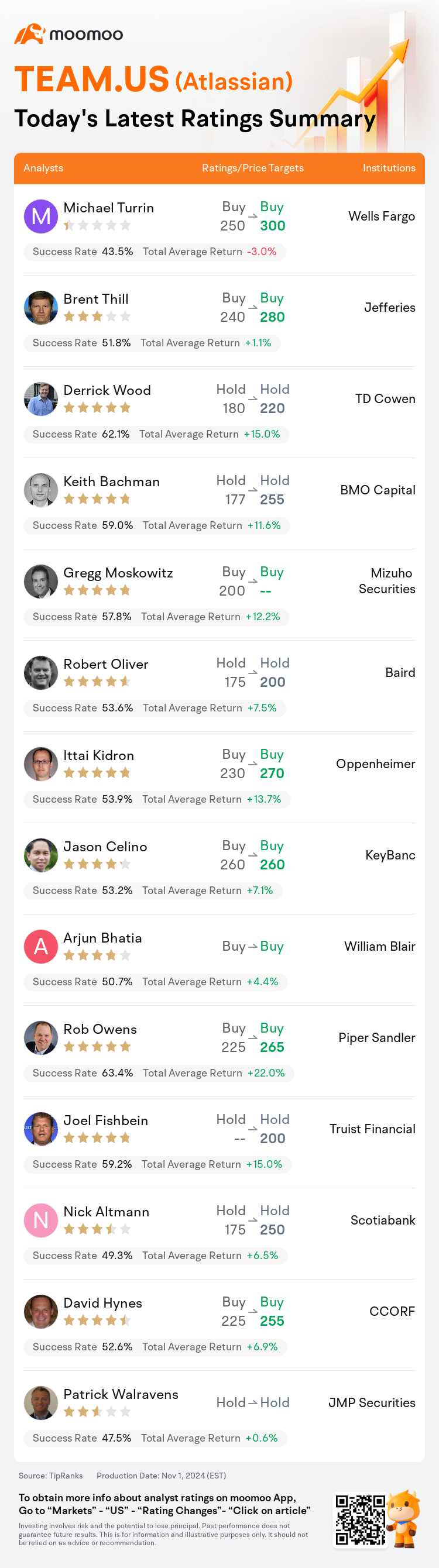

On Nov 01, major Wall Street analysts update their ratings for $Atlassian (TEAM.US)$, with price targets ranging from $200 to $300.

Wells Fargo analyst Michael Turrin maintains with a buy rating, and adjusts the target price from $250 to $300.

Jefferies analyst Brent Thill maintains with a buy rating, and adjusts the target price from $240 to $280.

TD Cowen analyst Derrick Wood maintains with a hold rating, and adjusts the target price from $180 to $220.

TD Cowen analyst Derrick Wood maintains with a hold rating, and adjusts the target price from $180 to $220.

BMO Capital analyst Keith Bachman maintains with a hold rating, and adjusts the target price from $177 to $255.

Mizuho Securities analyst Gregg Moskowitz maintains with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $Atlassian (TEAM.US)$'s main analysts recently are as follows:

Atlassian's strong performance in the September quarter was propelled by a widespread surge and Cloud growth that surpassed expectations. The company experienced a significant increase in seats across all products, robust deal activity, and favorable customer reactions to Loom and Rovo. Despite macroeconomic challenges, the quarter was deemed impressive. Looking ahead, there's optimism about the new CRO's potential impact on sales and the enhancement of enterprise cross-selling efforts.

Atlassian experienced a significant outperformance in Q1, surpassing expectations to a greater extent than usual due to conservative guidance and positive trends. It's believed that these results will bolster confidence in the outlook for the remainder of the year and support a trajectory towards a three-year compound annual growth rate of over 20%, potentially contributing to the extension of the stock's recent upward trend.

The company reported robust results and has updated its full-year guidance accordingly.

The strong top-line outperformance and raised guidance for Cloud growth by FY25 were key highlights in the recent performance review. The first quarter experienced the most significant Cloud outperformance in comparison to forecasts since the initiation of such guidance, accompanied by data center performance that also exceeded expectations.

Following Atlassian's 'strong' financial results for the first fiscal quarter, analysts have gained confidence that the company's guidance will likely enable a more predictable pattern of outperforming estimates and raising future projections. The company has demonstrated stable growth in paid seats over the last two quarters, and this, along with a cautious guidance approach that anticipates a challenging economic climate, sets a positive stage for the company's shares. Additionally, indicators from recent surveys suggest a cautious optimism for IT budget growth by 2025, which could be a harbinger of accelerated growth for Atlassian in the years following fiscal 2025.

Here are the latest investment ratings and price targets for $Atlassian (TEAM.US)$ from 14 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

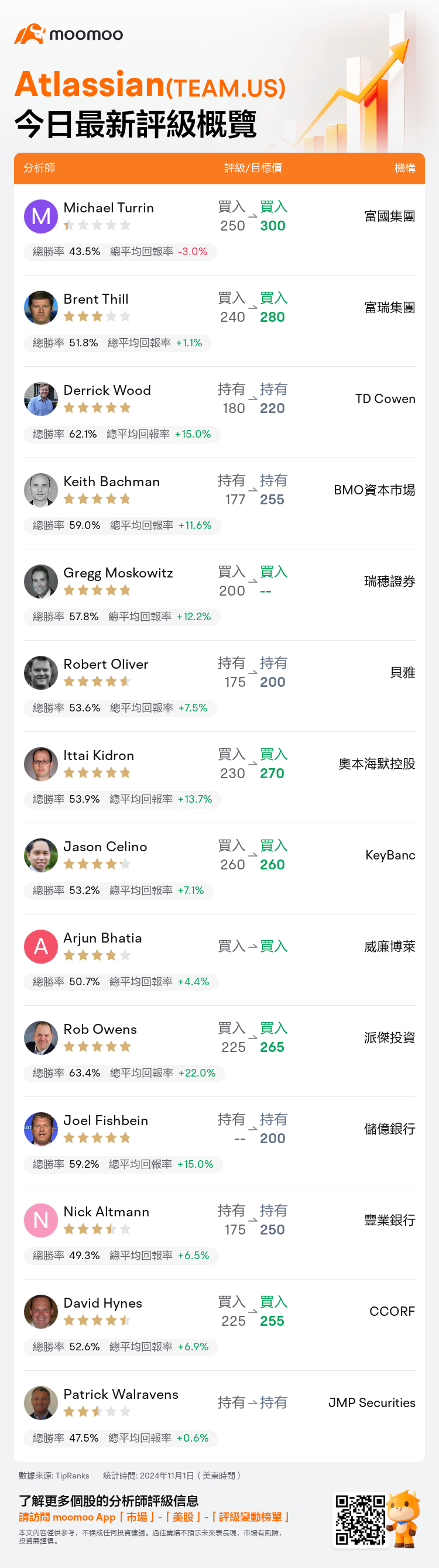

美東時間11月1日,多家華爾街大行更新了$Atlassian (TEAM.US)$的評級,目標價介於200美元至300美元。

富國集團分析師Michael Turrin維持買入評級,並將目標價從250美元上調至300美元。

富瑞集團分析師Brent Thill維持買入評級,並將目標價從240美元上調至280美元。

TD Cowen分析師Derrick Wood維持持有評級,並將目標價從180美元上調至220美元。

TD Cowen分析師Derrick Wood維持持有評級,並將目標價從180美元上調至220美元。

BMO資本市場分析師Keith Bachman維持持有評級,並將目標價從177美元上調至255美元。

瑞穗證券分析師Gregg Moskowitz維持買入評級。

此外,綜合報道,$Atlassian (TEAM.US)$近期主要分析師觀點如下:

Atlassian在九月季度表現強勁,得益於普遍激增和雲增長超出預期。公司所有產品的席位數量大幅增加,交易活動強勁,並且顧客對Loom和Rovo的反應積極。儘管宏觀經濟存在挑戰,該季度被認爲是令人印象深刻的。展望未來,人們對新首席營收官對銷售的潛在影響以及企業跨銷售努力的增強充滿樂觀。

Atlassian在Q1表現出色,超出預期的程度比往常更大,這歸因於保守的指導和積極趨勢。人們認爲這些結果將加強人們對年餘下時間展望的信心,並支持實現年複合增長率超過20%的軌跡,這有可能有助於延續股票最近的上升趨勢。

公司報告了強勁的業績,並相應地更新了全年指導。

最近的業績審議中,強勁的頂線表現和到FY25年雲增長的指導上調是關鍵亮點。第一季度雲業績超出預期表現,這是自設定這類指導以來對比預測中最顯着的一次,同時數據中心的表現也超出了預期。

在Atlassian第一個財季的'強勁'財務業績後,分析師們對公司的指導感到信心,可能會使公司更有可能出現超出預期並提高未來預測的更可預測模式。公司在過去兩個季度穩定增長的付費席位以及一種謹慎的指導方法,預計將迎接具有挑戰性的經濟環境的設想,爲公司股票設定了積極的舞臺。此外,最近調查的指標表明,到2025年IT預算增長可能會現謹慎樂觀情緒,這可能是Atlassian在2025財年後幾年加速增長的先行者。

以下爲今日14位分析師對$Atlassian (TEAM.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

TD Cowen分析師Derrick Wood維持持有評級,並將目標價從180美元上調至220美元。

TD Cowen分析師Derrick Wood維持持有評級,並將目標價從180美元上調至220美元。

TD Cowen analyst Derrick Wood maintains with a hold rating, and adjusts the target price from $180 to $220.

TD Cowen analyst Derrick Wood maintains with a hold rating, and adjusts the target price from $180 to $220.