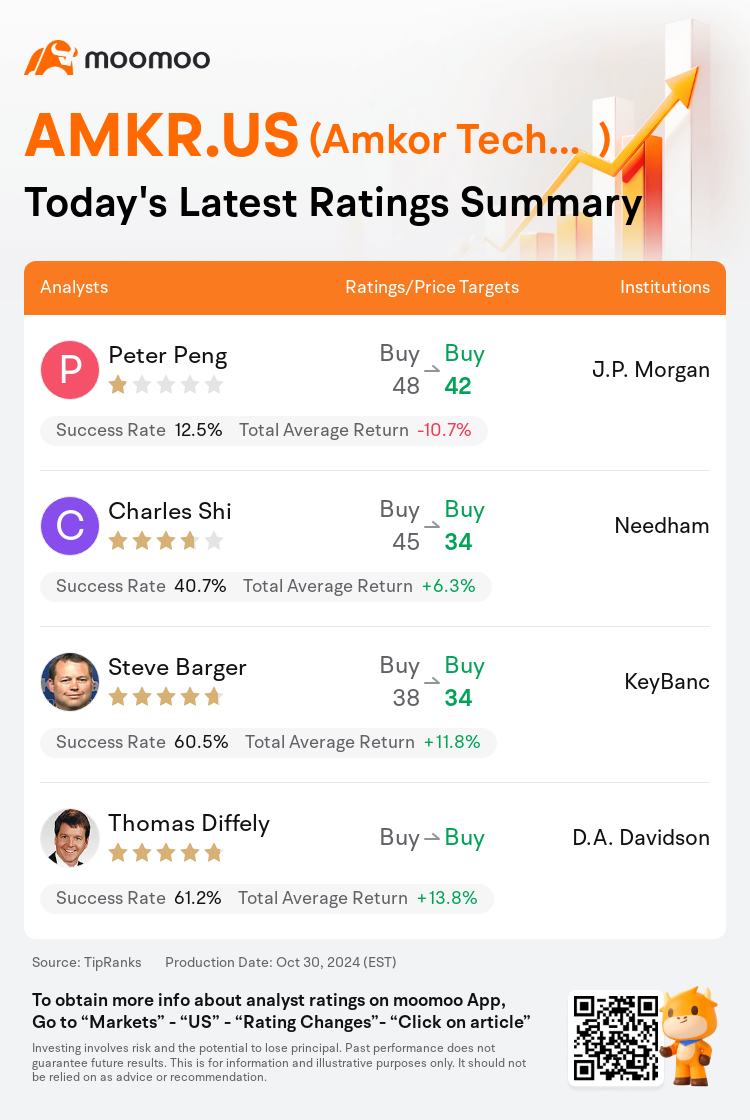

On Oct 30, major Wall Street analysts update their ratings for $Amkor Technology (AMKR.US)$, with price targets ranging from $34 to $42.

J.P. Morgan analyst Peter Peng maintains with a buy rating, and adjusts the target price from $48 to $42.

Needham analyst Charles Shi maintains with a buy rating, and adjusts the target price from $45 to $34.

KeyBanc analyst Steve Barger maintains with a buy rating, and adjusts the target price from $38 to $34.

KeyBanc analyst Steve Barger maintains with a buy rating, and adjusts the target price from $38 to $34.

D.A. Davidson analyst Thomas Diffely maintains with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $Amkor Technology (AMKR.US)$'s main analysts recently are as follows:

Initially adopting a cautious stance, it became evident that Amkor Technology's guidance for the December quarter fell short of both the analyst's and broader market projections. This shortfall was attributed to factors such as seasonality, accounting for the majority, and device transition, cited as a partial cause. Concerns were raised about a potential reduction in market share with one of its key clients. Subsequent to these revelations, projections were significantly lowered.

Amkor Technology reported marginally improved results for the September quarter, driven by an uptick in seasonal smartphone demand and sustained momentum in artificial intelligence packaging. However, this was set against a backdrop of subdued demand in the automotive and industrial sectors. Expectations for the forward estimates have been moderated, with a more favorable outlook anticipated for 2025.

Amkor Technology's third-quarter results were strong, yet the forecast for the fourth quarter was significantly reduced, suggesting an estimated 11% quarter-over-quarter decrease in overall revenue and a 23% quarter-over-quarter reduction in Communications revenue. This decline is considerably steeper than the single-digit drops typically observed in the fourth quarter. The primary cause of the weaker outlook for Amkor is believed to be a decrease in demand for high-end smartphones and an under-allocation of orders for 2024 models. Nevertheless, it is anticipated that the strength in Computing revenue will persist into the fourth quarter.

Amkor Technology reported a modest underperformance in Q3 earnings but provided guidance for Q4 that was significantly lower than expected, leading to a notable decline in share price after hours. This subdued outlook is mainly attributed to reduced activity in the Communications end market, with Amkor pointing out an atypical smartphone production schedule.

Here are the latest investment ratings and price targets for $Amkor Technology (AMKR.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

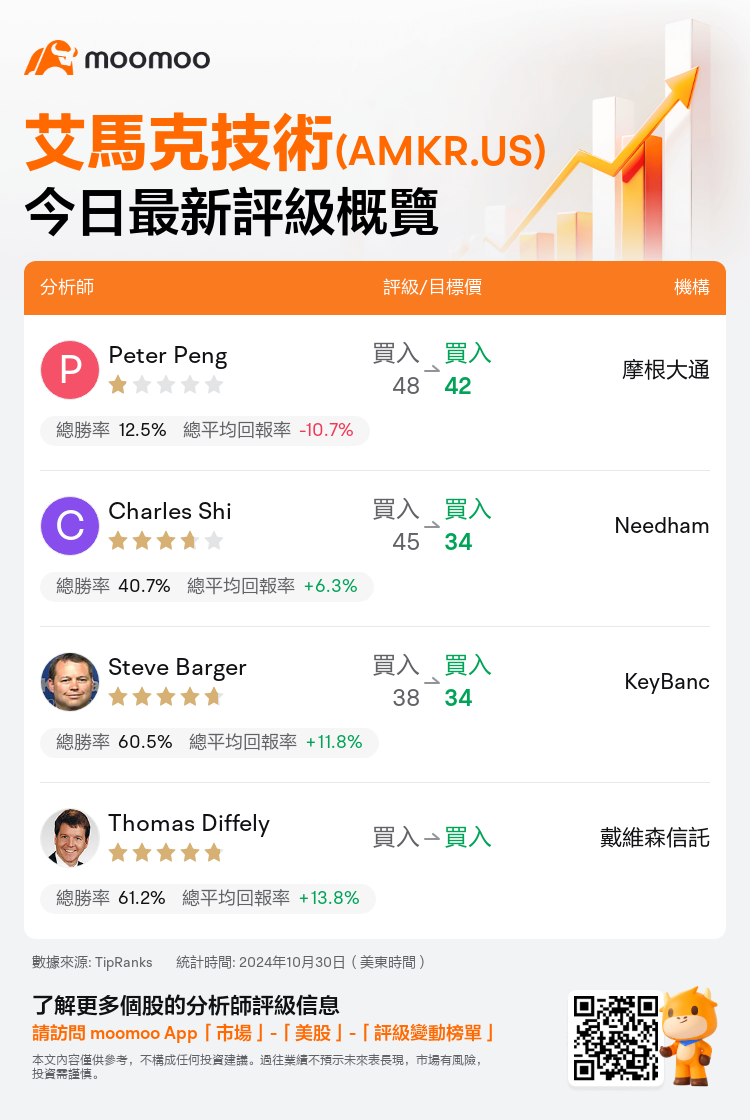

美東時間10月30日,多家華爾街大行更新了$艾馬克技術 (AMKR.US)$的評級,目標價介於34美元至42美元。

摩根大通分析師Peter Peng維持買入評級,並將目標價從48美元下調至42美元。

Needham分析師Charles Shi維持買入評級,並將目標價從45美元下調至34美元。

KeyBanc分析師Steve Barger維持買入評級,並將目標價從38美元下調至34美元。

KeyBanc分析師Steve Barger維持買入評級,並將目標價從38美元下調至34美元。

戴維森信託分析師Thomas Diffely維持買入評級。

此外,綜合報道,$艾馬克技術 (AMKR.US)$近期主要分析師觀點如下:

最初採取謹慎態度,很明顯艾馬克技術對12月季度的指引不僅落後於分析師和更廣泛市場的預測。這一缺口被歸因於季節性等因素,以佔大多數的會計,以及設備過渡,被列爲部分原因。人們對其關鍵客戶之一的市場份額可能下降表示擔憂。在這些揭示之後,預測大幅下調。

艾馬克技術報告稱,由於季節性智能手機需求的增加以及人工智能封裝的持續勢頭,9月季度的業績略有改善。然而,與汽車和工業領域的需求疲軟形成對照。對未來預估的期望已經調整,預計2025年會有更有利的展望。

艾馬克技術第三季度業績強勁,但第四季度的預測大幅減少,暗示整體營業收入將按季度計算下降約11%,通信-半導體營收按季度計算下降23%。這一下降比通常在第四季度觀察到的個位數下降要陡峭得多。艾馬克技術前景疲弱的主要原因被認爲是對高端智能手機需求的下降以及對2024年型號訂單的分配不足。儘管如此,人們預計計算營收的強勁勢頭將持續到第四季度。

艾馬克技術報告稱,第三季度收益表現輕微低於預期,但對第四季度的指引明顯低於預期,導致盤後股價顯著下跌。這種疲軟的展望主要歸因於通信終端市場活動的減少,艾馬克指出了一種非典型的智能手機生產時間表。

以下爲今日4位分析師對$艾馬克技術 (AMKR.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

KeyBanc分析師Steve Barger維持買入評級,並將目標價從38美元下調至34美元。

KeyBanc分析師Steve Barger維持買入評級,並將目標價從38美元下調至34美元。

KeyBanc analyst Steve Barger maintains with a buy rating, and adjusts the target price from $38 to $34.

KeyBanc analyst Steve Barger maintains with a buy rating, and adjusts the target price from $38 to $34.