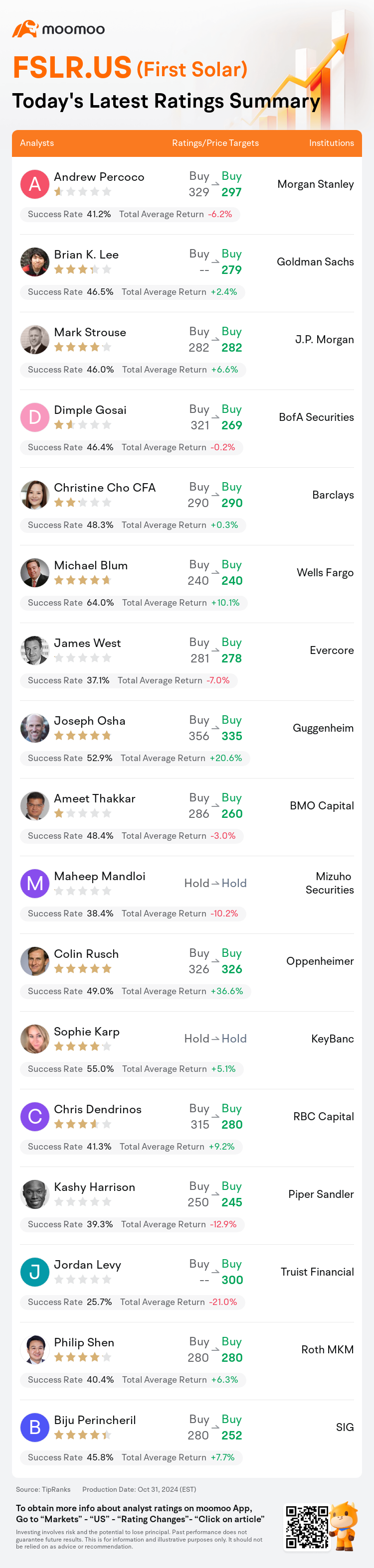

On Oct 31, major Wall Street analysts update their ratings for $First Solar (FSLR.US)$, with price targets ranging from $240 to $335.

Morgan Stanley analyst Andrew Percoco maintains with a buy rating, and adjusts the target price from $329 to $297.

Goldman Sachs analyst Brian K. Lee maintains with a buy rating, and sets the target price at $279.

J.P. Morgan analyst Mark Strouse maintains with a buy rating, and maintains the target price at $282.

J.P. Morgan analyst Mark Strouse maintains with a buy rating, and maintains the target price at $282.

BofA Securities analyst Dimple Gosai maintains with a buy rating, and adjusts the target price from $321 to $269.

Barclays analyst Christine Cho CFA maintains with a buy rating, and maintains the target price at $290.

Furthermore, according to the comprehensive report, the opinions of $First Solar (FSLR.US)$'s main analysts recently are as follows:

Despite a reduction in volume guidance, primarily due to three contract terminations and the assumption that modules would be sold within the year, these challenges are perceived as 'largely idiosyncratic.' The current difficulties are seen as 'situational rather than structural,' which suggests a temporary rather than a fundamental setback.

First Solar's third-quarter performance and guidance for 2024 volumes and revenue experienced downward pressure due to operational challenges and difficulties in the India market. The risk of project delays could continue into the fourth quarter, and the share price is likely to show increased volatility surrounding the U.S. presidential election. Nonetheless, the present valuation appears to significantly factor in the potential repeal of the IRA and/or earnings per share estimates that fall substantially below the consensus.

Following the Q3 report, there's an anticipation that First Solar's earnings potential could increase if the India factory resumes operation, especially with the possibility of higher tariffs depending on the election results.

The company's Q3 earnings fell short of expectations, with anticipated challenges stemming from cancellations and delays exacerbated by sharper price pressures in India. On the brighter side, the company is engaged in negotiations related to its TOPCon patents, which could enhance its valuation. Moreover, with the U.S. election in focus, the company stands to benefit from potentially more aggressive protectionist policies under a Republican administration.

Here are the latest investment ratings and price targets for $First Solar (FSLR.US)$ from 17 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月31日,多家華爾街大行更新了$第一太陽能 (FSLR.US)$的評級,目標價介於240美元至335美元。

摩根士丹利分析師Andrew Percoco維持買入評級,並將目標價從329美元下調至297美元。

高盛集團分析師Brian K. Lee維持買入評級,目標價279美元。

摩根大通分析師Mark Strouse維持買入評級,維持目標價282美元。

摩根大通分析師Mark Strouse維持買入評級,維持目標價282美元。

美銀證券分析師Dimple Gosai維持買入評級,並將目標價從321美元下調至269美元。

巴克萊銀行分析師Christine Cho CFA維持買入評級,維持目標價290美元。

此外,綜合報道,$第一太陽能 (FSLR.US)$近期主要分析師觀點如下:

儘管成交量指引有所下降,主要原因是三份合同的終止以及模塊將在今年內出售的假設,這些挑戰被認爲是 '在很大程度上是獨特的。' 目前的困難被視爲 '情境性而非結構性的',這表明是一種暫時性而非根本性的挫折。

第一太陽能第三季度業績和2024年成交量和營業收入預期受到運營挑戰和印度市場困難的下行壓力。項目延遲的風險可能持續到第四季度,股價可能會在美國總統選舉周圍表現出更高的波動性。儘管如此,目前的估值似乎已經顯著地考慮到了IRA的潛在廢除和/或盈利每股估算大幅低於共識。

根據第三季度報告,人們期待第一太陽能的盈利潛力如果印度工廠恢復運營,尤其是在選舉結果取決於可能徵收更高關稅的情況下,可以增加。

公司第三季度的收益未達預期,預計的挑戰源自在印度加劇的取消和延遲所帶來的更大的價格壓力。在更光明的一面,該公司正在就其TOPCon專利進行談判,這可能會提高其估值。此外,隨着美國選舉的關注,該公司有望在共和黨政府下實施更具侵略性的保護主義政策中受益。

以下爲今日17位分析師對$第一太陽能 (FSLR.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

摩根大通分析師Mark Strouse維持買入評級,維持目標價282美元。

摩根大通分析師Mark Strouse維持買入評級,維持目標價282美元。

J.P. Morgan analyst Mark Strouse maintains with a buy rating, and maintains the target price at $282.

J.P. Morgan analyst Mark Strouse maintains with a buy rating, and maintains the target price at $282.