Take Care Before Jumping Onto Arrail Group Limited (HKG:6639) Even Though It's 29% Cheaper

Take Care Before Jumping Onto Arrail Group Limited (HKG:6639) Even Though It's 29% Cheaper

Arrail Group Limited (HKG:6639) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 58% share price decline.

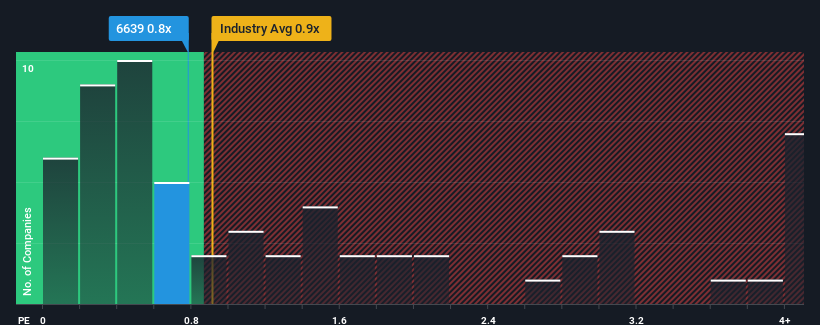

Even after such a large drop in price, there still wouldn't be many who think Arrail Group's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Hong Kong's Healthcare industry is similar at about 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Arrail Group's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Arrail Group has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Arrail Group will help you uncover what's on the horizon.How Is Arrail Group's Revenue Growth Trending?

Arrail Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Arrail Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. As a result, it also grew revenue by 15% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 17% per annum over the next three years. With the industry only predicted to deliver 8.0% per annum, the company is positioned for a stronger revenue result.

In light of this, it's curious that Arrail Group's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Following Arrail Group's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Arrail Group's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Arrail Group you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.