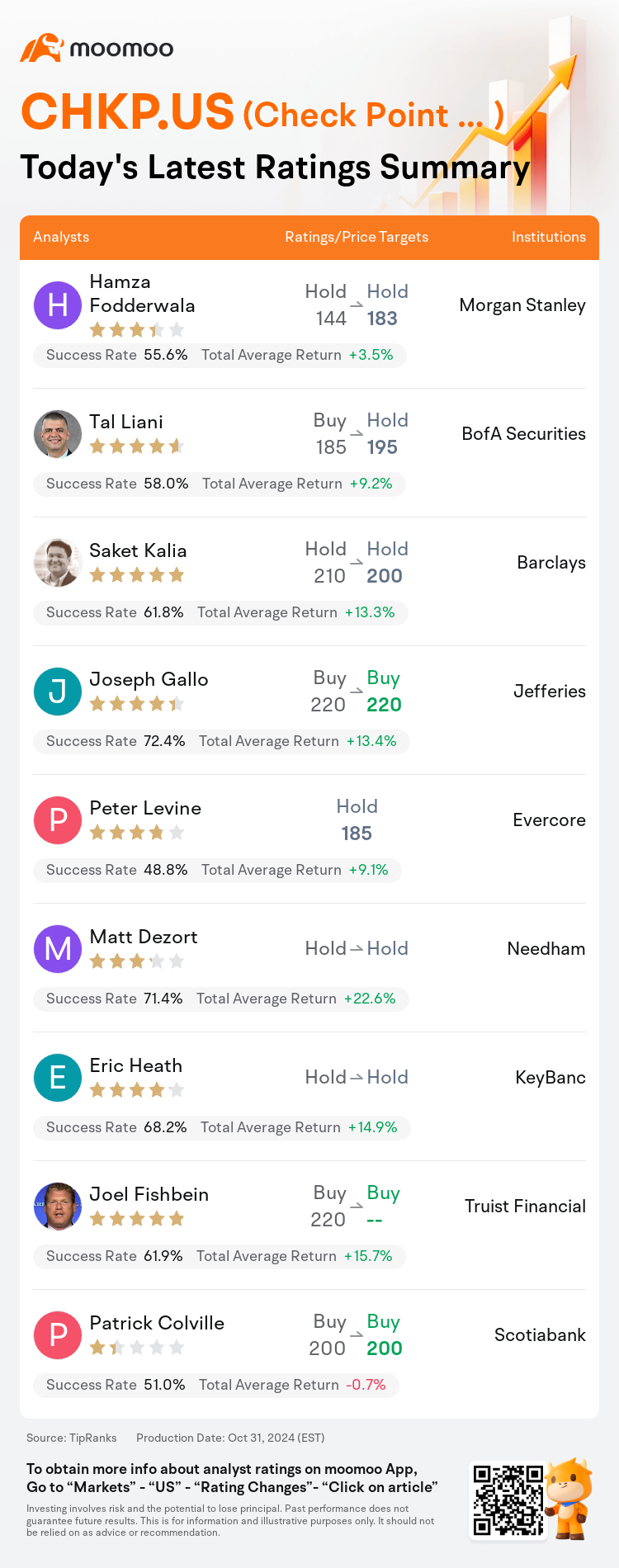

On Oct 31, major Wall Street analysts update their ratings for $Check Point Software (CHKP.US)$, with price targets ranging from $183 to $220.

Morgan Stanley analyst Hamza Fodderwala maintains with a hold rating, and adjusts the target price from $144 to $183.

BofA Securities analyst Tal Liani downgrades to a hold rating, and adjusts the target price from $185 to $195.

Barclays analyst Saket Kalia maintains with a hold rating, and adjusts the target price from $210 to $200.

Barclays analyst Saket Kalia maintains with a hold rating, and adjusts the target price from $210 to $200.

Jefferies analyst Joseph Gallo maintains with a buy rating, and maintains the target price at $220.

Evercore analyst Peter Levine initiates coverage with a hold rating, and sets the target price at $185.

Furthermore, according to the comprehensive report, the opinions of $Check Point Software (CHKP.US)$'s main analysts recently are as follows:

The firm's projection for Check Point reflects a tempered billings outcome in Q3. Looking forward, the anticipation is for a high-single digit expansion in Q4, as the delayed transactions may contribute 3 points to growth, and Cyberint could potentially add another point. Additionally, the analyst forecasts approximately 5% growth for FY25, acknowledging that future comparisons may present more challenging scenarios.

The company's third-quarter billings fell short of consensus estimates. However, if adjustments are considered, there would have been a slight improvement in billings growth compared to the previous quarter. The growth in Subscription revenue did not meet expectations, attributed to underwhelming performance in the cloud and endpoint security sectors. To view the company's prospects more favorably, a thorough evaluation of the potential for Cyberint, Perimeter 81, and Harmony Email/Avanan against the additional weaknesses observed in cloud and endpoint security subscriptions would be necessary.

Q3 results for Check Point were a combination of positives and negatives, with billings falling slightly short of consensus expectations due to the deferment of deals in Europe, despite a 4% year-over-year increase in product revenue.

The company experienced a growth of 6% in Q3 billings, falling short of the anticipated 8% consensus estimates and a 10% expectation by others, with a portion of the shortfall attributed to deals that were postponed to Q4. The long-term potential for Check Point is still evident, but investors may rightfully harbor concerns about the near-term outlook considering the Q3 underperformance coupled with a prudent Q4 budget outlook.

Here are the latest investment ratings and price targets for $Check Point Software (CHKP.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

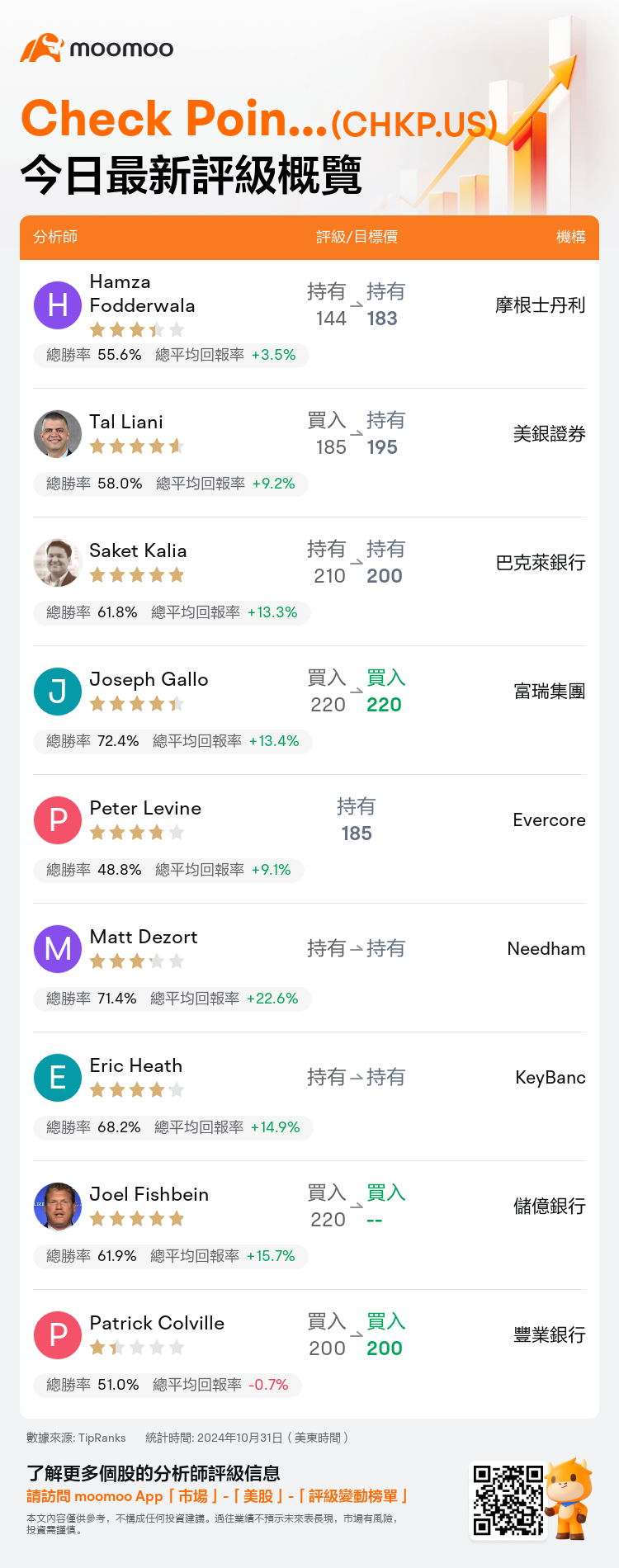

美東時間10月31日,多家華爾街大行更新了$Check Point軟件 (CHKP.US)$的評級,目標價介於183美元至220美元。

摩根士丹利分析師Hamza Fodderwala維持持有評級,並將目標價從144美元上調至183美元。

美銀證券分析師Tal Liani下調至持有評級,並將目標價從185美元上調至195美元。

巴克萊銀行分析師Saket Kalia維持持有評級,並將目標價從210美元下調至200美元。

巴克萊銀行分析師Saket Kalia維持持有評級,並將目標價從210美元下調至200美元。

富瑞集團分析師Joseph Gallo維持買入評級,維持目標價220美元。

Evercore分析師Peter Levine首次給予持有評級,目標價185美元。

此外,綜合報道,$Check Point軟件 (CHKP.US)$近期主要分析師觀點如下:

公司對石葡萄的預測反映了Q3中收款結果的溫和。展望未來,預期Q4將實現高個位數的擴張,因爲延遲的交易可能對增長貢獻3個百分點,而Cyberint可能另外貢獻1個百分點。此外,分析師預測FY25大約增長5%,並承認未來的比較可能呈現更具挑戰性的情景。

公司第三季度的收款低於共識預期。然而,如果考慮調整,與上一季度相比,收款增長可能略有改善。訂閱收入的增長沒有達到預期,歸因於雲和端點安全領域表現不佳。爲了更有利地看待公司的前景,必須對Cyberint、Perimeter 81和Harmony Email/Avanan的潛力進行徹底評估,以彌補雲和端點安全訂閱中觀察到的額外弱點。

石葡萄的Q3結果積極與消極並存,收款略低於共識預期,這是因爲在歐洲的交易延遲,儘管產品營業收入同比增長了4%。

公司Q3收款增長了6%,低於預期的8%共識估計和他人的10%期望,部分原因是將交易推遲至Q4。石葡萄的長期潛力仍然顯而易見,但考慮到Q3表現不佳和Q4預算前景謹慎,投資者可能有理由擔憂短期前景。

以下爲今日9位分析師對$Check Point軟件 (CHKP.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Saket Kalia維持持有評級,並將目標價從210美元下調至200美元。

巴克萊銀行分析師Saket Kalia維持持有評級,並將目標價從210美元下調至200美元。

Barclays analyst Saket Kalia maintains with a hold rating, and adjusts the target price from $210 to $200.

Barclays analyst Saket Kalia maintains with a hold rating, and adjusts the target price from $210 to $200.