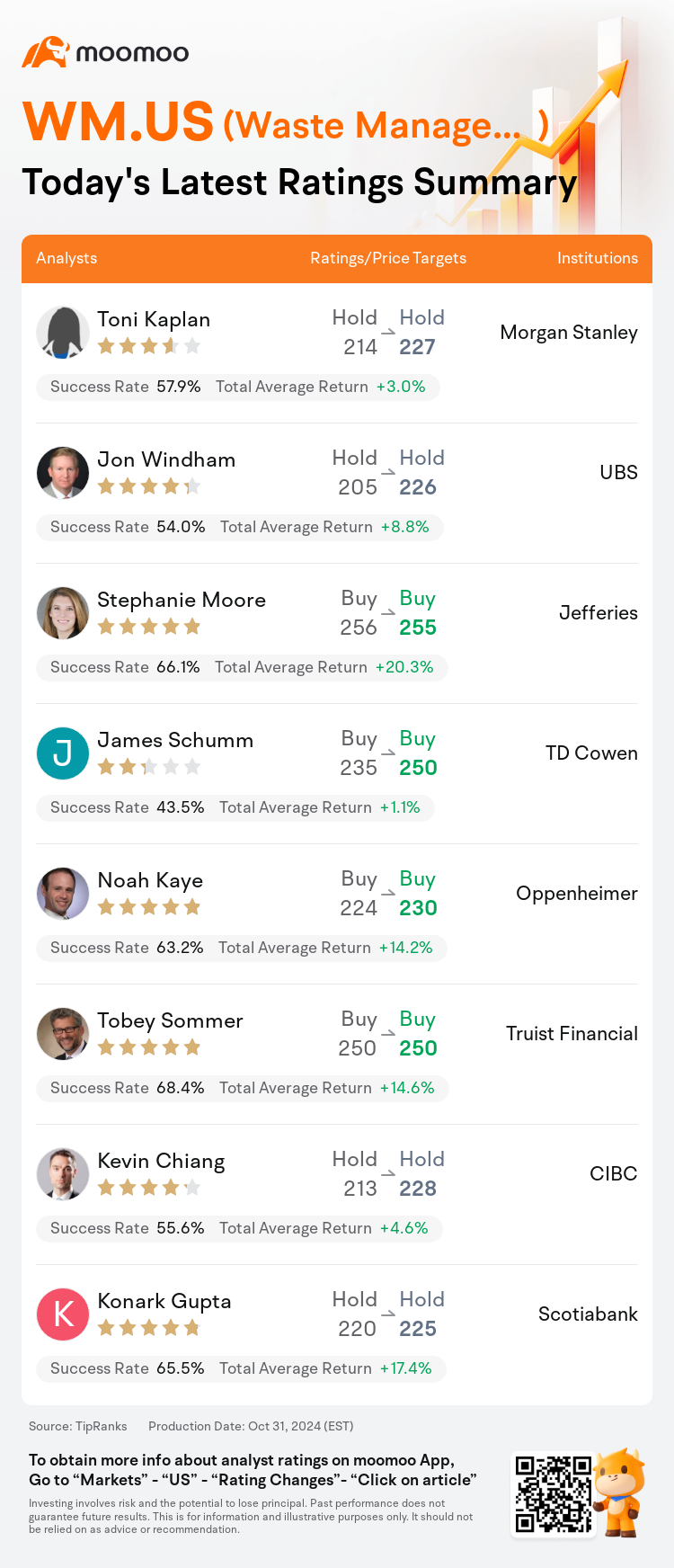

On Oct 31, major Wall Street analysts update their ratings for $Waste Management (WM.US)$, with price targets ranging from $225 to $255.

Morgan Stanley analyst Toni Kaplan maintains with a hold rating, and adjusts the target price from $214 to $227.

UBS analyst Jon Windham maintains with a hold rating, and adjusts the target price from $205 to $226.

Jefferies analyst Stephanie Moore maintains with a buy rating, and adjusts the target price from $256 to $255.

Jefferies analyst Stephanie Moore maintains with a buy rating, and adjusts the target price from $256 to $255.

TD Cowen analyst James Schumm maintains with a buy rating, and adjusts the target price from $235 to $250.

Oppenheimer analyst Noah Kaye maintains with a buy rating, and adjusts the target price from $224 to $230.

Furthermore, according to the comprehensive report, the opinions of $Waste Management (WM.US)$'s main analysts recently are as follows:

Following a 'solid' Q3 report, the implied Q4 outlook is viewed as 'very achievable,' and the setup for 2025 is considered 'far more interesting.'

The company's Q3 earnings surpassed expectations, which is seen as a positive indicator of its consistent core unit profitability growth. Additionally, there is optimism surrounding the visible earnings increase due to maturing green capital expenditures and the enhancement of free cash flow conversion.

The company is poised to achieve exceptional growth in 2025 due to a mix of enhanced returns from its investments related to sustainability, strategic acquisitions, and inherent advancements in its solid waste segment. Nonetheless, it's assessed that this positive outlook is considerably incorporated into the present market valuation.

WM's shares experienced an uptick following a third-quarter performance that surpassed top and bottom line consensus expectations, coupled with an increase in the projected midpoint for FY24 free cash flow, outpacing market predictions. The company's focus on technology-driven productivity investments continues to enhance favorable industry-level price cost dynamics, potentially leading to significant core margin growth extending into FY25.

Following a robust Q3 earnings release, the company demonstrated considerable pricing and volume growth along with a new peak in Adjusted EBITDA margin at 30.5%. The company has been experiencing benefits from an expanded price-cost spread, the divestment of low-margin volume, enhanced employee retention, and ongoing technology investments. Expectations are set for ongoing growth in the Solid Waste segment, greater contributions from sustainability investments, and the assimilation of Stericycle, which is anticipated to lead to significant advancements in revenue, earnings, and free cash flow.

Here are the latest investment ratings and price targets for $Waste Management (WM.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

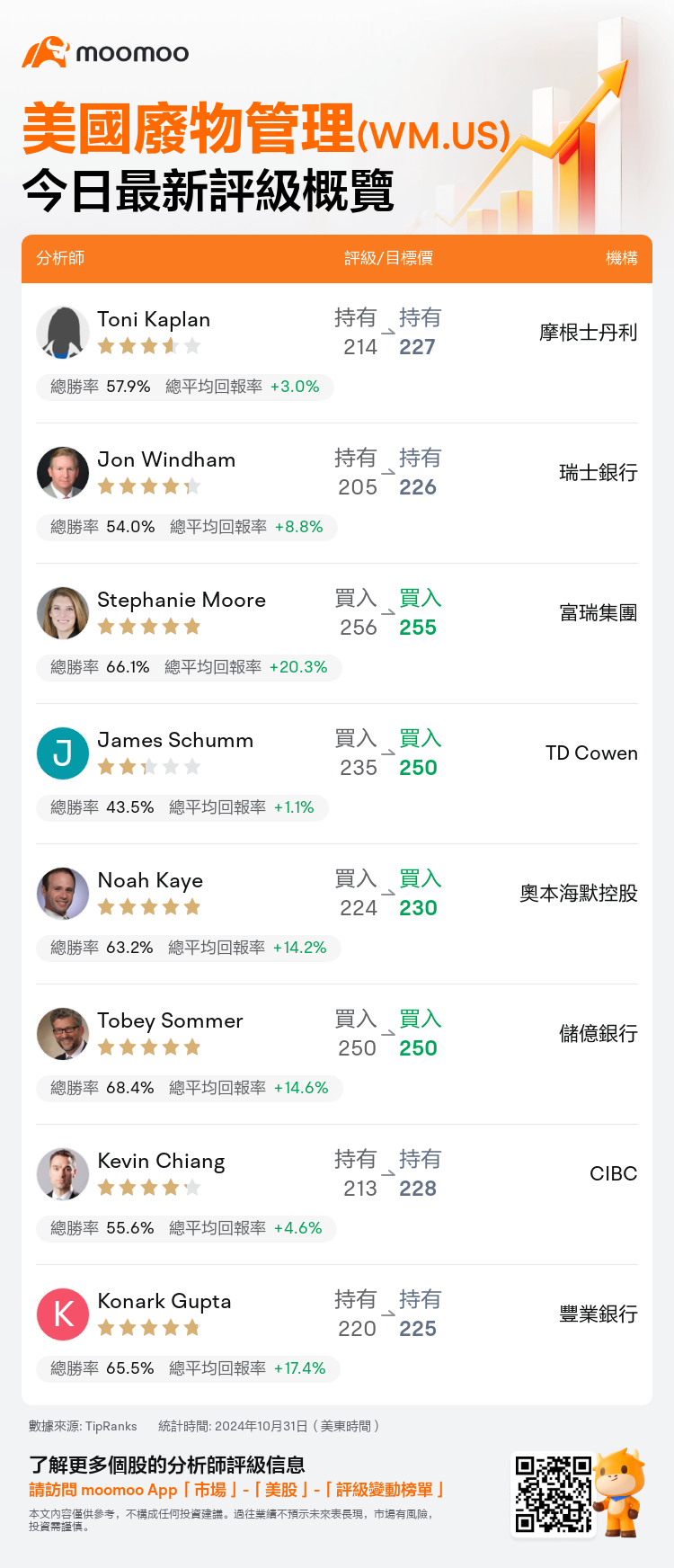

美東時間10月31日,多家華爾街大行更新了$美國廢物管理 (WM.US)$的評級,目標價介於225美元至255美元。

摩根士丹利分析師Toni Kaplan維持持有評級,並將目標價從214美元上調至227美元。

瑞士銀行分析師Jon Windham維持持有評級,並將目標價從205美元上調至226美元。

富瑞集團分析師Stephanie Moore維持買入評級,並將目標價從256美元下調至255美元。

富瑞集團分析師Stephanie Moore維持買入評級,並將目標價從256美元下調至255美元。

TD Cowen分析師James Schumm維持買入評級,並將目標價從235美元上調至250美元。

奧本海默控股分析師Noah Kaye維持買入評級,並將目標價從224美元上調至230美元。

此外,綜合報道,$美國廢物管理 (WM.US)$近期主要分析師觀點如下:

在一份'紮實'的第三季度報告之後,暗示的第四季度展望被視爲'非常可實現',而2025年的情況則被認爲'更有趣。'

公司第三季度收益超出預期,被視爲其持續核心單位利潤增長的積極指標。此外,由於成熟的綠色資本支出和自由現金流轉化的增加,公司周圍存在着對盈利增長的樂觀態度。

由於可持續發展相關投資、戰略收購和固體廢物板塊內在進步的提升,該公司有望在2025年實現異常增長。儘管如此,有人評估認爲這種積極展望已經在當前市場估值中相當體現。

WM的股票在第三季度業績超過市場預期的情況下出現上漲,預期的FY24自由現金流中點增長,超出了市場預測。公司專注於技術驅動的生產力投資持續增強有利的行業價格成本動態,可能導致FY25的重要核心利潤增長。

在強勁的第三季度收益發布之後,公司展示了相當的價格和成交量增長,調整後的EBITDA率達到了30.5%的新高。公司從擴大的價格成本差、剝離低利潤成交量、增強員工保留以及持續的科技投資中獲益。預期在固廢板塊持續增長,可持續性投資貢獻增加,以及Stericycle的整合中,預計將帶來營業收入、盈利和自由現金流方面的重大進展。

以下爲今日8位分析師對$美國廢物管理 (WM.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富瑞集團分析師Stephanie Moore維持買入評級,並將目標價從256美元下調至255美元。

富瑞集團分析師Stephanie Moore維持買入評級,並將目標價從256美元下調至255美元。

Jefferies analyst Stephanie Moore maintains with a buy rating, and adjusts the target price from $256 to $255.

Jefferies analyst Stephanie Moore maintains with a buy rating, and adjusts the target price from $256 to $255.