On Nov 01, major Wall Street analysts update their ratings for $Microsoft (MSFT.US)$, with price targets ranging from $465 to $550.

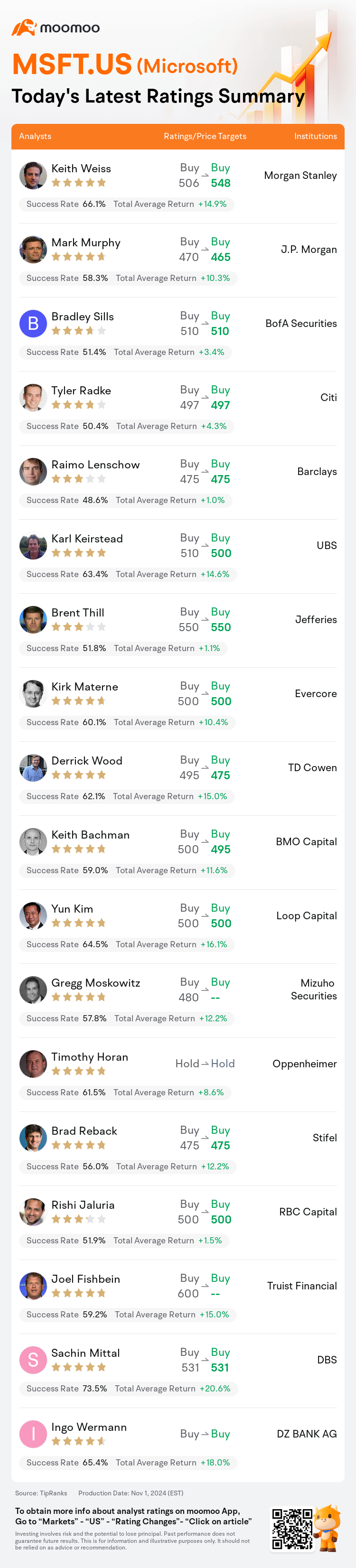

Morgan Stanley analyst Keith Weiss maintains with a buy rating, and adjusts the target price from $506 to $548.

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $470 to $465.

BofA Securities analyst Bradley Sills maintains with a buy rating, and maintains the target price at $510.

BofA Securities analyst Bradley Sills maintains with a buy rating, and maintains the target price at $510.

Citi analyst Tyler Radke maintains with a buy rating, and maintains the target price at $497.

Barclays analyst Raimo Lenschow maintains with a buy rating, and maintains the target price at $475.

Furthermore, according to the comprehensive report, the opinions of $Microsoft (MSFT.US)$'s main analysts recently are as follows:

Microsoft's recent quarterly results did not meet expectations, yet the outlook for Azure's performance by 2025 remains positive, maintaining a constructive stance on the company's prospects.

The firm voiced no concerns regarding Microsoft's Q1 outcomes, labeling them as 'broadly stable-good.' The expectation for Q2's total revenue was set at achievable levels, yet Microsoft's guidance fell short, prompting a decline in share prices after hours. The most significant shortfall in guidance was noted within More Personal Computing (MPC), yet the firm considers MPC's impact as secondary to the core thesis of Microsoft due to the greater importance of higher-margin, more consistent annuity streams. However, it acknowledges that these developments present inconvenient obstacles in the near term.

Azure's growth in constant currency during Q1 exceeded expectations slightly, with a notable contribution from GenAI, as demand continues to surpass supply. Anticipated Azure growth is projected to decelerate to 31%-32% in the upcoming quarter but is expected to pick up speed in the latter half of FY25. Additionally, overall GenAI revenue is forecasted to surpass a $10B run-rate in Q2 of FY25.

After evaluating Microsoft's Q1 outcomes, the observation was made that Azure's growth in the September quarter exceeded expectations by a narrow margin. Nonetheless, the revenue forecast for Azure in the December quarter might not fully meet investor expectations, partly due to a more pronounced supply and demand imbalance compared to the September quarter. Looking ahead, Microsoft's prospects include an anticipated acceleration in Azure's growth, an increase in Microsoft 365 ARPU spurred by a more diverse offering, and a potential reduction in capital expenditures.

The expectation is that shares will remain within a narrow range until there is a relaxation of capacity constraints and a subsequent acceleration of Azure, anticipated to begin in the March quarter. It is projected that a more significant acceleration of overall growth will manifest as the company progresses through the calendar year 2025, fueled by the evolution of AI initiatives, which is likely to create a more favorable scenario for the following year.

Here are the latest investment ratings and price targets for $Microsoft (MSFT.US)$ from 18 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月1日,多家華爾街大行更新了$微軟 (MSFT.US)$的評級,目標價介於465美元至550美元。

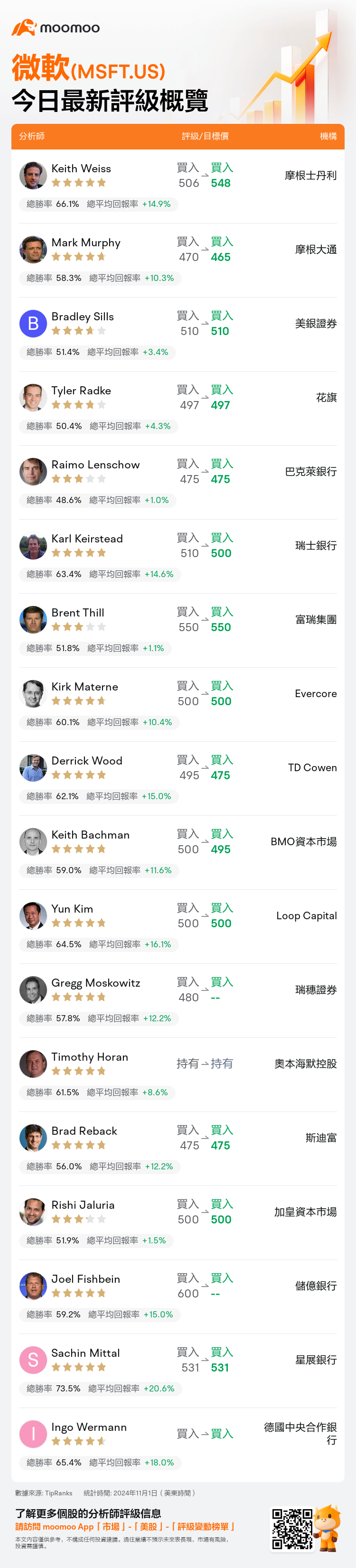

摩根士丹利分析師Keith Weiss維持買入評級,並將目標價從506美元上調至548美元。

摩根大通分析師Mark Murphy維持買入評級,並將目標價從470美元下調至465美元。

美銀證券分析師Bradley Sills維持買入評級,維持目標價510美元。

美銀證券分析師Bradley Sills維持買入評級,維持目標價510美元。

花旗分析師Tyler Radke維持買入評級,維持目標價497美元。

巴克萊銀行分析師Raimo Lenschow維持買入評級,維持目標價475美元。

此外,綜合報道,$微軟 (MSFT.US)$近期主要分析師觀點如下:

微軟最近的季度業績未達預期,但到2025年Azure的業績前景仍然積極,對公司前景持建設性立場。

公司對微軟Q1的結果沒有任何擔憂,將其標記爲'廣泛穩定-良好'。對Q2總營收的預期設定在可實現水平,但微軟的指導不足,導致分享價值在收盤後下降。在指導方面最顯著的預期不足是在更個人計算(MPC)中,但公司認爲MPC的影響次於微軟的核心命題,因爲更高利潤率、更一致的年金流更爲重要。然而,公司認識到這些發展在短期內帶來了不便的障礙。

在Q1中,Azure在恒定貨幣下的增長略微超出預期,其中GenAI做出了顯著貢獻,需求持續超過供應。預計Azure的增長在即將到來的季度將放緩至31%-32%,但預計在FY25的後半年速度將加快。此外,整體GenAI營收預計將在FY25的Q2超過100億美元的運行速率。

在評估微軟Q1的結果後,發現Azure在9月季度的增長僅略微超出預期。儘管如此,12月季度Azure的營收預測可能不會完全達到投資者的預期,部分原因是與9月季度相比,供求失衡更爲顯著。展望未來,微軟的前景包括Azure增長的預期加速,由更多元化產品帶來的Microsoft 365 ARPU增加,以及資本支出的潛在減少。

預期股票將會在一個狹窄的區間內保持,直到產能限制放寬並隨後Azure加速,預計將在3月季度開始。預計整體增長的更大加速將隨着公司在2025年日曆年的進展而顯現,AI倡議的發展將推動2026年更加有利的情景。

以下爲今日18位分析師對$微軟 (MSFT.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師Bradley Sills維持買入評級,維持目標價510美元。

美銀證券分析師Bradley Sills維持買入評級,維持目標價510美元。

BofA Securities analyst Bradley Sills maintains with a buy rating, and maintains the target price at $510.

BofA Securities analyst Bradley Sills maintains with a buy rating, and maintains the target price at $510.