On Oct 30, major Wall Street analysts update their ratings for $Trex Co. (TREX.US)$, with price targets ranging from $72 to $97.

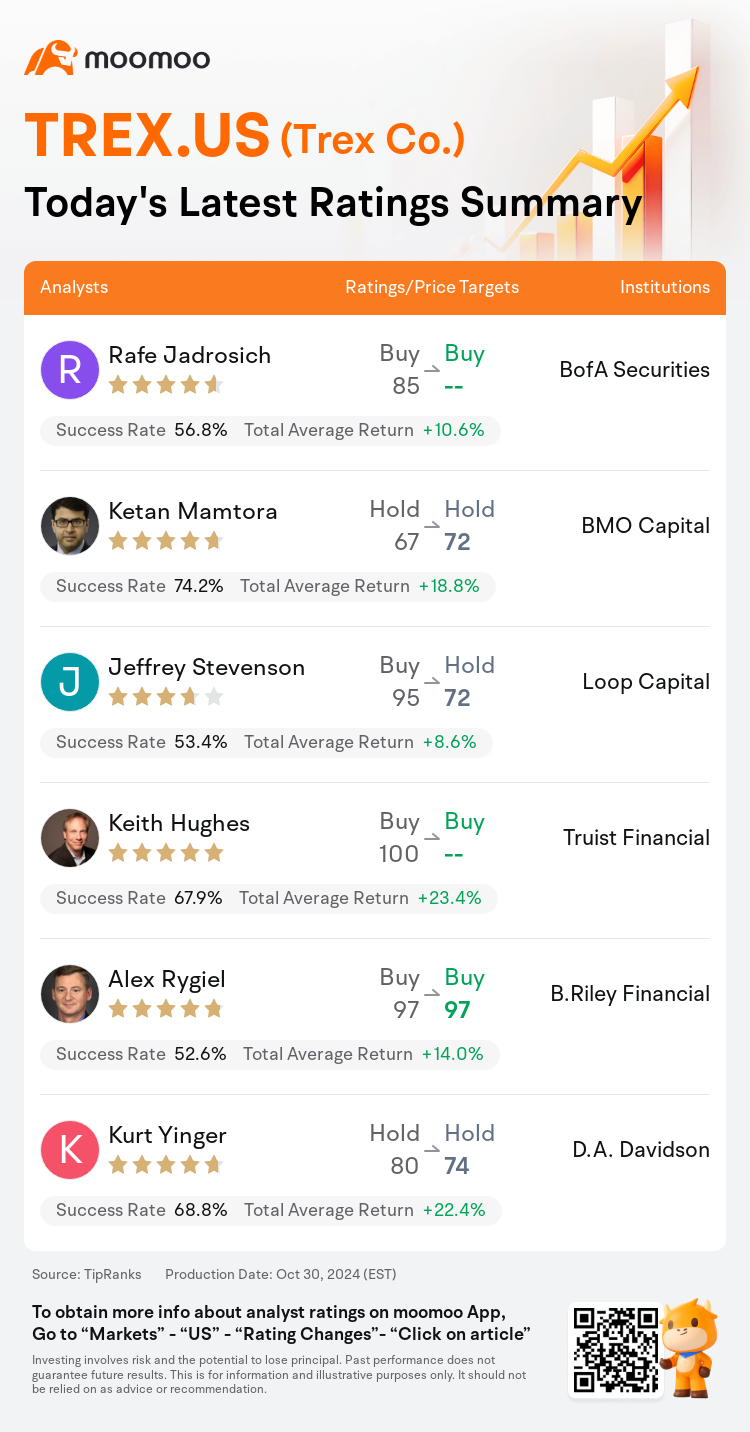

BofA Securities analyst Rafe Jadrosich maintains with a buy rating.

BMO Capital analyst Ketan Mamtora maintains with a hold rating, and adjusts the target price from $67 to $72.

Loop Capital analyst Jeffrey Stevenson downgrades to a hold rating, and adjusts the target price from $95 to $72.

Loop Capital analyst Jeffrey Stevenson downgrades to a hold rating, and adjusts the target price from $95 to $72.

Truist Financial analyst Keith Hughes maintains with a buy rating.

B.Riley Financial analyst Alex Rygiel maintains with a buy rating, and maintains the target price at $97.

Furthermore, according to the comprehensive report, the opinions of $Trex Co. (TREX.US)$'s main analysts recently are as follows:

The firm anticipates a potential relief rally for Trex Company following the earnings report, influenced by reduced startup costs anticipated in 2025. Nevertheless, the current quarter might not provide the definitive resolution investors were hoping for, as it still relies on several optimistic projections for 2025.

Following the company's third-quarter earnings surpassing expectations, it was observed that the anticipated decline in demand did not materialize as previously thought during the second-quarter call. Current projections suggest a modest decrease in fourth-quarter sell-through, contrasting with earlier predictions of a more significant drop, and a stable outlook for the following fiscal year. The extent of pre-purchase activities in the winter season may influence first-quarter outcomes, yet there is a growing optimism regarding demand and prospects for EBITDA expansion in the year 2025.

The firm noted that Trex Company's Q3 results surpassed expectations and although the implied Q4 guidance falls short of forecast, sell-out trends were somewhat better than anticipated, offering a measure of relief.

Here are the latest investment ratings and price targets for $Trex Co. (TREX.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月30日,多家華爾街大行更新了$Trex Co. (TREX.US)$的評級,目標價介於72美元至97美元。

美銀證券分析師Rafe Jadrosich維持買入評級。

BMO資本市場分析師Ketan Mamtora維持持有評級,並將目標價從67美元上調至72美元。

Loop Capital分析師Jeffrey Stevenson下調至持有評級,並將目標價從95美元下調至72美元。

Loop Capital分析師Jeffrey Stevenson下調至持有評級,並將目標價從95美元下調至72美元。

儲億銀行分析師Keith Hughes維持買入評級。

萊利金融分析師Alex Rygiel維持買入評級,維持目標價97美元。

此外,綜合報道,$Trex Co. (TREX.US)$近期主要分析師觀點如下:

公司預計特雷克斯公司在業績公佈後可能出現一輪潛在的救贖反彈,主要受到2025年預期降低的初始成本的影響。然而,當前季度可能並未給投資者帶來他們所期望的明確解決方案,因爲仍然依賴於對2025年的幾項樂觀預測。

在公司第三季度業績超出預期後,人們發現預期的需求下降並未像之前在第二季度電話會議中所想象的那樣發生。當前的預測表明第四季度銷售將略有下降,與之前對大幅下降的預測形成對比,以及對接下來的財政年度的穩定展望。冬季預購活動的程度可能會影響第一季度的業績,但對於2025年的需求和EBITDA擴張前景卻存在越來越多的樂觀情緒。

公司指出特雷克斯公司的第三季度業績超出預期,儘管暗示的第四季度指引不及預期,但銷售趨勢比預期略好,帶來了某種程度的寬慰。

以下爲今日6位分析師對$Trex Co. (TREX.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Loop Capital分析師Jeffrey Stevenson下調至持有評級,並將目標價從95美元下調至72美元。

Loop Capital分析師Jeffrey Stevenson下調至持有評級,並將目標價從95美元下調至72美元。

Loop Capital analyst Jeffrey Stevenson downgrades to a hold rating, and adjusts the target price from $95 to $72.

Loop Capital analyst Jeffrey Stevenson downgrades to a hold rating, and adjusts the target price from $95 to $72.