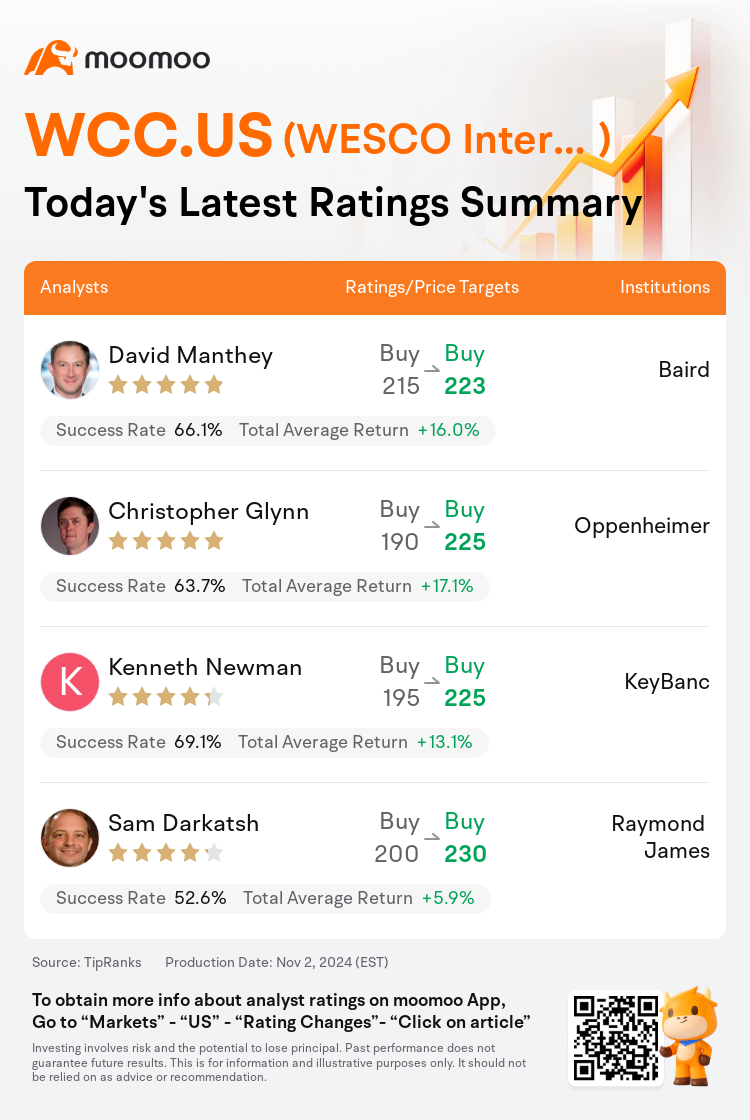

On Nov 02, major Wall Street analysts update their ratings for $WESCO International (WCC.US)$, with price targets ranging from $223 to $230.

Baird analyst David Manthey maintains with a buy rating, and adjusts the target price from $215 to $223.

Oppenheimer analyst Christopher Glynn maintains with a buy rating, and adjusts the target price from $190 to $225.

KeyBanc analyst Kenneth Newman maintains with a buy rating, and adjusts the target price from $195 to $225.

KeyBanc analyst Kenneth Newman maintains with a buy rating, and adjusts the target price from $195 to $225.

Raymond James analyst Sam Darkatsh maintains with a buy rating, and adjusts the target price from $200 to $230.

Furthermore, according to the comprehensive report, the opinions of $WESCO International (WCC.US)$'s main analysts recently are as follows:

Wesco's recent quarterly earnings surpassed expectations. The company's performance across various end markets remained relatively stable compared to the previous sequence, with sectors such as utility, broadband, industrial, and solar experiencing fluctuations but not deteriorating. Additionally, the firm's datacenter segment showcased a notable positive trend, achieving a remarkable 40% growth.

The firm indicated that the in-line results and guidance from Wesco were greeted with a notable relief rally. This reaction suggests that investors had braced for a potential shortfall or reduction in forecasts, as evidenced by the increased short interest leading up to the investor day.

The company's shares have shown outperformance subsequent to the third-quarter earnings surpass, which was propelled by robust results in the Data Center sector, more than compensating for the persisting softness in the Utility and Broadband segments. Analysts maintain a positive outlook on the company's potential to foster long-term expansion and consider it well-situated to capitalize on a number of secular growth trends that continue to demonstrate vigorous progress.

Here are the latest investment ratings and price targets for $WESCO International (WCC.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

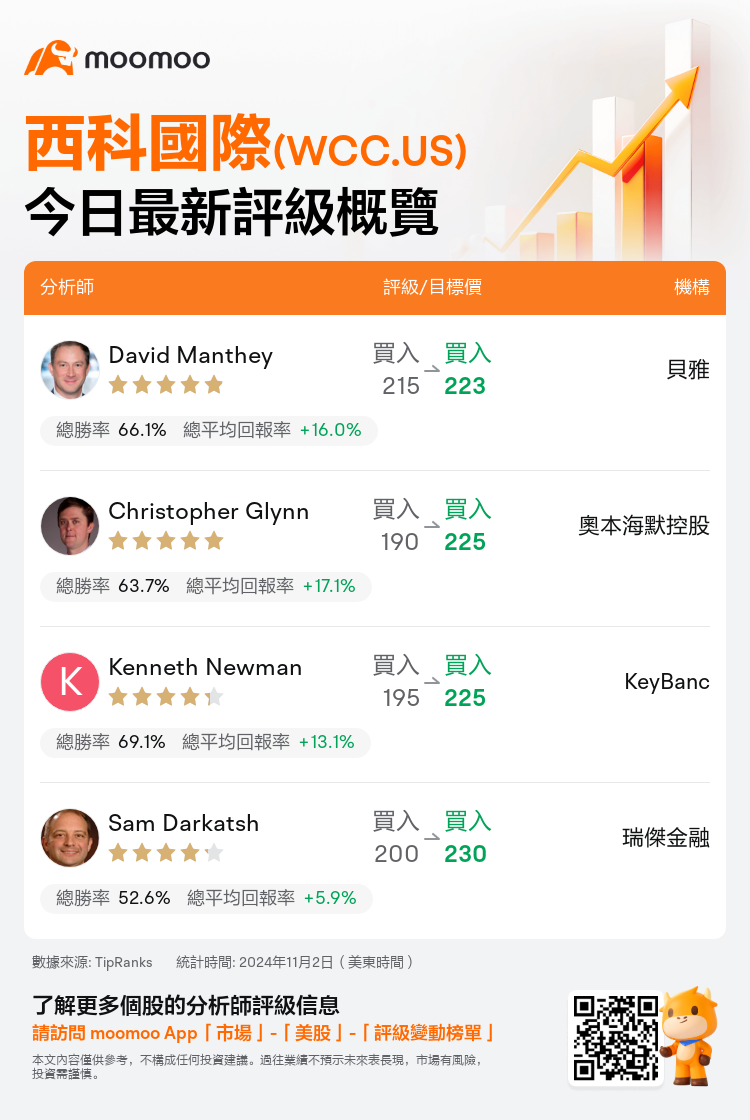

美東時間11月2日,多家華爾街大行更新了$西科國際 (WCC.US)$的評級,目標價介於223美元至230美元。

貝雅分析師David Manthey維持買入評級,並將目標價從215美元上調至223美元。

奧本海默控股分析師Christopher Glynn維持買入評級,並將目標價從190美元上調至225美元。

KeyBanc分析師Kenneth Newman維持買入評級,並將目標價從195美元上調至225美元。

KeyBanc分析師Kenneth Newman維持買入評級,並將目標價從195美元上調至225美元。

瑞傑金融分析師Sam Darkatsh維持買入評級,並將目標價從200美元上調至230美元。

此外,綜合報道,$西科國際 (WCC.US)$近期主要分析師觀點如下:

Wesco最近的季度盈利超出預期。與上一個時期相比,公司在各個終端市場表現相對穩定,其中公用事業、寬帶、工業和太陽能等板塊經歷波動但並未惡化。此外,公司的數據中心板塊展現出明顯的正增長趨勢,實現了顯著的40%增長。

公司表示,Wesco的符合預期的業績和指引受到了顯著的寬慰反彈。這種反應表明,投資者已經做好了準備迎接潛在的缺口或減少預測,這一點在投資者日之前的空頭持倉增加所證實。

該公司股價在第三季度盈利超過預期後表現出色,這是由數據中心板塊的強勁業績推動的,更多地彌補了公用事業和寬帶板塊持續疲軟的情況。分析師對公司長期擴張潛力持積極態度,並認爲公司具備資本化多項長期增長趨勢的潛力,這些趨勢繼續表現出強勁的進展。

以下爲今日4位分析師對$西科國際 (WCC.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

KeyBanc分析師Kenneth Newman維持買入評級,並將目標價從195美元上調至225美元。

KeyBanc分析師Kenneth Newman維持買入評級,並將目標價從195美元上調至225美元。

KeyBanc analyst Kenneth Newman maintains with a buy rating, and adjusts the target price from $195 to $225.

KeyBanc analyst Kenneth Newman maintains with a buy rating, and adjusts the target price from $195 to $225.