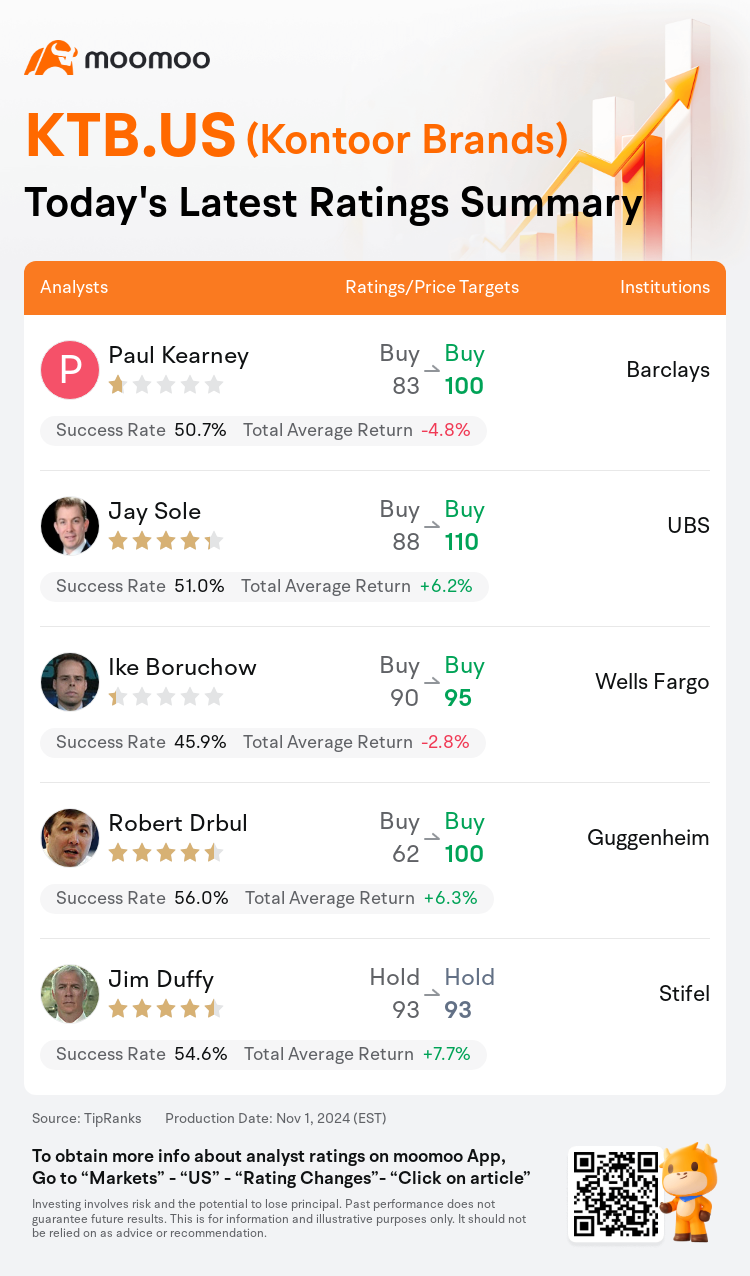

On Nov 01, major Wall Street analysts update their ratings for $Kontoor Brands (KTB.US)$, with price targets ranging from $93 to $110.

Barclays analyst Paul Kearney maintains with a buy rating, and adjusts the target price from $83 to $100.

UBS analyst Jay Sole maintains with a buy rating, and adjusts the target price from $88 to $110.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and adjusts the target price from $90 to $95.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and adjusts the target price from $90 to $95.

Guggenheim analyst Robert Drbul maintains with a buy rating, and adjusts the target price from $62 to $100.

Stifel analyst Jim Duffy maintains with a hold rating, and maintains the target price at $93.

Furthermore, according to the comprehensive report, the opinions of $Kontoor Brands (KTB.US)$'s main analysts recently are as follows:

Kontoor Brands' third-quarter report highlighted the brands' escalating momentum, showcasing the company's enhancement as a prominent denim entity, marked by continuous gains in point of sale share. The anticipated 11% compound annual growth rate over five years and the expectation of earnings per share outperformance in the near future are seen as potential catalysts for the company's stock movement.

Kontoor Brands is advancing on various fronts, achieving organic market share gains, extending its categories, and widening distribution channels. Additionally, the company is enhancing its leading operating margin, with prospects for further improvement over the forthcoming two years.

The firm's optimism towards Kontoor Brands is supported by enhanced profitability, ongoing market share gains, and visibility into the Spring/Summer '25 orderbook. This positive outlook is reflected in the increased EPS estimates for FY24 and FY25 following the Q3 report.

The company has demonstrated commendable execution amidst a fluctuating environment, and while its stock has experienced a significant 84% increase on a year-over-year basis, it is suggested that the current valuation fully reflects the expectations for a business with low-single digit revenue growth. The Project Jeanius is anticipated to contribute to margin improvement in the fiscal years of 2025 and 2026. However, considering the potential for valuation contraction, the reliance on Walmart accounting for 36% of business, and the unpredictability of commodity prices, it is challenging to argue for a persuasive growth narrative for the stock.

Here are the latest investment ratings and price targets for $Kontoor Brands (KTB.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

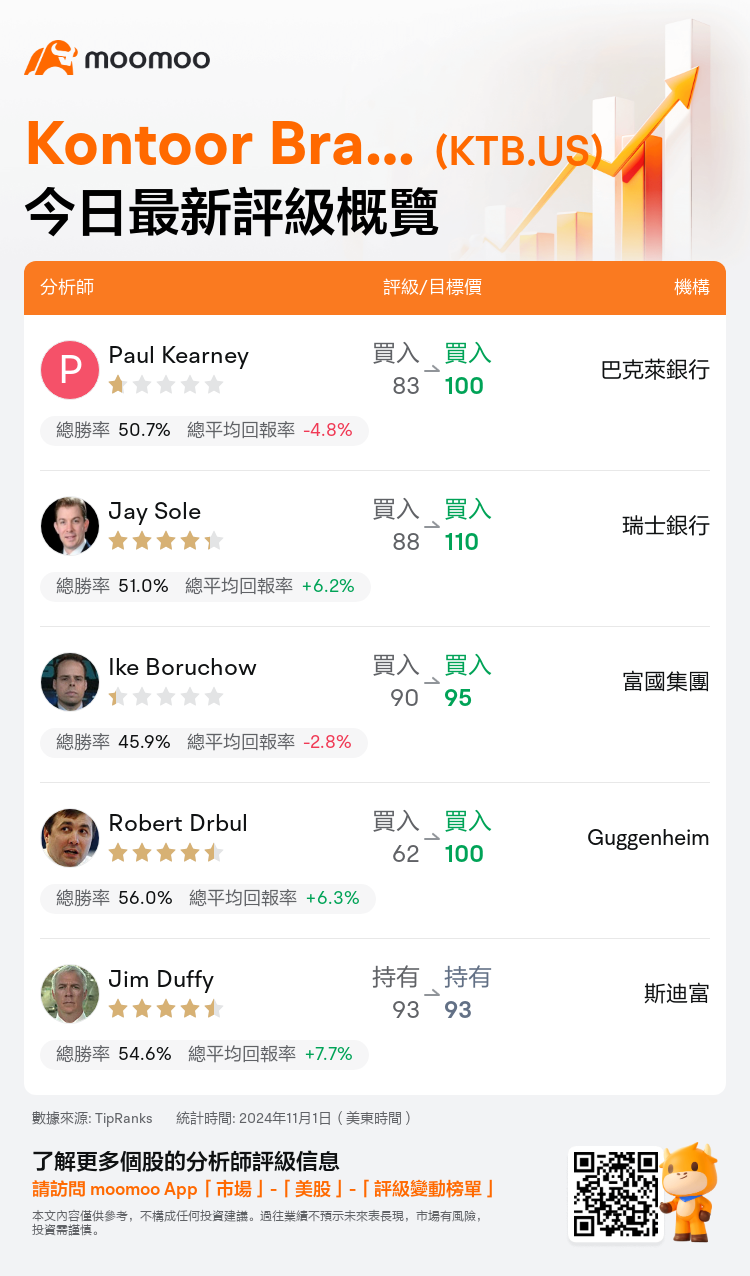

美東時間11月1日,多家華爾街大行更新了$Kontoor Brands (KTB.US)$的評級,目標價介於93美元至110美元。

巴克萊銀行分析師Paul Kearney維持買入評級,並將目標價從83美元上調至100美元。

瑞士銀行分析師Jay Sole維持買入評級,並將目標價從88美元上調至110美元。

富國集團分析師Ike Boruchow維持買入評級,並將目標價從90美元上調至95美元。

富國集團分析師Ike Boruchow維持買入評級,並將目標價從90美元上調至95美元。

Guggenheim分析師Robert Drbul維持買入評級,並將目標價從62美元上調至100美元。

斯迪富分析師Jim Duffy維持持有評級,維持目標價93美元。

此外,綜合報道,$Kontoor Brands (KTB.US)$近期主要分析師觀點如下:

Kontoor Brands第三季度報告突顯了該品牌不斷增長的勢頭,展示了公司作爲一個突出的牛仔品牌實體的提升,不斷增長的銷售點份額。預期的11%複合年增長率將在未來五年內實現,預計在不久的將來盈利每股將超出預期,被認爲是公司股票走勢的潛在催化劑。

Kontoor Brands正在各個方面取得進展,實現有機市場份額增長,擴大其產品類別,並拓寬了分銷渠道。此外,公司正在提升其領先的營業利潤率,展望未來兩年進一步改善的前景。

公司對Kontoor Brands的樂觀態度得到了增強的盈利能力、持續增長的市場份額以及對2025春夏訂貨冊的可見度的支持。這種積極的展望體現在Q3報告後對FY24和FY25的EPS估計增加。

公司在一個波動的環境中展現了值得稱讚的執行力,儘管其股價在同比基礎上經歷了顯著的84%增長,但有人認爲,目前的估值已充分體現了對低個位數營業收入增長的預期。Jeanius項目被預計將在2025和2026財年對利潤率改善做出貢獻。然而,考慮到估值收縮的可能性,對沃爾瑪業務佔36%的依賴性,以及商品價格的不可預測性,難以爲股票提出有力的增長敘事。

以下爲今日5位分析師對$Kontoor Brands (KTB.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師Ike Boruchow維持買入評級,並將目標價從90美元上調至95美元。

富國集團分析師Ike Boruchow維持買入評級,並將目標價從90美元上調至95美元。

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and adjusts the target price from $90 to $95.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and adjusts the target price from $90 to $95.