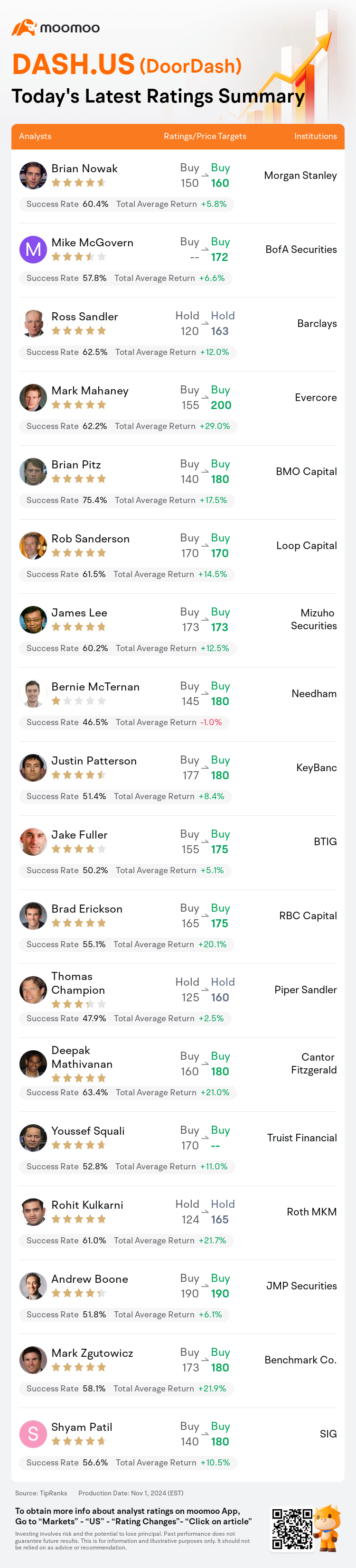

On Nov 01, major Wall Street analysts update their ratings for $DoorDash (DASH.US)$, with price targets ranging from $160 to $200.

Morgan Stanley analyst Brian Nowak maintains with a buy rating, and adjusts the target price from $150 to $160.

BofA Securities analyst Mike McGovern maintains with a buy rating, and sets the target price at $172.

Barclays analyst Ross Sandler maintains with a hold rating, and adjusts the target price from $120 to $163.

Barclays analyst Ross Sandler maintains with a hold rating, and adjusts the target price from $120 to $163.

Evercore analyst Mark Mahaney maintains with a buy rating, and adjusts the target price from $155 to $200.

BMO Capital analyst Brian Pitz maintains with a buy rating, and adjusts the target price from $140 to $180.

Furthermore, according to the comprehensive report, the opinions of $DoorDash (DASH.US)$'s main analysts recently are as follows:

DoorDash has achieved its first instance of GAAP profitability since its public offering in the third quarter. With what can be described as 'best in class execution' among delivery companies and performance that exceeds expectations across both new and established user groups, the outlook appears positive from multiple perspectives. The possibility of inclusion in the S&P 500 Index may become a topic of discussion around 2025.

DoorDash's recent quarterly performance exhibited a strong top-line surpassing expectations, though with a marginal increase in margin. The analyst's projections for the company's gross order volume, revenue, and EBITDA in 2025 have been revised upwards, reflecting a slight improvement compared to previous estimates.

DoorDash reported solid third-quarter EBITDA and expects a robust fourth quarter. This is attributed to stable growth in its restaurant business, vigorous expansion in new sectors and international markets, along with advancements in unit economics.

DoorDash's Q3 earnings surpassed expectations, and the company's performance is highlighted by its consistent ability to drive 20% bookings growth, which is projected to continue into FY24. The increase in user frequency, spurred by ongoing product enhancements, remains a key factor in the company's value proposition. Additionally, DoorDash is capitalizing on the rising consumer trend of allocating more spending toward the convenience economy.

Following the 'Beat & Raise Q3 EPS results,' there has been an adjustment in expectations with GMV estimates for FY25 increasing approximately 3% and revenue projections also rising by about 4%, according to an analyst.

Here are the latest investment ratings and price targets for $DoorDash (DASH.US)$ from 18 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

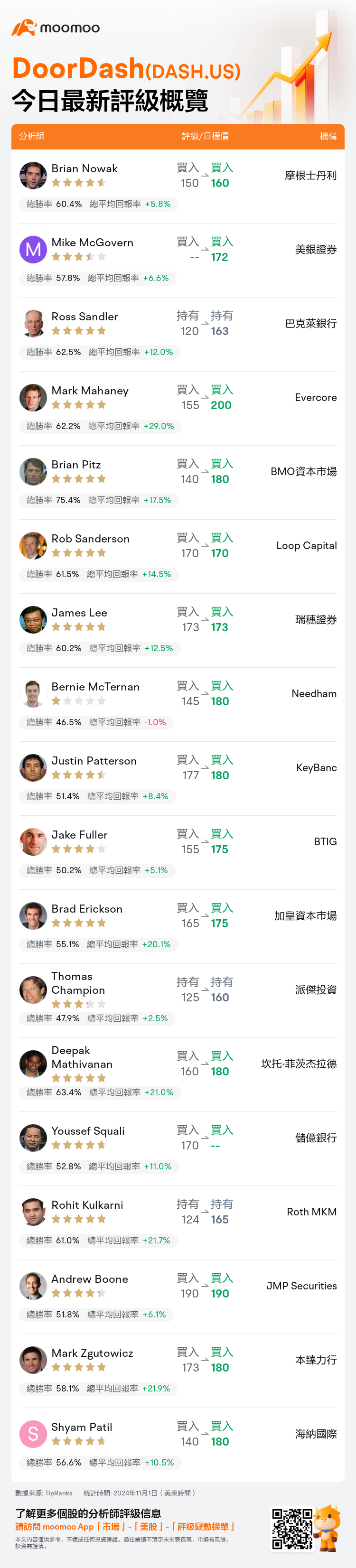

美東時間11月1日,多家華爾街大行更新了$DoorDash (DASH.US)$的評級,目標價介於160美元至200美元。

摩根士丹利分析師Brian Nowak維持買入評級,並將目標價從150美元上調至160美元。

美銀證券分析師Mike McGovern維持買入評級,目標價172美元。

巴克萊銀行分析師Ross Sandler維持持有評級,並將目標價從120美元上調至163美元。

巴克萊銀行分析師Ross Sandler維持持有評級,並將目標價從120美元上調至163美元。

Evercore分析師Mark Mahaney維持買入評級,並將目標價從155美元上調至200美元。

BMO資本市場分析師Brian Pitz維持買入評級,並將目標價從140美元上調至180美元。

此外,綜合報道,$DoorDash (DASH.US)$近期主要分析師觀點如下:

doordash自首次公開發行以來,於第三季度實現了符合一般公認會計准則的盈利能力。在送餐公司中執行力可謂最佳,並在新老用戶群體中表現超出預期,多方面展望都呈現積極態勢。被納入標普500指數的可能性可能會成爲2025年左右的討論話題。

doordash最近的季度業績表現強勁,超出預期,儘管利潤率略有增加。分析師對公司2025年的毛訂單量、營業收入和EBITDA的預測已經上調,與先前估計相比略有改善。

doordash報告了穩固的第三季度EBITDA,並預計第四季度將表現強勁。這歸因於其餐廳業務的穩定增長,在新領域和國際市場的積極擴張,以及單位經濟的進展。

doordash第三季度的收入超出預期,公司的表現以能夠持續推動20%的訂單增長能力爲亮點,預計將持續到2024財年。由持續產品改進推動的用戶頻率增加仍然是公司價值主張的關鍵因素。此外,doordash正在利用消費者趨勢增加更多開支支持便利經濟。

根據一位分析師的說法,隨着『打敗與提高Q3的EPS結果』,對2025財年GMV預估的期望發生調整,增長約3%,營業收入預期也增長約4%。

以下爲今日18位分析師對$DoorDash (DASH.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Ross Sandler維持持有評級,並將目標價從120美元上調至163美元。

巴克萊銀行分析師Ross Sandler維持持有評級,並將目標價從120美元上調至163美元。

Barclays analyst Ross Sandler maintains with a hold rating, and adjusts the target price from $120 to $163.

Barclays analyst Ross Sandler maintains with a hold rating, and adjusts the target price from $120 to $163.