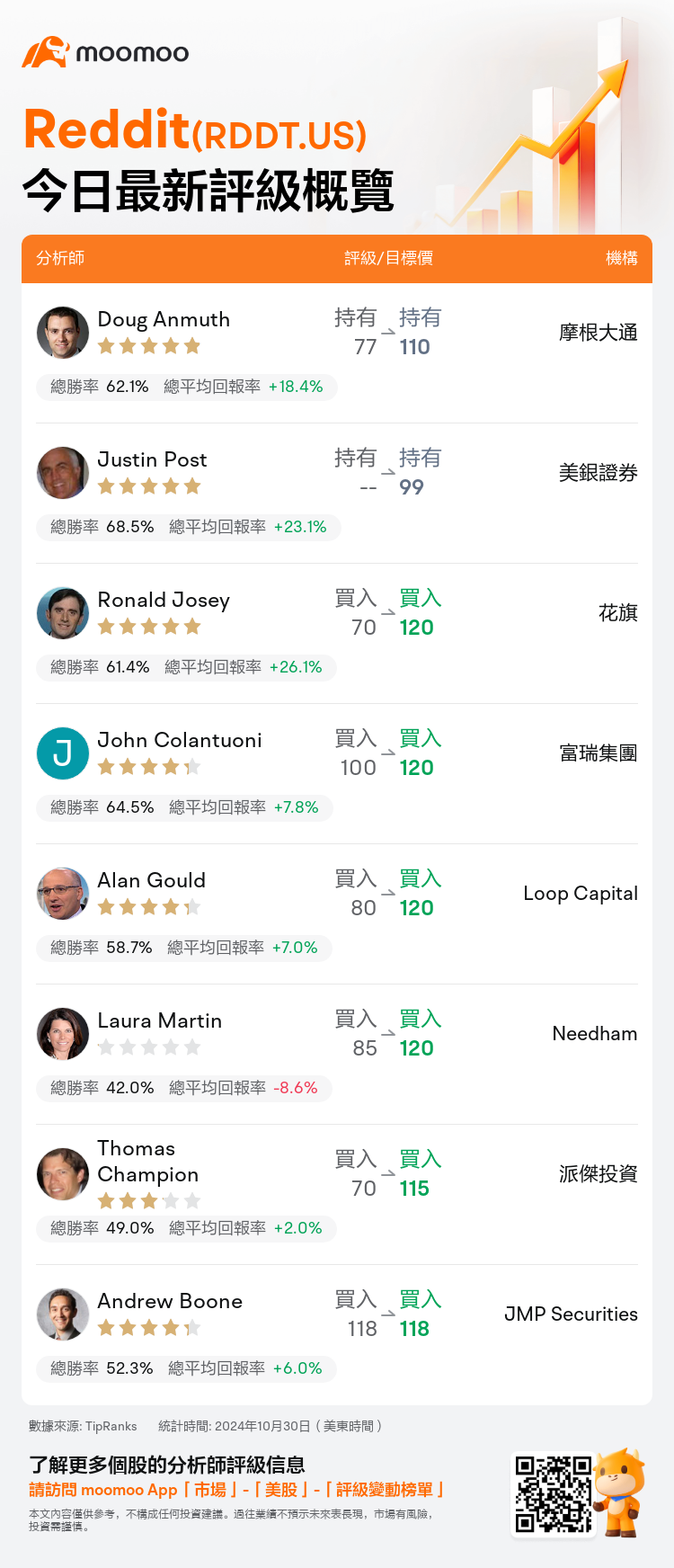

美東時間10月30日,多家華爾街大行更新了$Reddit (RDDT.US)$的評級,目標價介於99美元至120美元。

摩根大通分析師Doug Anmuth維持持有評級,並將目標價從77美元上調至110美元。

美銀證券分析師Justin Post維持持有評級,目標價99美元。

花旗分析師Ronald Josey維持買入評級,並將目標價從70美元上調至120美元。

花旗分析師Ronald Josey維持買入評級,並將目標價從70美元上調至120美元。

富瑞集團分析師John Colantuoni維持買入評級,並將目標價從100美元上調至120美元。

Loop Capital分析師Alan Gould維持買入評級,並將目標價從80美元上調至120美元。

此外,綜合報道,$Reddit (RDDT.US)$近期主要分析師觀點如下:

Reddit第三季度的表現超出了預期,公司的第四季度預期也非常強勁。 結構性改進正在使公司受益,因爲它不斷執行着橫跨產品開發、用戶參與和貨幣化工作的策略。

在Reddit強勁的第三季度業績和超出預期的第四季度預測後,該公司對Reddit的估值進行了調整。 這種調整考慮到廣告收入預期增長,與數據收入略微下降相平衡。 公司承認了公司持續強勁的廣告業績,但指出股票目前的高估值可能意味着增長潛力有限。

公司展示了強勁的第三季度業績,營收超出共識預測11%,EBITDA超出指導的最高端57%。 這些成果的亮點是平台持續擴大的用戶群體和增強的用戶參與度,日活躍用戶達到9700萬,較去年同期增加47%。 這種增長部分歸因於平台對話的增加以及在全球範圍內實施機器翻譯。 人們對這些趨勢會持續下去抱有樂觀態度,因爲公司推出了新的廣告格式,並開始利用搜索、視頻和購物等附加功能,從而增加公司的運營效率。

Reddit在這個季度展現了更大的上行潛力,不僅超過了首次公開募股後的初期成功,還取得了GAAP盈利的成就。 這一業績是由廣告營收的顯著增長推動的。 該平台目前仍處於增加用戶增長和推進貨幣化努力的初步階段。

以下爲今日8位分析師對$Reddit (RDDT.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

花旗分析師Ronald Josey維持買入評級,並將目標價從70美元上調至120美元。

花旗分析師Ronald Josey維持買入評級,並將目標價從70美元上調至120美元。

Citi analyst Ronald Josey maintains with a buy rating, and adjusts the target price from $70 to $120.

Citi analyst Ronald Josey maintains with a buy rating, and adjusts the target price from $70 to $120.