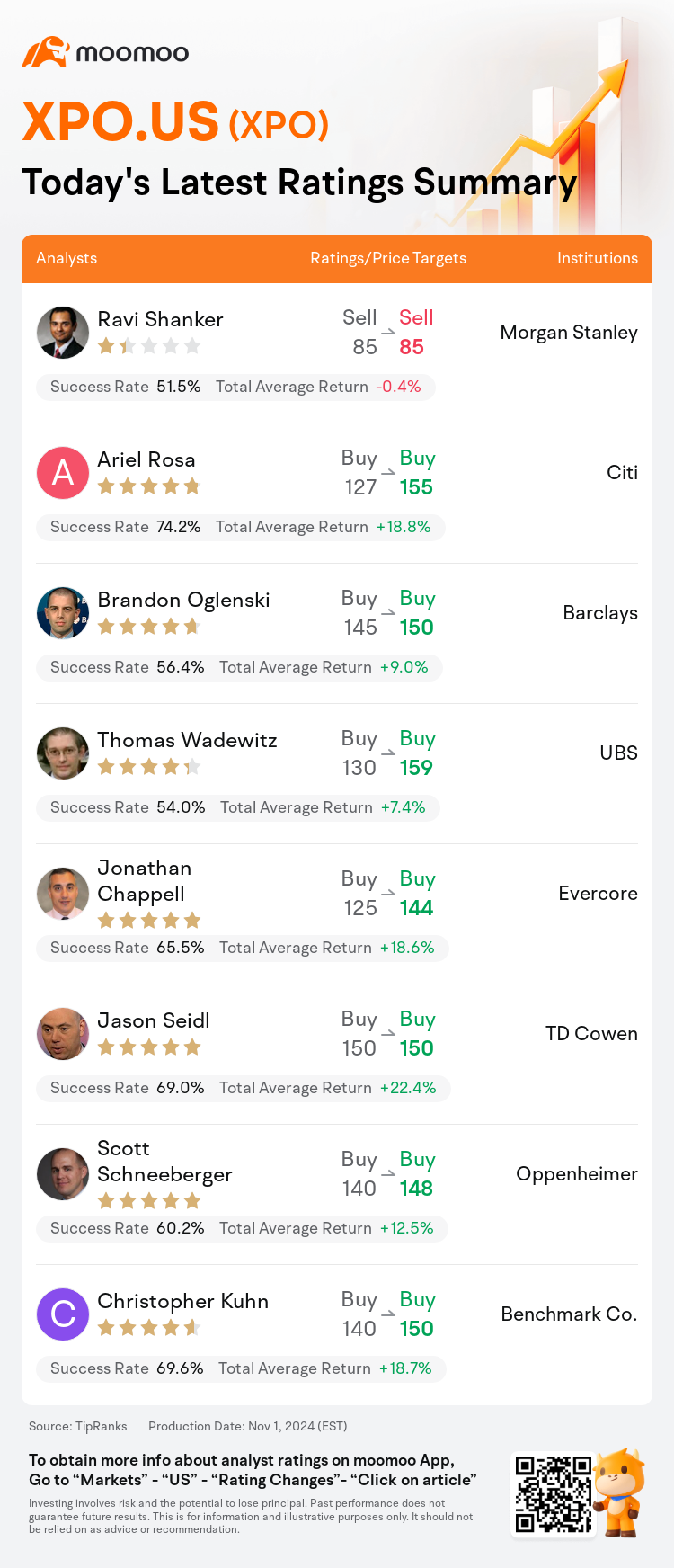

On Nov 01, major Wall Street analysts update their ratings for $XPO (XPO.US)$, with price targets ranging from $85 to $159.

Morgan Stanley analyst Ravi Shanker maintains with a sell rating, and maintains the target price at $85.

Citi analyst Ariel Rosa maintains with a buy rating, and adjusts the target price from $127 to $155.

Barclays analyst Brandon Oglenski maintains with a buy rating, and adjusts the target price from $145 to $150.

Barclays analyst Brandon Oglenski maintains with a buy rating, and adjusts the target price from $145 to $150.

UBS analyst Thomas Wadewitz maintains with a buy rating, and adjusts the target price from $130 to $159.

Evercore analyst Jonathan Chappell maintains with a buy rating, and adjusts the target price from $125 to $144.

Furthermore, according to the comprehensive report, the opinions of $XPO (XPO.US)$'s main analysts recently are as follows:

XPO, Inc's third quarter performance, along with positive insights from management, suggest that the company is effectively meeting its strategic goals. This underscores the argument that XPO warrants recognition as a top-tier national less-than-truckload carrier.

XPO, Inc. has sustained another strong quarter despite challenges in the freight landscape. It is anticipated that pricing trends will favor continued solid margins and earnings growth into 2025, in light of the company's consistent performance amidst a soft freight environment.

The company appears set to achieve a high-70% operating ratio by FY28, which could justify a share price around $219 based on a projected enterprise value to expected EBITDA multiple. XPO is recognized for its robust management team and a strategic plan aimed at enhancing service quality, pricing tactics, and operational efficacy, fostering a substantial rise in operating margins.

Following quarterly results, it's observed that XPO, Inc continues to perform effectively. The company's Q3 adjusted EBITDA significantly surpassed the consensus expectations.

XPO, Inc's recent performance exceeded forecasts and consensus expectations for the third quarter. The company's full-year Less-Than-Truckload (LTL) margin targets are anticipated to surpass the initial guidance, which is not common among transport peers. This comes even as the company has expanded its operations by opening 21 service centers within the year.

Here are the latest investment ratings and price targets for $XPO (XPO.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

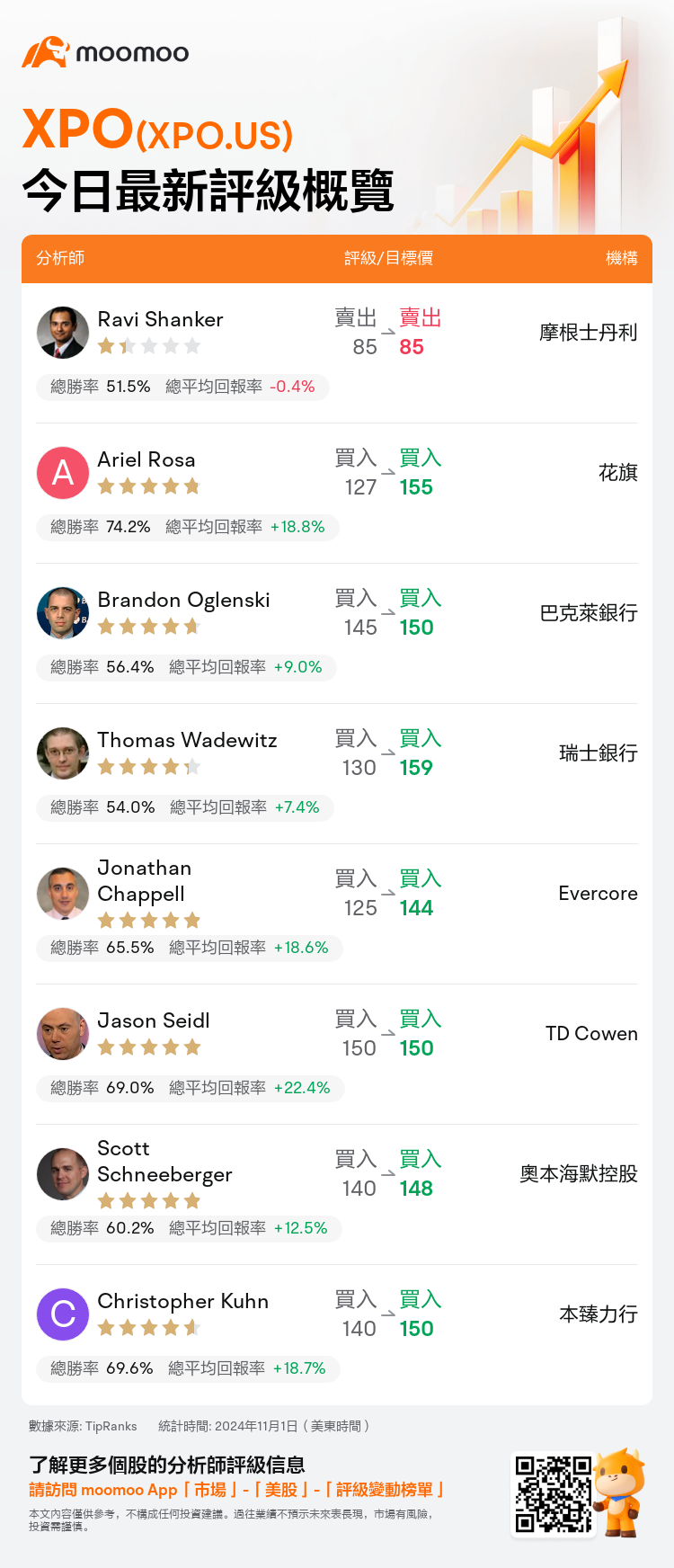

美東時間11月1日,多家華爾街大行更新了$XPO (XPO.US)$的評級,目標價介於85美元至159美元。

摩根士丹利分析師Ravi Shanker維持賣出評級,維持目標價85美元。

花旗分析師Ariel Rosa維持買入評級,並將目標價從127美元上調至155美元。

巴克萊銀行分析師Brandon Oglenski維持買入評級,並將目標價從145美元上調至150美元。

巴克萊銀行分析師Brandon Oglenski維持買入評級,並將目標價從145美元上調至150美元。

瑞士銀行分析師Thomas Wadewitz維持買入評級,並將目標價從130美元上調至159美元。

Evercore分析師Jonathan Chappell維持買入評級,並將目標價從125美元上調至144美元。

此外,綜合報道,$XPO (XPO.US)$近期主要分析師觀點如下:

xpo公司的第三季度表現,以及管理層積極的看法表明該公司有效地實現了其戰略目標。這凸顯了xpo作爲一家頂尖國家零擔運輸承運商的認可論點。

儘管貨運行業面臨挑戰,xpo公司仍然實現了又一個強勁的季度。預計價格趨勢將有利於繼續穩固的利潤率和收益增長至2025年,在公司在疲軟的貨運環境中持續表現良好的情況下。

該公司似乎將在FY28實現高70%的運營比率,這可能會支撐股價約爲219美元,基於預期企業價值與預期EBITDA倍數。xpo以其強大的管理團隊和旨在提升服務質量、定價策略和運營效率的戰略計劃而聞名,從而促進營運利潤大幅增長。

根據季度業績,xpo公司繼續有效地表現。公司的第三季度調整後EBITDA大幅超出了一致預期。

xpo公司最近的業績超出了第三季度的預測和一致預期。公司全年的零擔(LTL)利潤率目標預計將超過初步指導,這在運輸同行中並不常見。即使公司在年內開設了21個服務中心,這也是如此。

以下爲今日8位分析師對$XPO (XPO.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Brandon Oglenski維持買入評級,並將目標價從145美元上調至150美元。

巴克萊銀行分析師Brandon Oglenski維持買入評級,並將目標價從145美元上調至150美元。

Barclays analyst Brandon Oglenski maintains with a buy rating, and adjusts the target price from $145 to $150.

Barclays analyst Brandon Oglenski maintains with a buy rating, and adjusts the target price from $145 to $150.