Shenzhen Absen OptoelectronicLtd (SZSE:300389) Will Be Hoping To Turn Its Returns On Capital Around

Shenzhen Absen OptoelectronicLtd (SZSE:300389) Will Be Hoping To Turn Its Returns On Capital Around

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. In light of that, when we looked at Shenzhen Absen OptoelectronicLtd (SZSE:300389) and its ROCE trend, we weren't exactly thrilled.

如果您不確定在尋找下一個翻倍股票時從何開始,有幾個關鍵趨勢您應該關注。首先,我們希望看到已投資資本的回報率(ROCE)在增加,其次,是擴大的已投資資本基礎。最終,這表明這是一個正在以不斷增加的回報率再投資利潤的業務。因此,當我們查看深圳安森光電有限公司(SZSE:300389)及其ROCE趨勢時,我們並不是特別興奮。

Return On Capital Employed (ROCE): What Is It?

資本利用率(ROCE)是什麼?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Shenzhen Absen OptoelectronicLtd, this is the formula:

爲了澄清,如果您不確定,ROCE是評估公司在其業務中投資資本所賺取的稅前收入(以百分比表示)多少的指標。要爲深圳安森光電有限公司計算此指標,公式如下:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

資本利用率 = 利息和稅前利潤(EBIT) ÷ (總資產 - 流動負債)

0.079 = CN¥130m ÷ (CN¥3.6b - CN¥2.0b) (Based on the trailing twelve months to September 2024).

0.079 = CN¥13000萬 ÷ (CN¥36億 - CN¥20億)(根據截至2024年9月的過去12個月計算)。

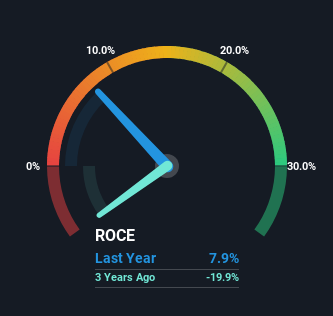

So, Shenzhen Absen OptoelectronicLtd has an ROCE of 7.9%. On its own that's a low return, but compared to the average of 5.8% generated by the Electronic industry, it's much better.

因此,深圳安森光電有限公司的ROCE爲7.9%。單獨來看這是一個較低的回報率,但與電子行業5.8%的平均水平相比,這要好得多。

Historical performance is a great place to start when researching a stock so above you can see the gauge for Shenzhen Absen OptoelectronicLtd's ROCE against it's prior returns. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Shenzhen Absen OptoelectronicLtd.

歷史表現是研究股票時一個很好的出發點,因此上面您可以看到深圳阿波羅光電有限公司的投資回報率(ROCE)與其之前收益的比較。如果您想深入了解歷史盈利情況,可以查看這些免費的圖表,詳細說明深圳阿波羅光電有限公司的營業收入和現金流表現。

So How Is Shenzhen Absen OptoelectronicLtd's ROCE Trending?

那麼,深圳阿波羅光電有限公司的ROCE趨勢如何?

The trend of ROCE doesn't look fantastic because it's fallen from 14% five years ago, while the business's capital employed increased by 21%. That being said, Shenzhen Absen OptoelectronicLtd raised some capital prior to their latest results being released, so that could partly explain the increase in capital employed. Shenzhen Absen OptoelectronicLtd probably hasn't received a full year of earnings yet from the new funds it raised, so these figures should be taken with a grain of salt.

ROCE的趨勢看起來並不理想,因爲它從五年前的14%下降,而公司的使用資本增加了21%。儘管如此,深圳阿波羅光電有限公司在最新業績發佈之前籌集了一些資本,因此這部分可能解釋了使用資本的增加。深圳阿波羅光電有限公司可能尚未從新募集的基金中獲得完整一年的收益,因此這些數字需謹慎看待。

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 54%, which has impacted the ROCE. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.

在此期間,我們注意到流動負債與總資產的比率上升到54%,這影響了ROCE。如果流動負債沒有像現在這樣增加,ROCE實際上可能會更低。這意味着實際上,公司有相當大一部分資金依靠公司的供應商或短期債權人來資助,這本身可能帶來一些風險。

Our Take On Shenzhen Absen OptoelectronicLtd's ROCE

我們對深圳阿波羅光電有限公司的ROCE的看法

While returns have fallen for Shenzhen Absen OptoelectronicLtd in recent times, we're encouraged to see that sales are growing and that the business is reinvesting in its operations. In light of this, the stock has only gained 28% over the last five years. Therefore we'd recommend looking further into this stock to confirm if it has the makings of a good investment.

儘管最近深圳阿波羅光電有限公司的回報有所下降,但我們欣慰地看到銷售在增長,公司正在對其業務進行再投資。因此,在過去五年中,該股票僅增長了28%。因此,我們建議進一步研究該股票,以確認其是否具有良好投資的潛力。

If you want to know some of the risks facing Shenzhen Absen OptoelectronicLtd we've found 4 warning signs (1 is concerning!) that you should be aware of before investing here.

如果您想了解深圳歐普光電有限公司面臨的一些風險,我們發現了4個警告信號(1個值得關注!)您在投資之前應該了解這些信息。

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

對於喜歡投資穩健公司的人,請查看這份具有穩健資產負債表和高權益回報的公司免費列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

0.079 = CN¥130m ÷ (CN¥3.6b - CN¥2.0b)

0.079 = CN¥130m ÷ (CN¥3.6b - CN¥2.0b)