Market Mover | Wayfair Shares Surge 11% After Q3 Earnings Release, Reporting Strong Profitability Along with Further Market Share Gains

Market Mover | Wayfair Shares Surge 11% After Q3 Earnings Release, Reporting Strong Profitability Along with Further Market Share Gains

November 1, 2024 - $Wayfair (W.US)$ shares surged 11.84% to $47.90 in pre-market trading on Friday. The company reported financial results for its third quarter ended September 30, 2024.

2024 年 11 月 1 日- $Wayfair (W.US)$ 週五盤前交易中,股價飆升11.84%,至47.90美元。該公司公佈了截至2024年9月30日的第三季度財務業績。

Q3 Highlights

第三季度亮點

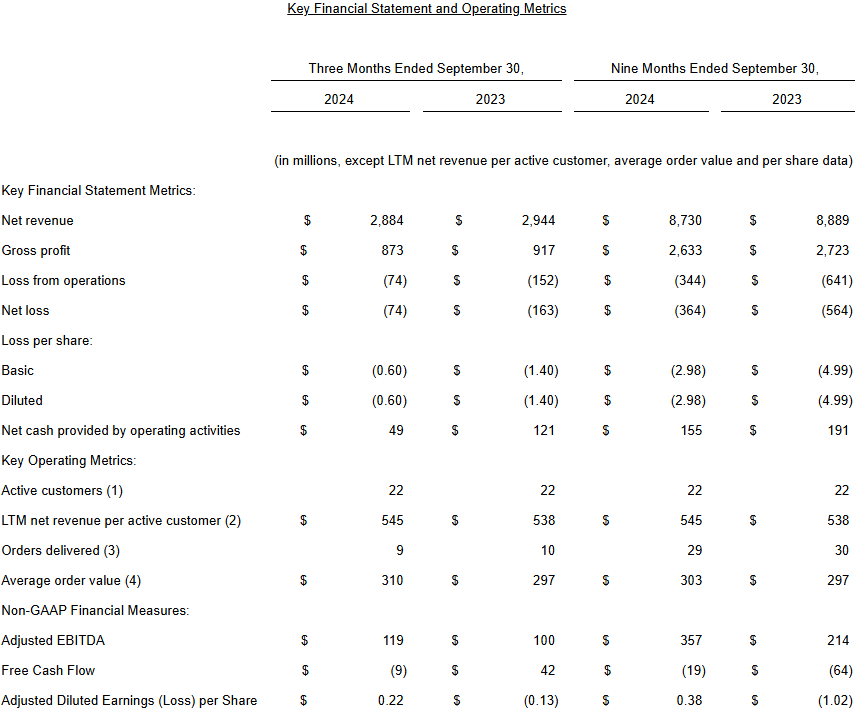

Total net revenue of $2.9 billion, decreased $60 million, down 2.0% year over year

U.S. net revenue of $2.5 billion, decreased $60 million, down 2.3% year over year

International net revenue of $372 million and International Net Revenue Constant Currency Growth remained constant year over year

Gross profit was $873 million, or 30.3% of total net revenue

Net loss was $74 million and Non-GAAP Adjusted EBITDA was $119 million

Diluted loss per share was $0.60 and Non-GAAP Adjusted Diluted Earnings Per Share was $0.22.

總淨收入爲29億美元,減少6,000萬美元,同比下降2.0%

美國淨收入爲25億美元,減少6000萬美元,同比下降2.3%

國際淨收入爲3.72億美元,國際淨收入固定貨幣同比增長保持不變

毛利爲8.73億美元,佔總淨收入的30.3%

淨虧損爲7400萬美元,非公認會計准則調整後的息稅折舊攤銷前利潤爲1.19億美元

攤薄後每股虧損爲0.60美元,非公認會計准則調整後的每股攤薄收益爲0.22美元。

"Q3 marked another proofpoint of resilience for Wayfair with further market share capture in the face of sustained challenges in the category. Once again, we navigated a dynamic consumer environment while driving further discipline on costs to achieve a mid-single-digit Adjusted EBITDA margin for the second quarter in a row. As I've mentioned before, our north star is driving Adjusted EBITDA dollars in excess of equity-based compensation and capital expenditures, and we're pleased to be making noteworthy improvements across each of these fronts," said Niraj Shah, CEO, co-founder and co-chairman, Wayfair.

「第三季度標誌着Wayfair韌性的又一證明,面對該類別的持續挑戰,市場份額將進一步佔據。我們再次駕馭了充滿活力的消費環境,同時進一步嚴格控制成本,連續第二季度實現了中等個位數的調整後息稅折舊攤銷前利潤率。正如我之前提到的,我們的北極星推動調整後的息稅折舊攤銷前利潤超過了股票薪酬和資本支出,我們很高興在每個方面都取得了顯著的改善。」 Wayfair首席執行官、聯合創始人兼聯席董事長Niraj Shah說。

About Wayfair

關於 Wayfair

Wayfair is the destination for all things home, and we make it easy to create a home that is just right for you. Whether you're looking for that perfect piece or redesigning your entire space, Wayfair offers quality finds for every style and budget, and a seamless experience from inspiration to installation.

Wayfair是所有家居用品的目的地,我們可以輕鬆創建適合您的房屋。無論您是在尋找完美的作品還是重新設計整個空間,Wayfair都能提供適合各種風格和預算的優質產品,並提供從靈感到安裝的無縫體驗。

Related Reading: Press Release

相關閱讀: 新聞稿

International net revenue of $372 million and International Net Revenue Constant Currency Growth remained constant year over year

International net revenue of $372 million and International Net Revenue Constant Currency Growth remained constant year over year