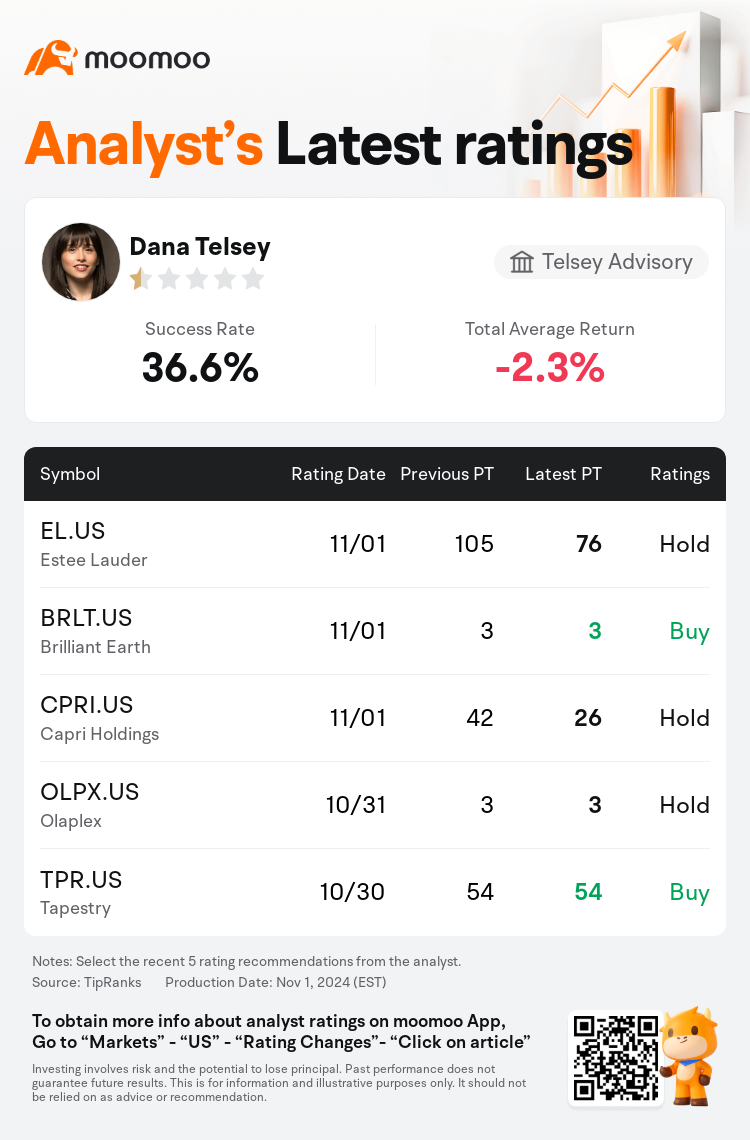

Telsey Advisory analyst Dana Telsey maintains $Estee Lauder (EL.US)$ with a hold rating, and adjusts the target price from $105 to $76.

According to TipRanks data, the analyst has a success rate of 36.6% and a total average return of -2.3% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Estee Lauder (EL.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Estee Lauder (EL.US)$'s main analysts recently are as follows:

Estee Lauder's Q1 performance, which exceeded expectations, was overshadowed by a Q2 forecast that didn't meet consensus, along with the withdrawal of second half guidance and a reduction in dividends. The analyst believes that the company's future is not clearly visible at this point and is looking forward to potential strategic shifts and additional productivity initiatives from the newly appointed executive team, which should also address the company's substantial cost structure.

The recent adjustment in the dividend to 35 cents per share quarterly, with the anticipation that Estee Lauder remains dedicated to a dividend payout ratio around 40%, indicates a net income forecast of $1.2 billion, or an earnings power of $3.50 per share over time. The assessment suggests that it may be too early to take advantage of the current lower stock price considering the ongoing slowdown and uncertainty in China, along with the transition to a new CEO at the beginning of the year.

Persistent sales declines and limited future visibility prompted management to withdraw guidance. The absence of clear projections is anticipated to persist for an extended period. Operational leverage challenges due to lower-than-expected volume in China and Asia's travel retail sector suggest that the execution of the company's plan and the realization of returns may be postponed. It is therefore suggested that investors await more favorable indications of demand improvement.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

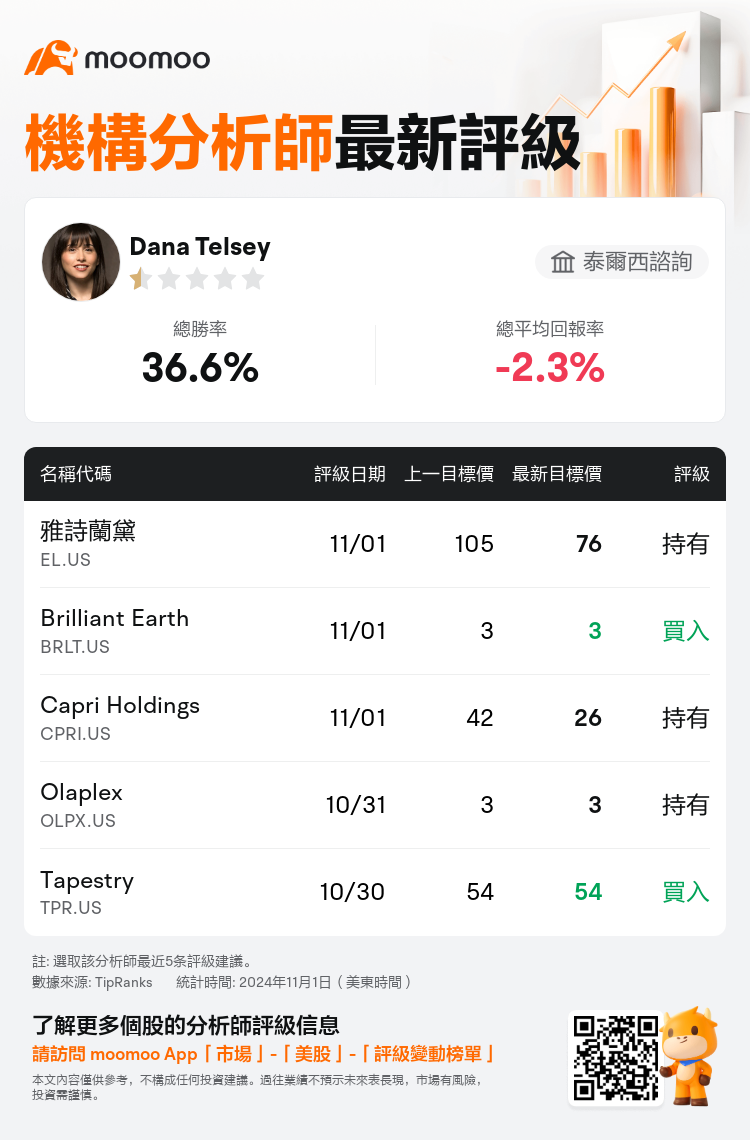

泰爾西諮詢分析師Dana Telsey維持$雅詩蘭黛 (EL.US)$持有評級,並將目標價從105美元下調至76美元。

根據TipRanks數據顯示,該分析師近一年總勝率為36.6%,總平均回報率為-2.3%。

此外,綜合報道,$雅詩蘭黛 (EL.US)$近期主要分析師觀點如下:

此外,綜合報道,$雅詩蘭黛 (EL.US)$近期主要分析師觀點如下:

雅詩蘭黛的第一季業績超出預期,但第二季的預測未達共識,加上撤回下半年業績指引和分紅派息的減少,給人留下陰影。分析師認爲,目前公司的未來並不明朗,期待新任執行團隊可能進行的戰略轉變和額外的生產力舉措,同時解決公司龐大的成本結構問題。

最近將每股季度股息調整爲35美分,預計雅詩蘭黛將繼續致力於約40%的股息支付比率,表明淨利潤預測爲12億美元,或者隨着時間的推移,每股盈利能力爲3.50美元。評估表明,考慮到中國經濟持續放緩和不確定性,以及年初換屆帶來的不確定性,現階段可能還爲時過早才能利用目前較低的股價。

持續下滑的銷售額和有限的未來可見性促使管理層撤回了指引。預計清晰的預測將持續一段時間。由於中國和亞洲旅遊零售板塊成交量低於預期,運營槓桿挑戰表明公司計劃的執行和回報實現可能會推遲。因此建議投資者等待更多有利的需求改善跡象。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$雅詩蘭黛 (EL.US)$近期主要分析師觀點如下:

此外,綜合報道,$雅詩蘭黛 (EL.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of