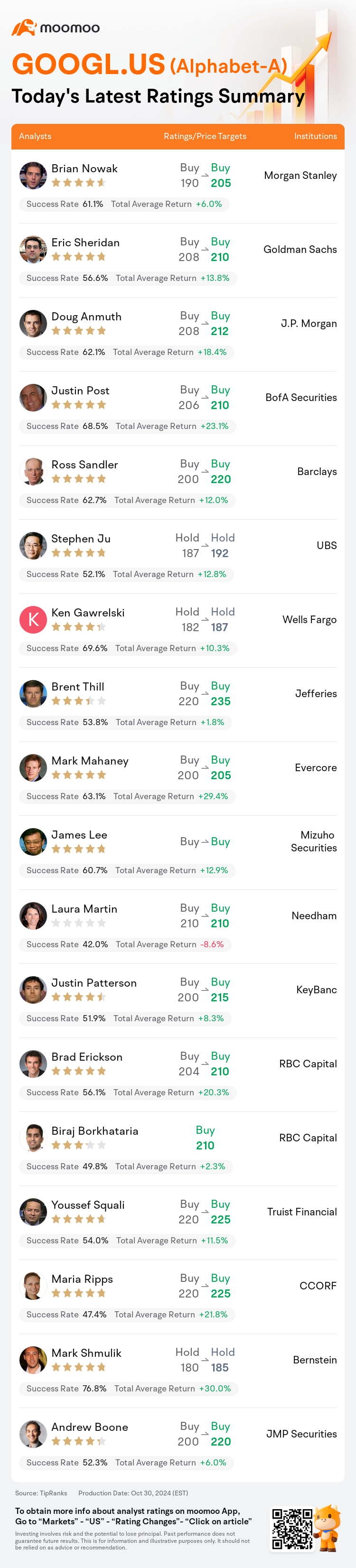

On Oct 30, major Wall Street analysts update their ratings for $Alphabet-A (GOOGL.US)$, with price targets ranging from $185 to $235.

Morgan Stanley analyst Brian Nowak maintains with a buy rating, and adjusts the target price from $190 to $205.

Goldman Sachs analyst Eric Sheridan maintains with a buy rating, and adjusts the target price from $208 to $210.

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $208 to $212.

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $208 to $212.

BofA Securities analyst Justin Post maintains with a buy rating, and adjusts the target price from $206 to $210.

Barclays analyst Ross Sandler maintains with a buy rating, and adjusts the target price from $200 to $220.

Furthermore, according to the comprehensive report, the opinions of $Alphabet-A (GOOGL.US)$'s main analysts recently are as follows:

Alphabet's third-quarter performance was robust, showcasing considerable growth in Cloud, with margins also being a highlight. Looking ahead to 2025, net revenue projections have been adjusted upwards by 2% to $332B, factoring in an anticipated higher growth in Cloud, Network, and Other revenues, albeit with a slight decrease expected in Google Properties revenue. The operating income estimates have also been revised upwards, reflecting a pronounced emphasis on cost management.

Alphabet's financial outcomes are expected to contribute to the ongoing discussion surrounding its capital expenditures and return on invested capital. Despite this, shareholder concerns persist regarding regulatory challenges faced by Google, as well as potential market share declines in its key operations, which are anticipated to limit valuation multiples. Investors are anticipated to focus on the potential for share price appreciation driven by consistent growth in earnings per share.

The firm came out of Alphabet's Q3 earnings with a more positive stance on the stock. The 12% year-over-year growth in Google Search and YouTube revenues underscore the sustained adoption of Alphabet's monetization tools as query growth progresses. Despite ongoing regulatory concerns and rising competition in generative artificial intelligence, the firm was bolstered by the Q3 outcomes.

Alphabet's recent quarter demonstrated the resilience of Search, with YouTube's performance also surpassing expectations, coupled with notable cost control. The disclosure of various emerging products, accompanied by signs of adoption, engagement, and monetization, is likely to bolster market confidence in the company's long-term strategy.

Alphabet is showing positive signs across various aspects of its operations, according to an analyst's observation. The company's advancements in artificial intelligence, a steady digital advertising market, stringent cost management alongside infrastructure investments, and robust free cash flow generation are all contributing to its upward trajectory. However, the analyst notes that the stock may experience some volatility while adjustments related to Search are implemented, due to the significant scope of its influence.

Here are the latest investment ratings and price targets for $Alphabet-A (GOOGL.US)$ from 18 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

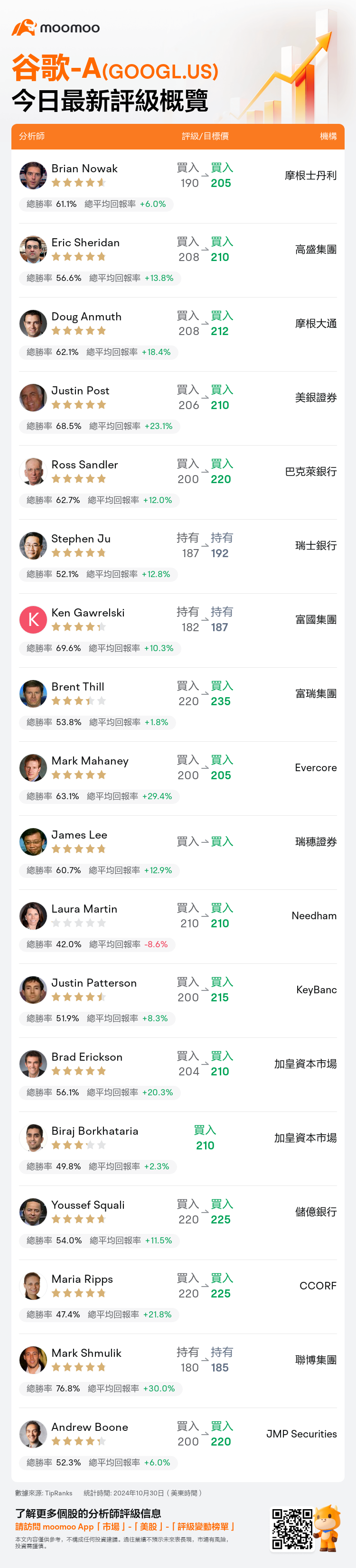

美東時間10月30日,多家華爾街大行更新了$谷歌-A (GOOGL.US)$的評級,目標價介於185美元至235美元。

摩根士丹利分析師Brian Nowak維持買入評級,並將目標價從190美元上調至205美元。

高盛集團分析師Eric Sheridan維持買入評級,並將目標價從208美元上調至210美元。

摩根大通分析師Doug Anmuth維持買入評級,並將目標價從208美元上調至212美元。

摩根大通分析師Doug Anmuth維持買入評級,並將目標價從208美元上調至212美元。

美銀證券分析師Justin Post維持買入評級,並將目標價從206美元上調至210美元。

巴克萊銀行分析師Ross Sandler維持買入評級,並將目標價從200美元上調至220美元。

此外,綜合報道,$谷歌-A (GOOGL.US)$近期主要分析師觀點如下:

Alphabet的第三季度表現強勁,在Cloud方面表現出可觀增長,利潤率也成爲亮點。展望到2025年,淨營收預測已上調2%,達到3320億美元,預計Cloud、網絡以及其他營收將增長迅速,儘管預計Google Properties營收會略微下降。運營收入預估也已上調,反映出對成本管理的強調。

預計Alphabet的財務業績將影響有關其資本支出和投資回報的持續討論。儘管如此,股東對Google面臨的監管挑戰以及其主要業務可能面臨的市場份額下降仍然持續關注,這可能限制估值倍數。投資者預計將關注每股收益的持續增長所帶來的股價上漲潛力。

公司從Alphabet第三季度業績中對該股持更爲積極的看法。Google Search和YouTube營收同比增長12%,凸顯出Alphabet貨幣化工具持續被採用並隨着查詢增長而進展的特點。儘管監管問題仍在繼續,人工智能生成領域的競爭日益激烈,公司仍受到第三季度業績的支撐。

Alphabet最近的季度展現了Search的韌性,YouTube的表現也超出預期,並輔以顯著的成本控制。披露各種新興產品,以及採用、參與和貨幣化跡象的出現,可能會增強市場對公司長期策略的信心。

根據分析師的觀察,Alphabet在公司運營的各個方面都顯示出積極跡象。公司在人工智能的進步、穩健的數字廣告市場、嚴格的成本管理以及基礎設施投資、以及穩健的自由現金流生成方面都促成了公司的上升軌跡。然而,分析師指出,由於Search相關調整的重要影響範圍,股票可能會經歷一些波動。

以下爲今日18位分析師對$谷歌-A (GOOGL.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

摩根大通分析師Doug Anmuth維持買入評級,並將目標價從208美元上調至212美元。

摩根大通分析師Doug Anmuth維持買入評級,並將目標價從208美元上調至212美元。

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $208 to $212.

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $208 to $212.