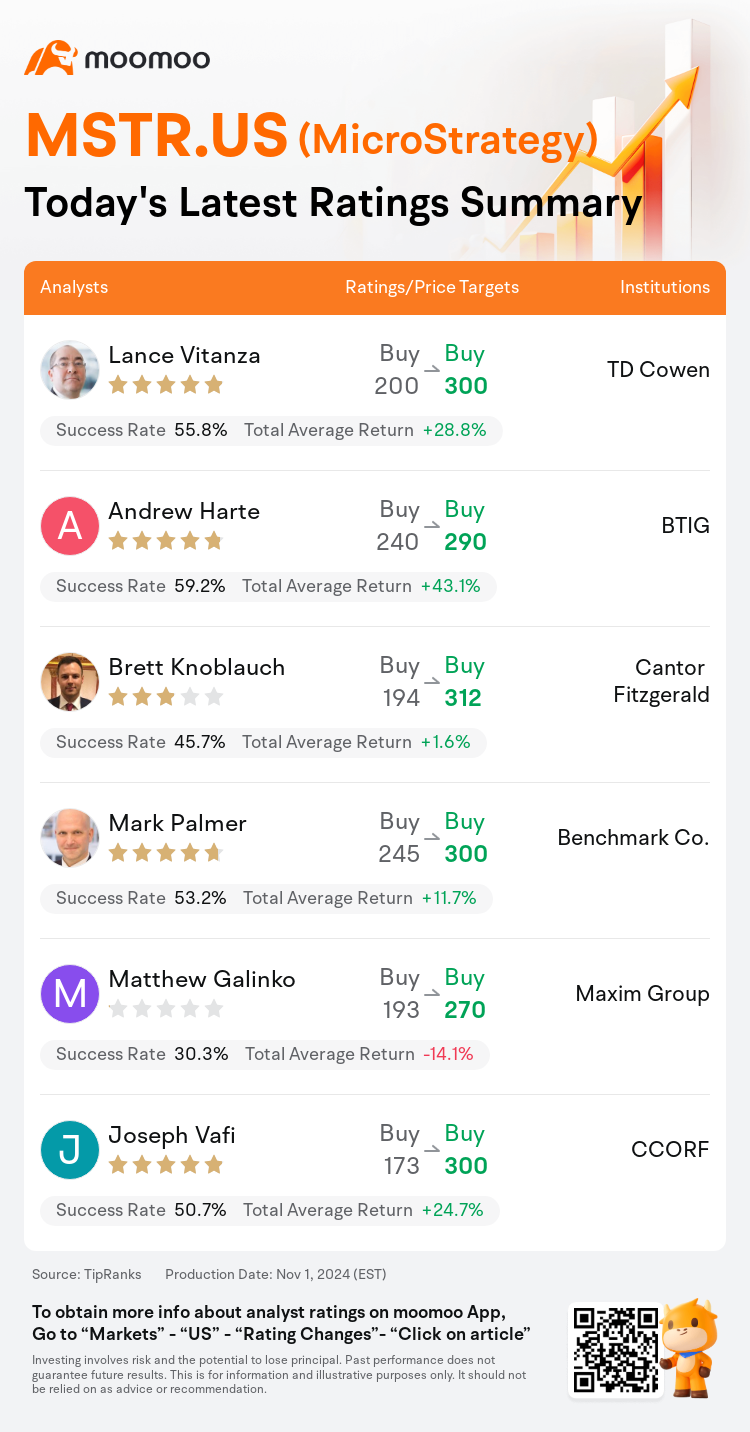

On Nov 01, major Wall Street analysts update their ratings for $MicroStrategy (MSTR.US)$, with price targets ranging from $270 to $312.

TD Cowen analyst Lance Vitanza maintains with a buy rating, and adjusts the target price from $200 to $300.

BTIG analyst Andrew Harte maintains with a buy rating, and adjusts the target price from $240 to $290.

Cantor Fitzgerald analyst Brett Knoblauch maintains with a buy rating, and adjusts the target price from $194 to $312.

Cantor Fitzgerald analyst Brett Knoblauch maintains with a buy rating, and adjusts the target price from $194 to $312.

Benchmark Co. analyst Mark Palmer maintains with a buy rating, and adjusts the target price from $245 to $300.

Maxim Group analyst Matthew Galinko maintains with a buy rating, and adjusts the target price from $193 to $270.

Furthermore, according to the comprehensive report, the opinions of $MicroStrategy (MSTR.US)$'s main analysts recently are as follows:

The firm noted that while the operating results were satisfactory, it was the bold new capital strategy aimed at reinforcing MicroStrategy's status as a premier Bitcoin Treasury Company that captured attention.

In light of the Q3 report, MicroStrategy unveiled a substantial capital acquisition strategy, targeting a $42B fundraise over the coming three years. The company's approach involves obtaining $21B through equity offerings and an equal amount through debt instruments, with the objective of expanding its bitcoin portfolio. The rationale behind the company's market premium compared to the spot value of its bitcoin assets is attributed to its historical success in enhancing bitcoin yield through strategic capital raises aimed at purchasing more bitcoin, coupled with its ambitious plans to secure an additional $42B in bitcoin over the next three years.

Here are the latest investment ratings and price targets for $MicroStrategy (MSTR.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

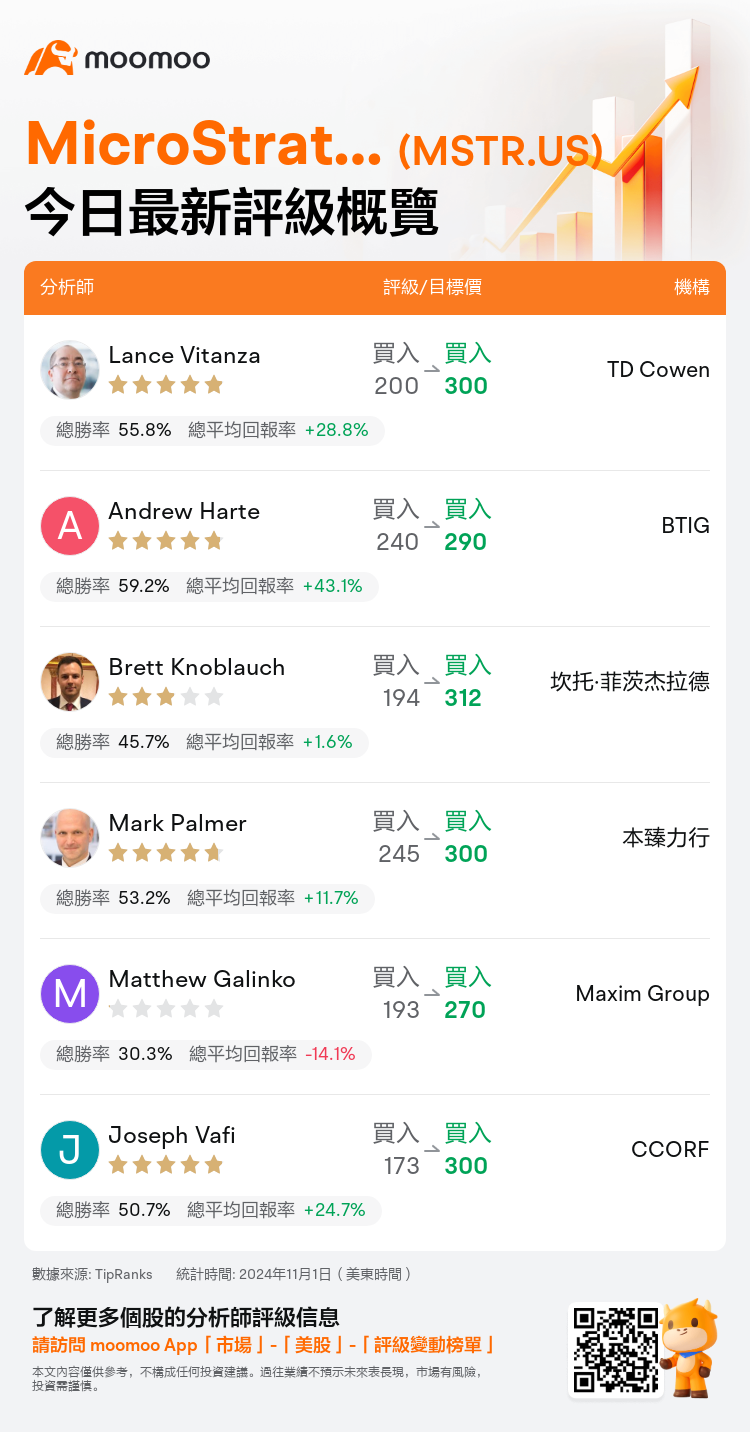

美東時間11月1日,多家華爾街大行更新了$MicroStrategy (MSTR.US)$的評級,目標價介於270美元至312美元。

TD Cowen分析師Lance Vitanza維持買入評級,並將目標價從200美元上調至300美元。

BTIG分析師Andrew Harte維持買入評級,並將目標價從240美元上調至290美元。

坎托·菲茨杰拉德分析師Brett Knoblauch維持買入評級,並將目標價從194美元上調至312美元。

坎托·菲茨杰拉德分析師Brett Knoblauch維持買入評級,並將目標價從194美元上調至312美元。

本臻力行分析師Mark Palmer維持買入評級,並將目標價從245美元上調至300美元。

Maxim Group分析師Matthew Galinko維持買入評級,並將目標價從193美元上調至270美元。

此外,綜合報道,$MicroStrategy (MSTR.US)$近期主要分析師觀點如下:

該公司指出,儘管運營結果令人滿意,但旨在強化microstrategy作爲一家頂尖比特幣金庫公司地位的大膽資本策略卻吸引了注意。

鑑於第三季度報告,microstrategy披露了一項重大的資本收購策略,旨在在未來三年籌集420億美元。該公司的做法涉及通過股本發行和同等金額的債務工具融資210億美元,其目標是擴大其比特幣投資組合。該公司比特幣資產的市場溢價背後的理由,與其歷史上成功地通過戰略性的資本增長提高比特幣收益、計劃在接下來的三年內再融資420億美元有關。

以下爲今日6位分析師對$MicroStrategy (MSTR.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

坎托·菲茨杰拉德分析師Brett Knoblauch維持買入評級,並將目標價從194美元上調至312美元。

坎托·菲茨杰拉德分析師Brett Knoblauch維持買入評級,並將目標價從194美元上調至312美元。

Cantor Fitzgerald analyst Brett Knoblauch maintains with a buy rating, and adjusts the target price from $194 to $312.

Cantor Fitzgerald analyst Brett Knoblauch maintains with a buy rating, and adjusts the target price from $194 to $312.