Why Boeing Shares Traded Higher On Friday

Why Boeing Shares Traded Higher On Friday

Boeing Co. (NYSE:BA) shares traded higher Friday as striking employees are expected to vote on a new contract proposal on Monday, Nov. 4. Here's what you need to know.

波音公司紐約證券交易所代碼:BA)股價週五上漲,原因是罷工的員工預計將在11月4日星期一對新的合同提案進行投票。以下是你需要知道的。

What To Know: According to Aviation Daily, the company announced a tentative deal with the International Association of Machinists (IAM), potentially ending a 49-day strike. This union-recommended agreement proposes a 38% wage increase over four years—13% in the first year, followed by 9% in each of the next two years and 7% in the final year.

須知:據《航空日報》報道,該公司宣佈與國際機械師協會(IAM)達成一項暫定協議,有可能結束爲期49天的罷工。這項工會建議的協議提議在四年內增加38%的工資——第一年增長13%,隨後兩年每年增長9%,最後一年增加7%。

Additionally, workers would receive a $12,000 ratification bonus and improved 401(k) contributions. Boeing also committed to locating any new aircraft production in the Puget Sound region of Washington, a key concession for the union.

此外,工人將獲得12,000美元的批准獎金和增加的401(k)份繳款。波音還承諾將任何新飛機生產地點設在華盛頓的普吉特海灣地區,這是工會的一項重要讓步。

This deal comes after union members previously rejected two offers, including a 35% wage increase in October. The initial union request included a 40% wage increase and pension restorations, but the new deal focuses on wage hikes and bonuses, while pensions remain unchanged. If approved, Boeing expects production facilities to gradually reopen as early as Nov. 6, with full staffing anticipated over the following weeks.

該協議是在工會成員此前拒絕了兩項提議之後達成的,其中包括10月份增加35%的工資。工會最初的要求包括增加40%的工資和恢復養老金,但新協議側重於工資上漲和獎金,而養老金保持不變。如果獲得批准,波音公司預計生產設施最早將在11月6日逐步重新開放,預計將在接下來的幾周內實現人員滿員。

The strike and production delays have impacted Boeing's suppliers, with some, like Spirit AeroSystems, already implementing employee furloughs. Boeing CEO Kelly Ortberg emphasized the importance of a careful restart process, citing ongoing issues with production stability and meeting FAA safety standards.

罷工和生產延誤影響了波音的供應商,一些供應商,例如Spirit AeroSystems,已經實施了員工休假。波音首席執行官凱利·奧特伯格強調了謹慎重啓過程的重要性,理由是生產穩定性和滿足美國聯邦航空局安全標準方面持續存在問題。

What Else: Boeing's rating also remains on S&P's CreditWatch following a larger-than-anticipated equity issuance, which helps offset projected cash flow deficits through 2025. However, S&P noted Boeing's limited flexibility for further cash flow pressures and cited ongoing strike-related and post-strike operational risks as areas of concern.

還有什麼:在股票發行量超出預期之後,波音的評級也保持在標普的CreditWatch上,這有助於抵消2025年之前預計的現金流赤字。但是,標準普爾指出,波音應對進一步現金流壓力的靈活性有限,並將持續的罷工相關和罷工後的運營風險列爲關注領域。

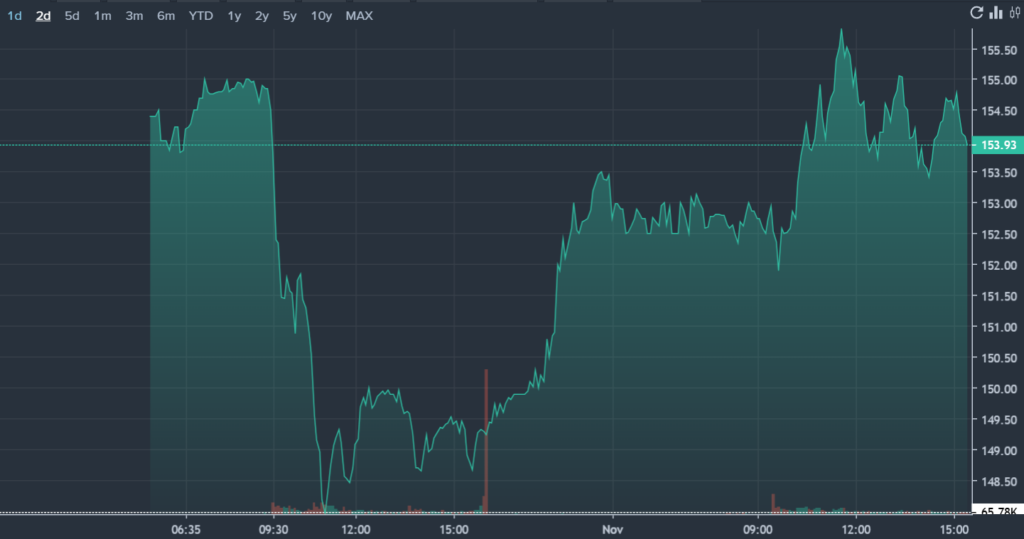

BA Price Action: Boeing shares were up 3.5% at $154.59 on Friday, according to Benzinga Pro.

英國航空價格走勢:根據Benzinga Pro的數據,週五波音股價上漲3.5%,至154.59美元。

- Biden Can Blame Boeing For Massive Jobs Data Miss

- 拜登可以將大量就業數據丟失歸咎於波音

Photo via Shutterstock.

照片來自 Shutterstock。

This deal comes after union members previously rejected two offers, including a 35% wage increase in October. The initial union request included a 40% wage increase and pension restorations, but the new deal focuses on wage hikes and bonuses, while pensions remain unchanged. If approved, Boeing expects production facilities to gradually reopen as early as Nov. 6, with full staffing anticipated over the following weeks.

This deal comes after union members previously rejected two offers, including a 35% wage increase in October. The initial union request included a 40% wage increase and pension restorations, but the new deal focuses on wage hikes and bonuses, while pensions remain unchanged. If approved, Boeing expects production facilities to gradually reopen as early as Nov. 6, with full staffing anticipated over the following weeks.