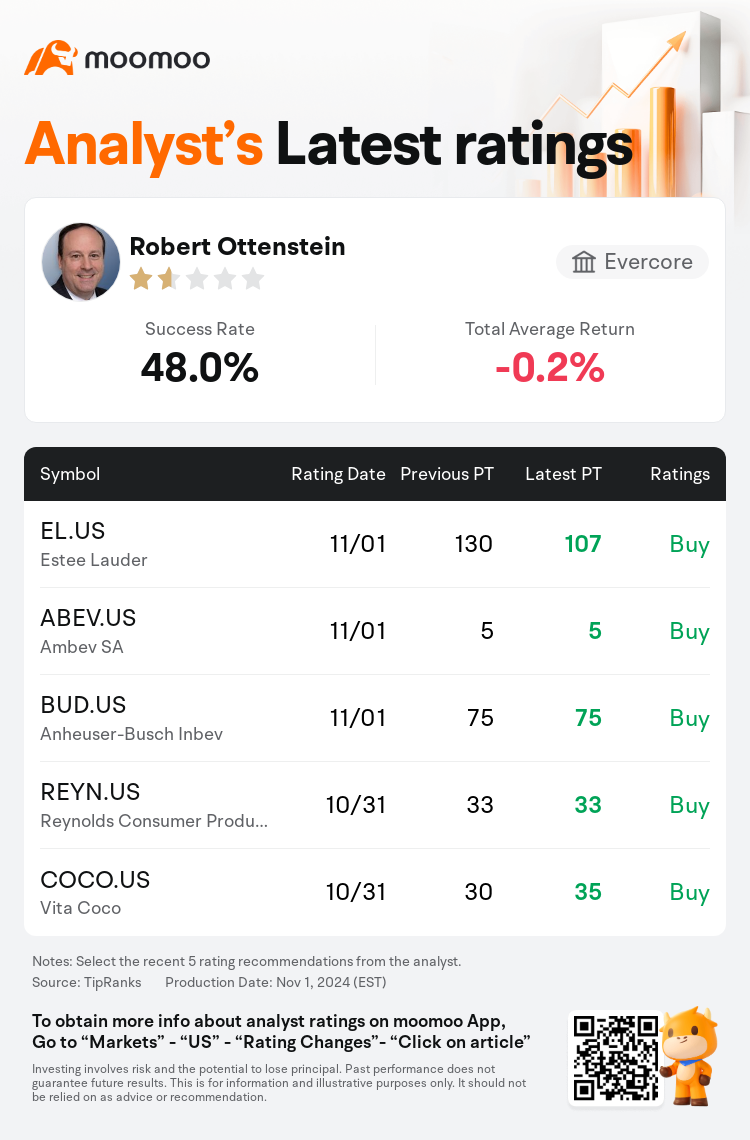

Evercore analyst Robert Ottenstein maintains $Estee Lauder (EL.US)$ with a buy rating, and adjusts the target price from $130 to $107.

According to TipRanks data, the analyst has a success rate of 48.0% and a total average return of -0.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Estee Lauder (EL.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Estee Lauder (EL.US)$'s main analysts recently are as follows:

The company's Q1 performance exceeded expectations but was overshadowed by Q2 projections not meeting consensus, retracted guidance for the second half of the year, and a reduction in dividend payments. The analyst points out that current visibility is limited, expressing anticipation for potential changes in strategy and any new plans for increased productivity from the incoming executives. There is a suggestion for a more comprehensive restructuring plan to address the company's high cost structure.

The projection that Estee Lauder will maintain a dividend payout ratio close to 40%, based on the newly announced 35 cents per share quarterly dividend, suggests a net income of approximately $1.2 billion or an earnings power of $3.50 per share over time. The analyst believes that it may be too early to take advantage of the current price decline given the ongoing slowdown and uncertainty in China, and with the transition to a new CEO in January.

Persistent sales declines and limited visibility ahead, which prompted management to withdraw guidance, are of particular concern. The lack of expected visibility is anticipated to persist for at least another three months. Given the operating deleverage from lower volumes in China and Asia travel retail, the execution of plans and returns may be delayed. It is considered prudent to recommend that investors await stronger indications of demand improvement.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

Evercore分析師Robert Ottenstein維持$雅詩蘭黛 (EL.US)$買入評級,並將目標價從130美元下調至107美元。

根據TipRanks數據顯示,該分析師近一年總勝率為48.0%,總平均回報率為-0.2%。

此外,綜合報道,$雅詩蘭黛 (EL.US)$近期主要分析師觀點如下:

此外,綜合報道,$雅詩蘭黛 (EL.US)$近期主要分析師觀點如下:

公司的第一季業績超出預期,但第二季的預測未達共識,年下半段的指引被撤銷,股息支付減少。分析師指出當前的可見度有限,表達了對策略和新任高管從而提高生產力計劃的潛在變化的期待。有建議進行更全面的重組計劃,以解決公司高成本結構的問題。

預計雅詩蘭黛將保持近40%的股息支付比率,基於新宣佈的每股35美分的季度股息,暗示着淨利潤約12億美元或隨時間推移每股3.50美元的收益能力。分析師認爲,目前價格下跌的機會可能尚爲時過早,考慮到中國經濟的放緩和不確定性,以及明年1月新CEO上任。

持續的銷售額下降和前景有限,促使管理層撤回指引,這是一個特別令人擔憂的問題。預料至少未來三個月的可見度將持續下降。考慮到中國和亞洲旅行零售額下降的運營攤薄效應,計劃的執行和回報可能會延遲。建議投資者謹慎等待需求改善的更強烈跡象。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$雅詩蘭黛 (EL.US)$近期主要分析師觀點如下:

此外,綜合報道,$雅詩蘭黛 (EL.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of