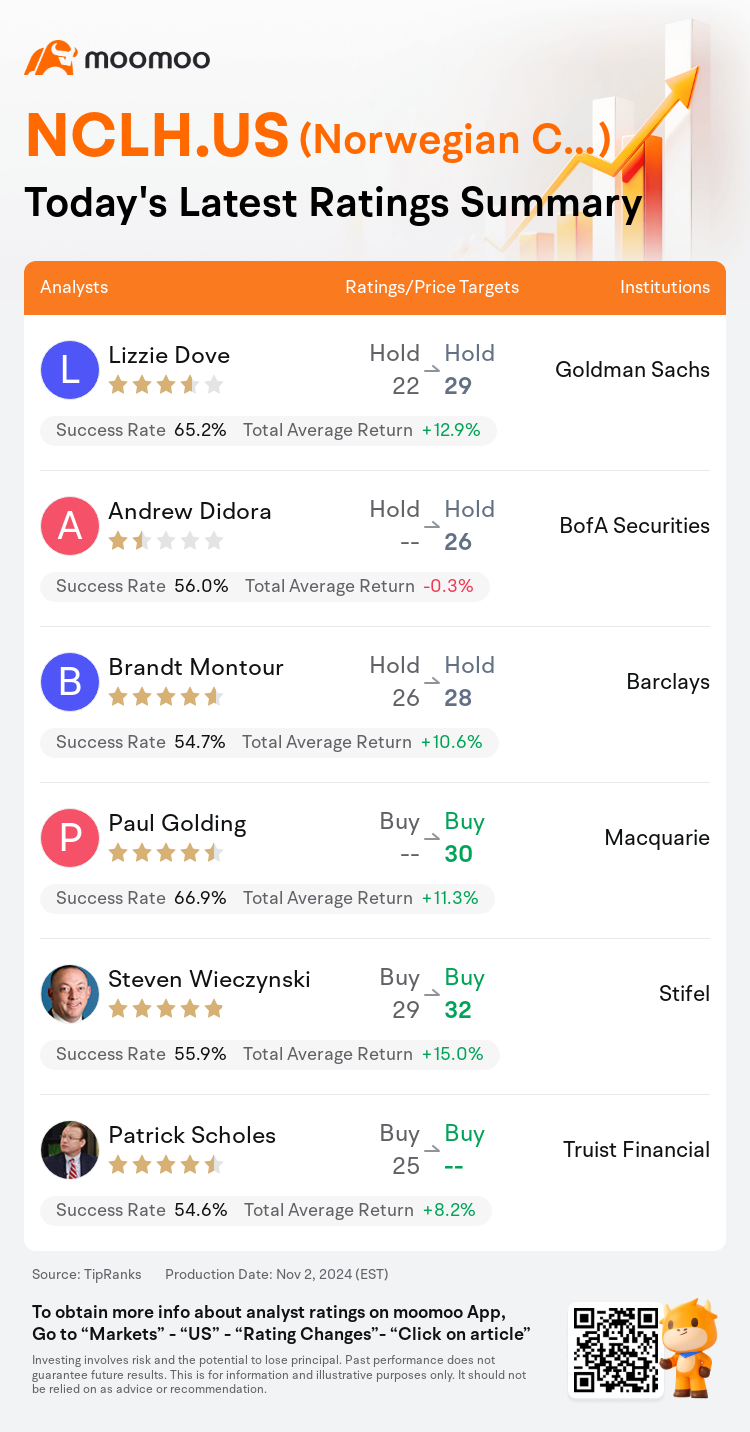

On Nov 02, major Wall Street analysts update their ratings for $Norwegian Cruise (NCLH.US)$, with price targets ranging from $26 to $32.

Goldman Sachs analyst Lizzie Dove maintains with a hold rating, and adjusts the target price from $22 to $29.

BofA Securities analyst Andrew Didora maintains with a hold rating, and sets the target price at $26.

Barclays analyst Brandt Montour maintains with a hold rating, and adjusts the target price from $26 to $28.

Barclays analyst Brandt Montour maintains with a hold rating, and adjusts the target price from $26 to $28.

Macquarie analyst Paul Golding maintains with a buy rating, and sets the target price at $30.

Stifel analyst Steven Wieczynski maintains with a buy rating, and adjusts the target price from $29 to $32.

Furthermore, according to the comprehensive report, the opinions of $Norwegian Cruise (NCLH.US)$'s main analysts recently are as follows:

The company's momentum remains strong following the earnings report, but the perception of the stock is somewhat overly favorable.

Norwegian Cruise Line's 'solid' Q3 results, consistent with trends seen in other cruise companies, have been recognized for their continued demand strength and onboard spending. This has led to the company raising its 2024 EBITDA guidance again, to $2.425B from $2.35B. The analyst has made 'only modest tweaks' to the 2025 forecasts.

Norwegian Cruise Line's potential for yield and share performance is seen as significant, driven by an 'outsized Beta', especially following the company's third-quarter report.

Ahead of Norwegian's earnings report and following the results from its industry counterparts, anticipation arises for a 'largely mirroring' outcome, indicating a strong third quarter, possible disruptions in the fourth quarter, but favorable commentary on bookings for 2025. However, concerns are raised due to the return to a premium valuation and analyses indicating 'only modest cost-outs'.

The recent quarterly results for Norwegian Cruise Line have clarified the trajectory towards its 2026 goals, potentially even surpassing them.

Here are the latest investment ratings and price targets for $Norwegian Cruise (NCLH.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月2日,多家華爾街大行更新了$挪威郵輪 (NCLH.US)$的評級,目標價介於26美元至32美元。

高盛集團分析師Lizzie Dove維持持有評級,並將目標價從22美元上調至29美元。

美銀證券分析師Andrew Didora維持持有評級,目標價26美元。

巴克萊銀行分析師Brandt Montour維持持有評級,並將目標價從26美元上調至28美元。

巴克萊銀行分析師Brandt Montour維持持有評級,並將目標價從26美元上調至28美元。

麥格理集團分析師Paul Golding維持買入評級,目標價30美元。

斯迪富分析師Steven Wieczynski維持買入評級,並將目標價從29美元上調至32美元。

此外,綜合報道,$挪威郵輪 (NCLH.US)$近期主要分析師觀點如下:

公司在業績發佈後的勢頭依然強勁,但股票的市場認知略顯過高。

挪威郵輪公司「solId」第三季度業績與其他郵輪公司的趨勢一致,因持續強勁的需求和船上消費而備受認可。這導致公司再次上調2024年的EBITDA指引,至24.25億美元,而不是23.5億美元。分析師對2025年的預測僅做出「輕微調整」。

挪威郵輪公司的收益和股票表現潛力被視爲重大,受到「超大Beta」的推動,尤其是在公司第三季度報告後。

挪威的業績發佈之前,以及在行業內其他公司發佈業績之後,人們對「很大程度上類似」的結果充滿期待,預示着強勁的第三季度,可能會出現第四季度的干擾,但對2025年預訂的評論卻是積極的。然而,由於回歸高溢價估值以及分析表明「僅有輕微的成本削減」,人們也對「僅有輕微的成本削減」表示擔憂。

挪威郵輪公司最近的季度業績結果闡明瞭實現2026年目標的軌跡,甚至有可能超越目標。

以下爲今日6位分析師對$挪威郵輪 (NCLH.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Brandt Montour維持持有評級,並將目標價從26美元上調至28美元。

巴克萊銀行分析師Brandt Montour維持持有評級,並將目標價從26美元上調至28美元。

Barclays analyst Brandt Montour maintains with a hold rating, and adjusts the target price from $26 to $28.

Barclays analyst Brandt Montour maintains with a hold rating, and adjusts the target price from $26 to $28.