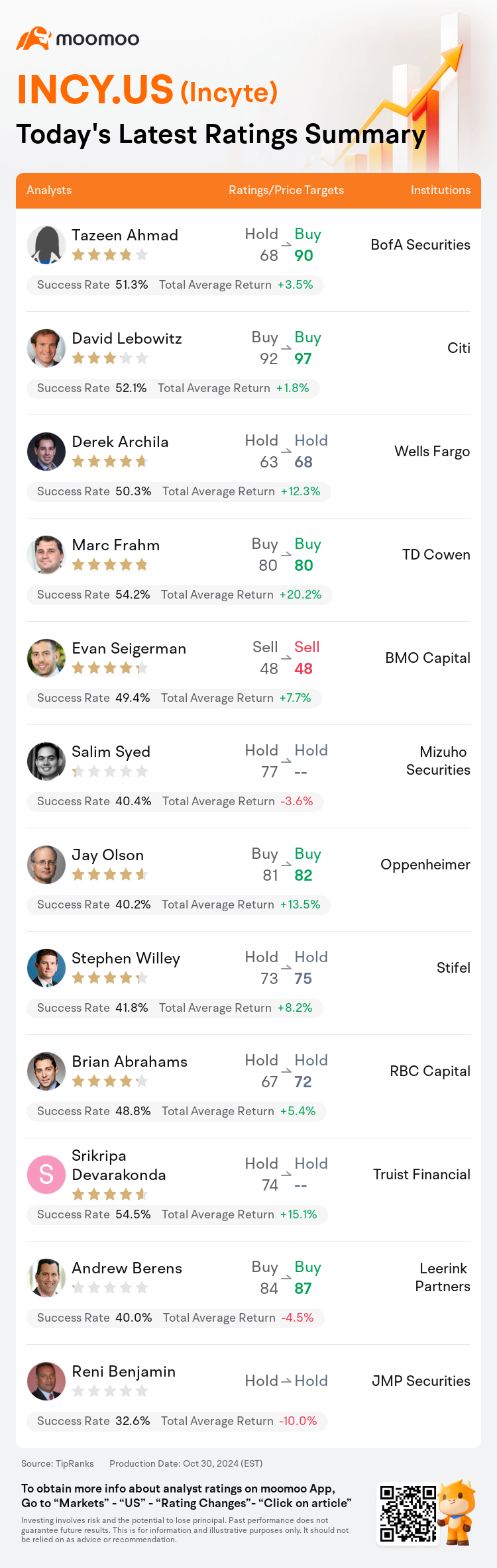

On Oct 30, major Wall Street analysts update their ratings for $Incyte (INCY.US)$, with price targets ranging from $48 to $97.

BofA Securities analyst Tazeen Ahmad upgrades to a buy rating, and adjusts the target price from $68 to $90.

Citi analyst David Lebowitz maintains with a buy rating, and adjusts the target price from $92 to $97.

Wells Fargo analyst Derek Archila maintains with a hold rating, and adjusts the target price from $63 to $68.

Wells Fargo analyst Derek Archila maintains with a hold rating, and adjusts the target price from $63 to $68.

TD Cowen analyst Marc Frahm maintains with a buy rating, and maintains the target price at $80.

BMO Capital analyst Evan Seigerman maintains with a sell rating, and maintains the target price at $48.

Furthermore, according to the comprehensive report, the opinions of $Incyte (INCY.US)$'s main analysts recently are as follows:

Incyte's Q3 results have been notable for surpassing revenue expectations, primarily driven by the sustained growth of its key products, Jakafi and Opzelura. The company's underlying narrative is strengthened by its steady commercial performance, reduced apprehensions regarding Jakafi's competition, and a robust pipeline with multiple potential opportunities.

Previous concerns regarding competitive pressure to Jakafi in myelofibrosis appear to be abating in light of the strong continued demand, suggesting a diminished risk profile. Additionally, the sustained growth of Opzelura, alongside the potential for expansion into pediatric atopic dermatitis, is viewed positively.

The company's recent top-line performance surpassed expectations, accompanied by an updated forecast for FY24 that remained relatively steady or showed potential improvement. This was despite the projection for Jakafi being balanced out by a diminished outlook for the Heme/Oncology segment. Nevertheless, there persists a level of uncertainty regarding the company's long-term prospects, primarily due to apprehensions about growth considering that the bulk of pipeline revenue is anticipated subsequent to the Jakafi patent expiration in 2028.

Incyte has been observed to deliver strong third-quarter results, surpassing expectations with the performance of Jakafi and Opzelura, and also outperforming in terms of profits. Demonstrating effective commercial strategies, the company has increased its forecast for fiscal year 2024, suggesting robust sales for Jakafi in the fourth quarter and a 6% growth for the entire fiscal year. The focus is anticipated to shift towards the company's pipeline projects, where several imminent events are expected, including updates on the LIMBER program and key data releases from clinical studies on MRGPRX2 in chronic spontaneous urticaria, along with Phase 3 results for povorcitinib in hidradenitis suppurativa, which will shed light on potential growth drivers beyond the patent expiration of Jakafi.

It is believed that the recent uplift in Incyte's share value may be partially due to a better-than-expected financial performance, yet it may also be attributed to the anticipation of numerous significant data disclosures expected in the first half of 2025. Shares are anticipated to perform positively leading up to these events, although the stock valuation is not considered particularly low.

Here are the latest investment ratings and price targets for $Incyte (INCY.US)$ from 12 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

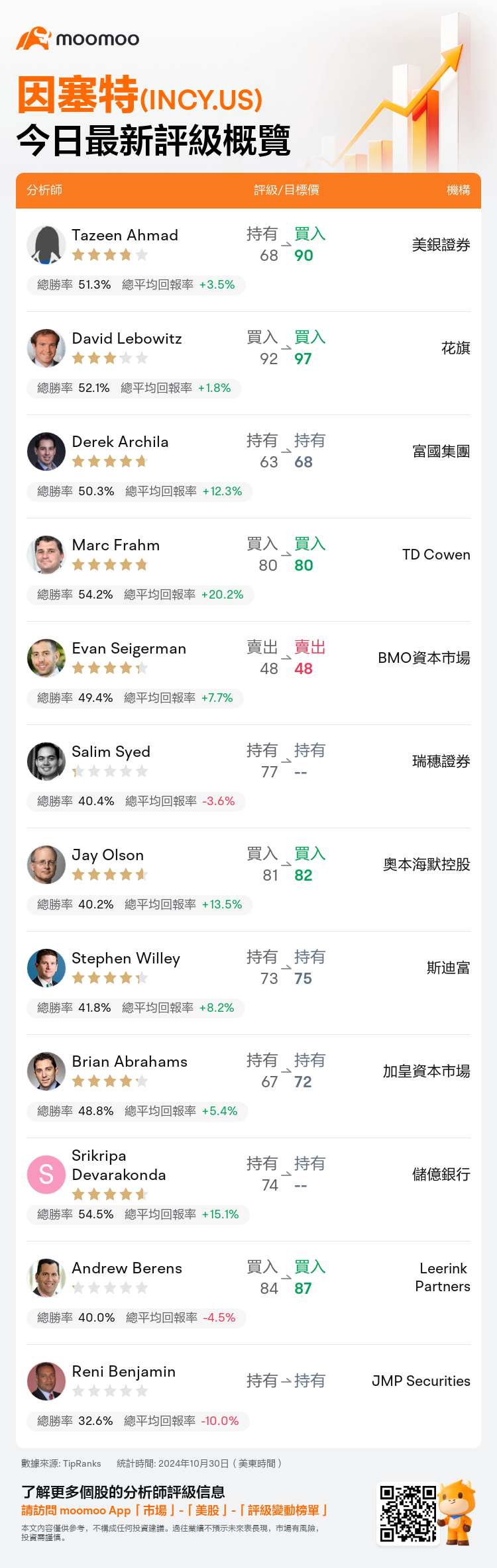

美東時間10月30日,多家華爾街大行更新了$因塞特 (INCY.US)$的評級,目標價介於48美元至97美元。

美銀證券分析師Tazeen Ahmad上調至買入評級,並將目標價從68美元上調至90美元。

花旗分析師David Lebowitz維持買入評級,並將目標價從92美元上調至97美元。

富國集團分析師Derek Archila維持持有評級,並將目標價從63美元上調至68美元。

富國集團分析師Derek Archila維持持有評級,並將目標價從63美元上調至68美元。

TD Cowen分析師Marc Frahm維持買入評級,維持目標價80美元。

BMO資本市場分析師Evan Seigerman維持賣出評級,維持目標價48美元。

此外,綜合報道,$因塞特 (INCY.US)$近期主要分析師觀點如下:

因塞特第三季度的業績表現引人矚目,超出營業收入預期,主要受其主要產品Jakafi和Opzelura持續增長的推動。公司的基本故事得到加強,主要受其穩健的商業表現、減少對Jakafi競爭的擔憂以及具有潛在多個機會的強大產品線的支撐。

針對骨髓纖維化患者對Jakafi領域的競爭壓力的先前擔憂,隨着持續強勁的需求而有所減輕,表明風險剖面有所降低。此外,Opzelura持續增長,加上擴展至兒童特應性皮炎的潛力,被視爲積極因素。

公司最近的營業績表現超出預期,並伴隨着對FY24的更新預測,保持相對穩定或顯示出潛在的改善。儘管對Jakafi的預測被向下調整,但血液/腫瘤領域的前景仍然樂觀。儘管如此,對公司長期前景存在一定程度的不確定性,主要是由於對增長的擔憂,考慮到產品線收入的大部分預計將在2028年Jakafi專利到期後發生。

因塞特已經觀察到在第三季度交出強勁的業績,業績表現超出預期,主要得益於Jakafi和Opzelura的表現,並在利潤方面表現出色。公司展現了有效的商業策略,提高了2024財年的預測,預示着四季度Jakafi的強勁銷售和整個財年6%的增長。焦點預計將轉向公司的項目管線,在那裏預期將發生幾個即將到來的事件,包括LIMBER計劃的更新以及針對慢性自發性蕁麻疹中MRGPRX2的臨床研究關鍵數據發佈,以及hidradenitis suppurativa中povorcitinib的三期結果,這將爲Jakafi專利到期後的潛在增長動力帶來啓示。

有人認爲因塞特的股價最近上漲,部分原因可能是因爲超出預期的財務表現,同時也可能歸因於預期在2025年上半年發佈許多重要數據披露。預計股票將在這些事件之前表現積極,儘管股票估值並不特別低。

以下爲今日12位分析師對$因塞特 (INCY.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師Derek Archila維持持有評級,並將目標價從63美元上調至68美元。

富國集團分析師Derek Archila維持持有評級,並將目標價從63美元上調至68美元。

Wells Fargo analyst Derek Archila maintains with a hold rating, and adjusts the target price from $63 to $68.

Wells Fargo analyst Derek Archila maintains with a hold rating, and adjusts the target price from $63 to $68.