Is Patrick Industries, Inc.'s (NASDAQ:PATK) ROE Of 14% Impressive?

Is Patrick Industries, Inc.'s (NASDAQ:PATK) ROE Of 14% Impressive?

Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is for those who would like to learn about Return On Equity (ROE). To keep the lesson grounded in practicality, we'll use ROE to better understand Patrick Industries, Inc. (NASDAQ:PATK).

許多投資者仍在學習有關股票分析中可以派上用場的各種指標。本文旨在幫助那些想了解淨資產收益率(roe)的人。爲了使課堂內容更貼近實際情況,我們將使用roe來更好地理解patrick industries(納斯達克代碼:PATK)。

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

roe或股東權益回報率是評估公司如何有效地從股東那裏獲得回報的有用工具。簡而言之,它用於評估公司相對於其權益資本的盈利能力。

How Do You Calculate Return On Equity?

如何計算淨資產收益率?

The formula for ROE is:

roe的公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

淨資產收益率 = 淨利潤(來自持續經營) ÷ 股東權益

So, based on the above formula, the ROE for Patrick Industries is:

因此,根據上述公式,Patrick Industries的roe爲:

14% = US$155m ÷ US$1.1b (Based on the trailing twelve months to September 2024).

14% = 15500萬美元 ÷ 11億美元(基於截至2024年9月的過去十二個月)。

The 'return' is the yearly profit. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.14 in profit.

'回報'即爲年利潤。也就是說,對於每1美元的股本,該公司能夠賺取0.14美元的利潤。

Does Patrick Industries Have A Good Return On Equity?

帕特里克產業的淨資產收益率如何?

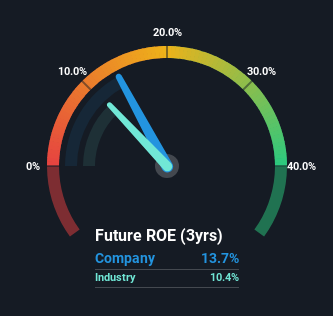

One simple way to determine if a company has a good return on equity is to compare it to the average for its industry. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. As you can see in the graphic below, Patrick Industries has a higher ROE than the average (10%) in the Auto Components industry.

確定一個公司是否具有良好的淨資產收益率的一種簡單方法是將其與同行業的平均水平進行比較。 這種方法的侷限性在於,一些公司與同一行業分類內的其他公司有很大不同。 正如您在下圖中所看到的,帕特里克產業的淨資產收益率高於汽車零部件行業的平均水平(10%)。

That's what we like to see. Bear in mind, a high ROE doesn't always mean superior financial performance. Especially when a firm uses high levels of debt to finance its debt which may boost its ROE but the high leverage puts the company at risk. Our risks dashboardshould have the 3 risks we have identified for Patrick Industries.

這正是我們想要看到的。請記住,高淨資產收益率並不總是意味着卓越的財務表現。 尤其當一家公司利用高額負債來融資,這可能會提高其淨資產收益率,但高槓杆率會讓公司面臨風險。 我們的風險儀表板應該列出我們鑑定出的帕特里克產業的3個風險。

Why You Should Consider Debt When Looking At ROE

爲什麼在觀察ROE時你應該考慮債務問題?

Virtually all companies need money to invest in the business, to grow profits. That cash can come from retained earnings, issuing new shares (equity), or debt. In the first and second cases, the ROE will reflect this use of cash for investment in the business. In the latter case, the use of debt will improve the returns, but will not change the equity. In this manner the use of debt will boost ROE, even though the core economics of the business stay the same.

幾乎所有公司都需要資金來投資業務以增加利潤。這筆資金可以來自留存收益、發行新股票(股權)或債務。在前兩種情況下,ROE將反映這些用於投資業務的資金的使用情況。在後一種情況下,債務的使用將提高回報,但不會改變股本。通過這種方式,儘管企業的核心經濟狀況保持不變,但債務的使用將提高ROE。

Patrick Industries' Debt And Its 14% ROE

Patrick Industries的債務及其14%的roe

Patrick Industries does use a high amount of debt to increase returns. It has a debt to equity ratio of 1.23. There's no doubt its ROE is decent, but the very high debt the company carries is not too exciting to see. Debt increases risk and reduces options for the company in the future, so you generally want to see some good returns from using it.

Patrick Industries確實使用了大量債務來增加回報。其債務與權益比爲1.23。毫無疑問,其ROE是不錯的,但公司所承擔的債務卻不太令人興奮。債務會增加風險,並減少了公司未來的選擇,因此通常希望從中獲得一些良好的回報。

Summary

總結

Return on equity is useful for comparing the quality of different businesses. In our books, the highest quality companies have high return on equity, despite low debt. If two companies have the same ROE, then I would generally prefer the one with less debt.

當然,聯合租賃公司可能並不是最佳的買入股票。因此,您可能也希望查看這個包含其他高ROE低負債的公司的免費系列。

But ROE is just one piece of a bigger puzzle, since high quality businesses often trade on high multiples of earnings. Profit growth rates, versus the expectations reflected in the price of the stock, are a particularly important to consider. So you might want to take a peek at this data-rich interactive graph of forecasts for the company.

但roe只是更大謎題中的一部分,因爲高質量企業通常以高倍數的收益率交易。利潤增長率與股票價格所體現的預期相比,是一個特別重要的考慮因素。因此,您可能想要查看這個數據豐富的互動預測圖表。

Of course Patrick Industries may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

當然,Patrick Industries可能不是最好的股票購買選擇。所以您可能希望查看這個免費收藏的其他公司,這些公司具有高roe和低債務。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity