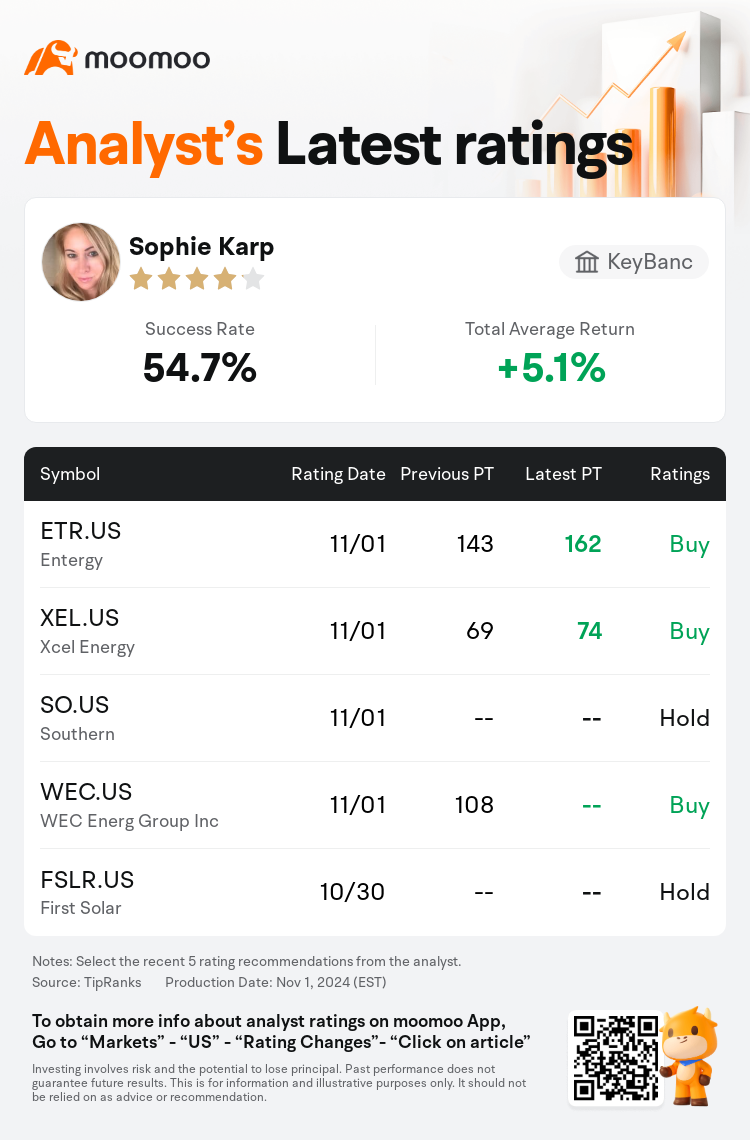

KeyBanc analyst Sophie Karp maintains $Entergy (ETR.US)$ with a buy rating, and adjusts the target price from $143 to $162.

According to TipRanks data, the analyst has a success rate of 54.7% and a total average return of 5.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Entergy (ETR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Entergy (ETR.US)$'s main analysts recently are as follows:

Following Entergy's announcement of a Q3 EPS beat and an update to the lower end of its 2024 EPS guidance, along with fundamental updates that enhance the early outlook for its 2026-2028 EPS target to a range of 8%-9%, the company's sustained fundamental performance and top quartile EPS growth, coupled with a conservative plan, position Entergy's narrative as notably premium.

Entergy has provided a 'robust' financial update, and its strong industrial sales growth profile, which is unique and has been underappreciated, did not align with expectations of a major update alongside Q3 results. Entergy has announced an increase of 20% in its 5-year CapEx and has raised the EPS guidance ranges for 2026-2028 by 4%-9%, predominantly due to higher planned investments in transmission and generation.

Entergy has reasserted its 2024 projections and anticipates a 6%-8% EPS growth rate extending into 2025. The company's long-term EPS compound annual growth rate is now anticipated to be between 8%-9%, bolstered by an enhanced industrial sales forecast and an augmented capital plan, which includes a significant boost from a large data center client and increased demand across the region. This aligns with the longstanding positive outlook on Entergy, with prospects for continued growth in the company's service areas.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

KeyBanc分析師Sophie Karp維持$安特吉 (ETR.US)$買入評級,並將目標價從143美元上調至162美元。

根據TipRanks數據顯示,該分析師近一年總勝率為54.7%,總平均回報率為5.1%。

此外,綜合報道,$安特吉 (ETR.US)$近期主要分析師觀點如下:

此外,綜合報道,$安特吉 (ETR.US)$近期主要分析師觀點如下:

在Entergy宣佈第三季度每股收益超過預期,更新其2024年每股收益指引的下限,以及將2026-2028年每股收益目標的早期展望提高至8%-9%的基本面更新之後,該公司持續的基本表現和前四分之一的每股收益增長,加上保守的計劃,使Entergy的說法顯得溢價。

Entergy提供了 「強勁的」 財務最新情況,其強勁的工業銷售增長概況是獨一無二的,一直被低估,與對第三季度業績重大更新的預期不符。Entergy宣佈其5年期資本支出增長20%,並將2026-2028年的每股收益指導區間提高了4%-9%,這主要是由於計劃增加對輸電和發電的投資。

Entergy重申了其2024年的預測,並預計到2025年,每股收益增長率將達到6%-8%。該公司的長期每股收益複合年增長率目前預計在8%-9%之間,這得益於工業銷售預測的增強和資本計劃的擴大,其中包括大型數據中心客戶的大力提振和該地區需求的增加。這與Entergy長期以來的樂觀前景一致,公司服務領域有望持續增長。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$安特吉 (ETR.US)$近期主要分析師觀點如下:

此外,綜合報道,$安特吉 (ETR.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of