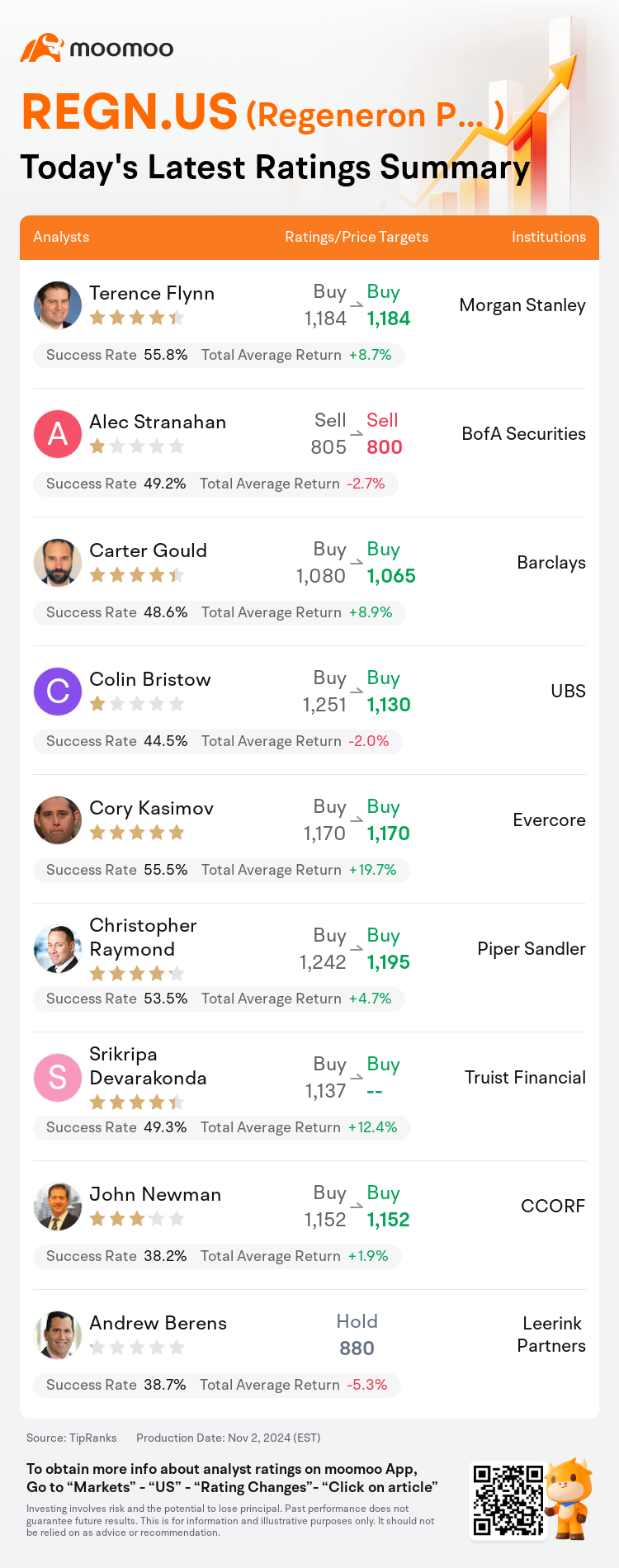

On Nov 02, major Wall Street analysts update their ratings for $Regeneron Pharmaceuticals (REGN.US)$, with price targets ranging from $800 to $1,195.

Morgan Stanley analyst Terence Flynn maintains with a buy rating, and maintains the target price at $1,184.

BofA Securities analyst Alec Stranahan maintains with a sell rating, and adjusts the target price from $805 to $800.

Barclays analyst Carter Gould maintains with a buy rating, and adjusts the target price from $1,080 to $1,065.

Barclays analyst Carter Gould maintains with a buy rating, and adjusts the target price from $1,080 to $1,065.

UBS analyst Colin Bristow maintains with a buy rating, and adjusts the target price from $1,251 to $1,130.

Evercore analyst Cory Kasimov maintains with a buy rating, and maintains the target price at $1,170.

Furthermore, according to the comprehensive report, the opinions of $Regeneron Pharmaceuticals (REGN.US)$'s main analysts recently are as follows:

Regeneron's Q3 financial results surpassed expectations marginally in terms of revenue and more significantly in earnings per share. Nevertheless, this was eclipsed by the performance of the Eylea franchise. Concerns have been raised about the future of the Eylea franchise due to the impending introduction of a biosimilar version by a competitor. These concerns encompass not only the anticipated faster erosion of the standard dose's market share, which may be underestimated by the market, but also potential negative effects on the higher dose variant.

Recent pressures on Regeneron shares are seen as excessive, according to analysts. This sentiment follows reactions to developments with Pavblu and a less than favorable Q4 outlook for Eylea HD, coupled with unclear projections regarding Eylea's future growth.

The decline in Regeneron's stock value following Q3 earnings was somewhat unexpected, as it was presumed that the near- and long-term consensus estimates for the optho franchise were overly optimistic. Nevertheless, it is believed that Regeneron's intrinsic fair value is substantially higher than the current share price.

Regeneron's recent quarterly financials aligned with optimistic revenue projections and surpassed expectations on earnings growth. However, the company's stock continues to encounter challenges stemming from its Eylea franchise and the looming threat of biosimilar competitors. The anticipated impact of a biosimilar by a competing company is still uncertain, but the initial response suggests it may not be as significant as feared, particularly given the tepid reception of other similar biosimilars in the market. The market's reaction to the pace at which patients are transitioning to Eylea HD has further pressured the stock's performance.

Here are the latest investment ratings and price targets for $Regeneron Pharmaceuticals (REGN.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

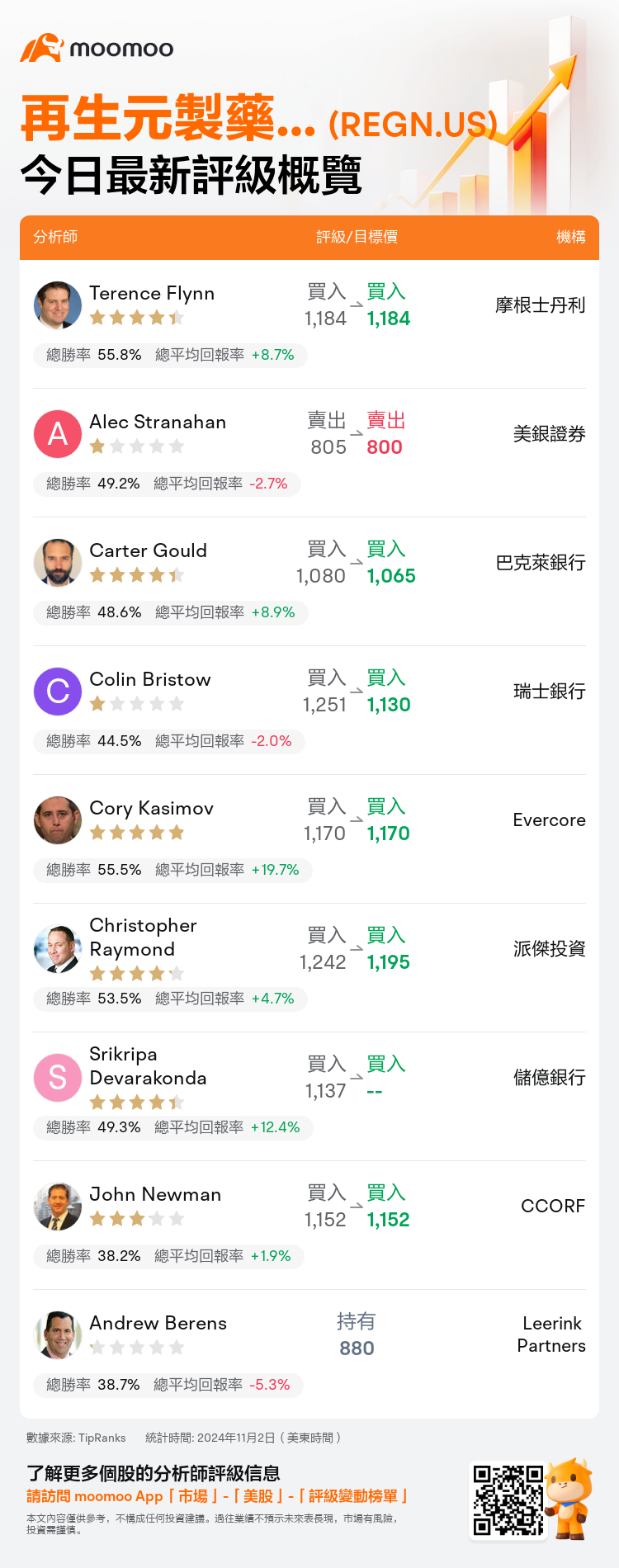

美東時間11月2日,多家華爾街大行更新了$再生元製藥公司 (REGN.US)$的評級,目標價介於800美元至1,195美元。

摩根士丹利分析師Terence Flynn維持買入評級,維持目標價1,184美元。

美銀證券分析師Alec Stranahan維持賣出評級,並將目標價從805美元下調至800美元。

巴克萊銀行分析師Carter Gould維持買入評級,並將目標價從1,080美元下調至1,065美元。

巴克萊銀行分析師Carter Gould維持買入評級,並將目標價從1,080美元下調至1,065美元。

瑞士銀行分析師Colin Bristow維持買入評級,並將目標價從1,251美元下調至1,130美元。

Evercore分析師Cory Kasimov維持買入評級,維持目標價1,170美元。

此外,綜合報道,$再生元製藥公司 (REGN.US)$近期主要分析師觀點如下:

Regeneron的第三季財務業績在營業收入方面略高於預期,而在每股收益方面更顯著。然而,這被Eylea特許經營業績所掩蓋。由於競爭對手即將推出生物類似藥版本,對Eylea特許經營的未來產生了擔憂。這些擔憂不僅涵蓋了標準劑量市場份額預計將更快侵蝕,而市場可能低估,還包括對更高劑量變體潛在負面影響的擔憂。

據分析師稱,近期對Regeneron股票的壓力被認爲是過度的。這種情緒是對Pavblu發展和Eylea HD不太樂觀的第四季度展望的反應,再加上關於Eylea未來增長的不明朗預測。

Regeneron在第三季度業績後股價下跌有些出乎意料,因爲人們認爲該公司眼科特許經營的近期和長期共識預測過於樂觀。儘管如此,人們認爲Regeneron的固有公允價值遠高於當前股價。

Regeneron最近的季度財務業績與樂觀的營收預測一致,並在盈利增長方面超出預期。然而,該公司的股票繼續面臨源自其Eylea特許經營和生物類似競爭對手懸在頭頂的挑戰。儘管預計來自競爭公司的生物類似藥的影響仍不確定,但初步反應表明可能不會像之前擔心的那樣重要,尤其是考慮到市場上其他類似生物類似藥物的迎合態度偏冷。市場對患者轉向Eylea HD的速度的反應進一步壓制了該股的表現。

以下爲今日9位分析師對$再生元製藥公司 (REGN.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Carter Gould維持買入評級,並將目標價從1,080美元下調至1,065美元。

巴克萊銀行分析師Carter Gould維持買入評級,並將目標價從1,080美元下調至1,065美元。

Barclays analyst Carter Gould maintains with a buy rating, and adjusts the target price from $1,080 to $1,065.

Barclays analyst Carter Gould maintains with a buy rating, and adjusts the target price from $1,080 to $1,065.