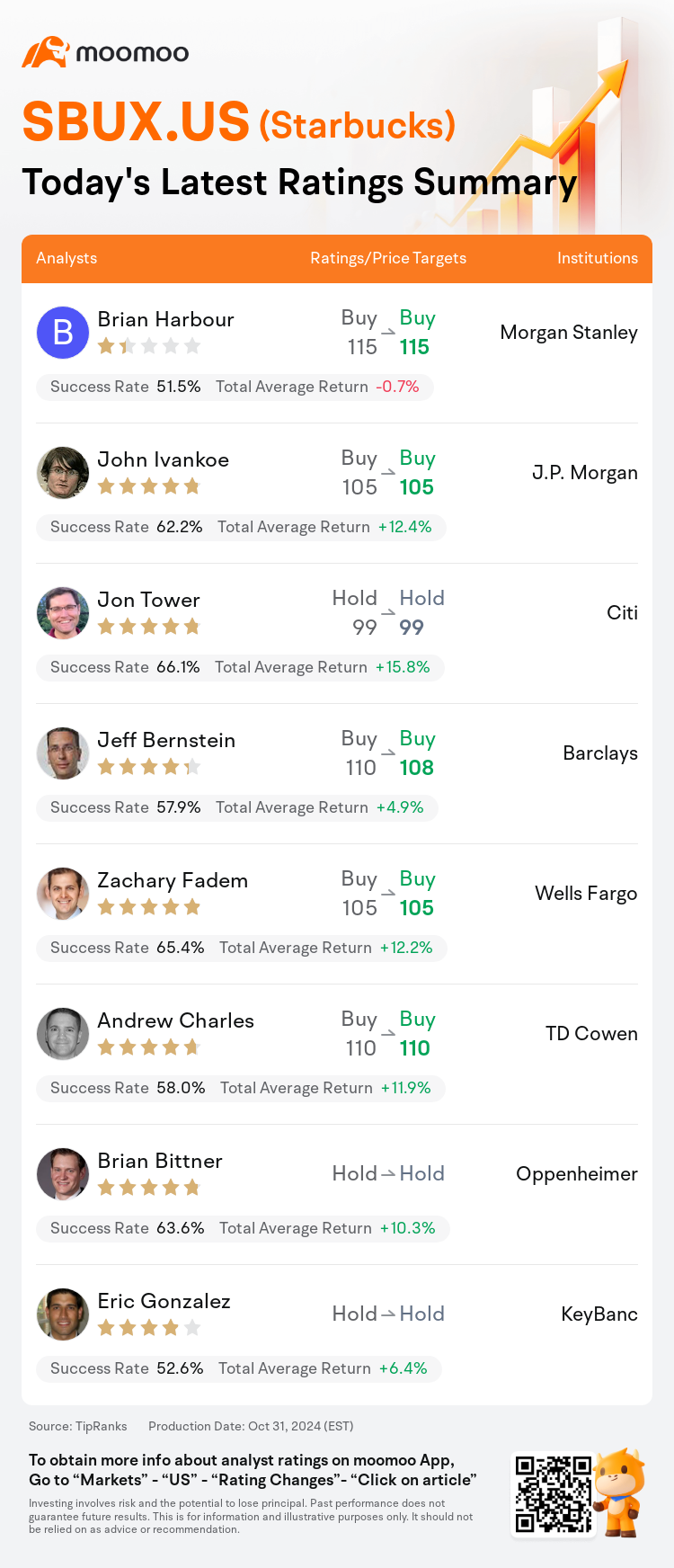

On Oct 31, major Wall Street analysts update their ratings for $Starbucks (SBUX.US)$, with price targets ranging from $99 to $115.

Morgan Stanley analyst Brian Harbour maintains with a buy rating, and maintains the target price at $115.

J.P. Morgan analyst John Ivankoe maintains with a buy rating, and maintains the target price at $105.

Citi analyst Jon Tower maintains with a hold rating, and maintains the target price at $99.

Citi analyst Jon Tower maintains with a hold rating, and maintains the target price at $99.

Barclays analyst Jeff Bernstein maintains with a buy rating, and adjusts the target price from $110 to $108.

Wells Fargo analyst Zachary Fadem maintains with a buy rating, and maintains the target price at $105.

Furthermore, according to the comprehensive report, the opinions of $Starbucks (SBUX.US)$'s main analysts recently are as follows:

Following the earnings report, it's noted that Starbucks is undertaking numerous initiatives aimed at bolstering the brand over both short and long terms. Although these strategies are not expected to produce immediate results, they lay out a clear vision that is anticipated to attract large-cap, growth investors. The sentiment suggests that these shares are poised for an upswing in advance of the company's anticipated recovery.

Starbucks' strategic initiatives are beginning to crystallize, aligning with anticipations set prior to the quarter. Nonetheless, unless there is a significant positive shift in costs in future quarters, it seems likely there will be a considerable adjustment to earnings in fiscal 2025, casting doubts on the attractiveness of the stock's current valuation.

The firm's perspective is that Starbucks' current valuation accurately encompasses the growing challenges related to near-term revenue and profit projections. This is balanced by a certain degree of assurance in the management's capacity for delivering sustained yearly growth in operating margins and earnings per share, that align with the company's historical growth patterns.

The preliminary announcement of the fiscal Q4 outcomes last week shifted the emphasis during the earnings call towards the company's future prospects. While the upcoming quarters are anticipated to pose challenges, there is an expectation that the latter half of 2025 will provide substantial signs that the strategic plan is effective. Observations suggest optimism regarding the comprehensive nature of the new CEO's plan and its potential to significantly enhance the customer experience and the company's overall direction.

Here are the latest investment ratings and price targets for $Starbucks (SBUX.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

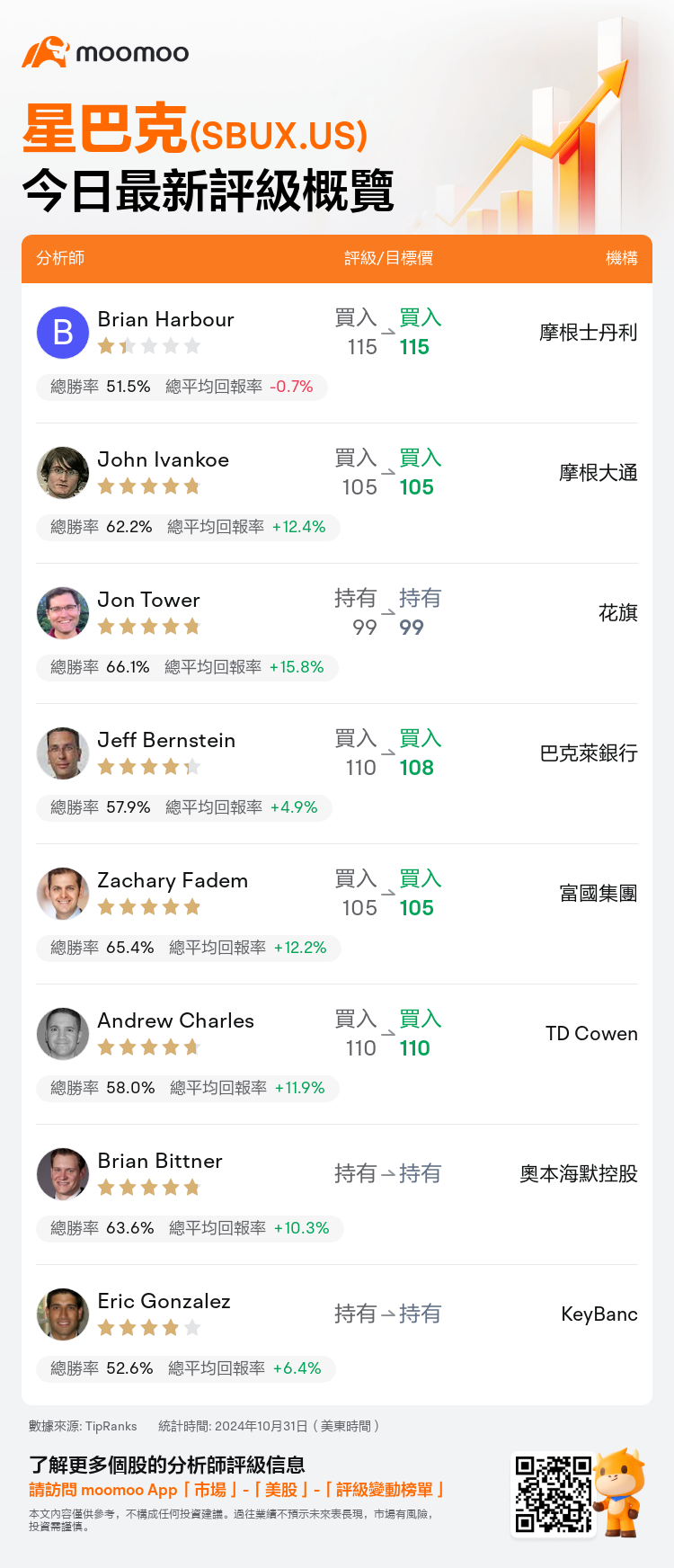

美東時間10月31日,多家華爾街大行更新了$星巴克 (SBUX.US)$的評級,目標價介於99美元至115美元。

摩根士丹利分析師Brian Harbour維持買入評級,維持目標價115美元。

摩根大通分析師John Ivankoe維持買入評級,維持目標價105美元。

花旗分析師Jon Tower維持持有評級,維持目標價99美元。

花旗分析師Jon Tower維持持有評級,維持目標價99美元。

巴克萊銀行分析師Jeff Bernstein維持買入評級,並將目標價從110美元下調至108美元。

富國集團分析師Zachary Fadem維持買入評級,維持目標價105美元。

此外,綜合報道,$星巴克 (SBUX.US)$近期主要分析師觀點如下:

在業績報告後,注意到星巴克正在進行多項旨在增強品牌在短期和長期內影響力的倡議。儘管這些策略不太可能產生立竿見影的效果,但它們確立了一個清晰的願景,預計能吸引大型成長投資者。這種情緒表明,這些股票有望在公司預期復甦之前出現上漲。

星巴克的戰略倡議開始逐漸明晰,與季度前設定的預期相吻合。然而,除非未來季度成本出現顯著正向轉變,否則很可能會對2025財年的收益產生相當大的調整,令人對股票當前估值的吸引力產生疑慮。

公司的觀點是,星巴克當前的估值準確反映了與近期營收和利潤預測相關的不斷增長的挑戰。這得到了一定程度上對管理層交付持續年度增長的操作利潤和每股收益的信心,這與公司歷史增長模式相吻合。

上週宣佈財務第四季度業績的初步結果將焦點從盈利電話會議轉移到公司未來前景。雖然未來幾個季度預計會面臨挑戰,但預計2025年下半年將會提供充分跡象表明戰略計劃的有效性。觀察表明對新CEO計劃的全面性質以及其顯著提升客戶體驗和公司整體方向的潛力持樂觀態度。

以下爲今日8位分析師對$星巴克 (SBUX.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

花旗分析師Jon Tower維持持有評級,維持目標價99美元。

花旗分析師Jon Tower維持持有評級,維持目標價99美元。

Citi analyst Jon Tower maintains with a hold rating, and maintains the target price at $99.

Citi analyst Jon Tower maintains with a hold rating, and maintains the target price at $99.