Is It Smart To Buy SouthState Corporation (NYSE:SSB) Before It Goes Ex-Dividend?

Is It Smart To Buy SouthState Corporation (NYSE:SSB) Before It Goes Ex-Dividend?

Readers hoping to buy SouthState Corporation (NYSE:SSB) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Accordingly, SouthState investors that purchase the stock on or after the 8th of November will not receive the dividend, which will be paid on the 15th of November.

希望購買SouthState Corporation (紐交所:SSB) 股票以獲取分紅派息的投資者需要儘快採取行動,因爲該股即將交易除權。除淨日是公司股權登記日的前一個工作日,也就是公司確定哪些股東有資格收取分紅的日期。除淨日很重要,因爲任何股票交易需要在股權登記日之前結算,才有資格獲得分紅。因此,從11月8日起購買SouthState股票的投資者將無法收到即將在11月15日支付的分紅。

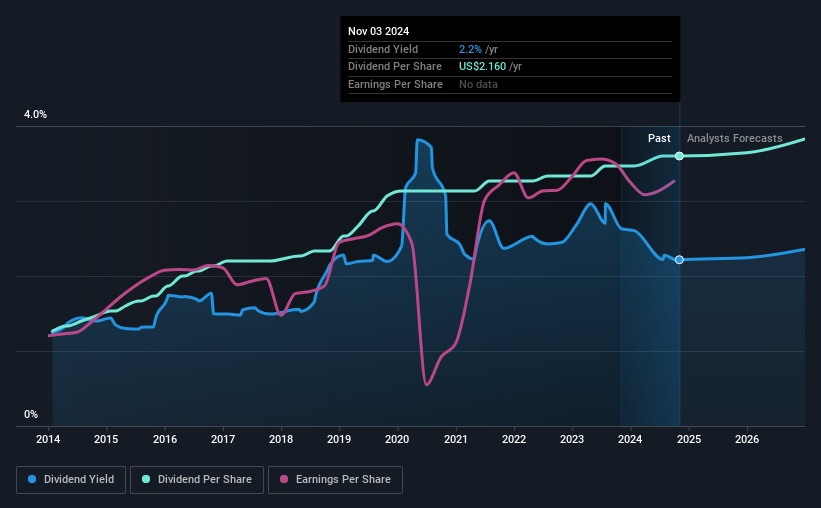

The company's next dividend payment will be US$0.54 per share, and in the last 12 months, the company paid a total of US$2.16 per share. Last year's total dividend payments show that SouthState has a trailing yield of 2.2% on the current share price of US$97.42. If you buy this business for its dividend, you should have an idea of whether SouthState's dividend is reliable and sustainable. So we need to investigate whether SouthState can afford its dividend, and if the dividend could grow.

公司下一個分紅支付將爲每股0.54美元,在過去12個月裏,公司每股支付了總計2.16美元。去年的總分紅支付顯示,SouthState在當前股價97.42美元的基礎上,擁有2.2%的追蹤收益。如果您購買此業務是爲了分紅,您應該了解SouthState的分紅是否可靠和可持續。因此,我們需要調查SouthState是否有能力支付其分紅,以及分紅是否會增長。

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. SouthState paid out a comfortable 32% of its profit last year.

分紅通常是從公司收入中支付的,因此如果公司支付的分紅超過其盈利,其分紅通常面臨更高的風險被削減。SouthState去年支付了其利潤的舒適32%作爲分紅。

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

通常,股息支付比利潤少的公司具有更可持續的股息。支付比率越低,業務在被迫削減股息之前擁有的操作餘地就越大。

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

點擊此處查看公司的支付比率以及未來分紅的分析師預期。

Have Earnings And Dividends Been Growing?

收益和股息一直在增長嗎?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. This is why it's a relief to see SouthState earnings per share are up 5.9% per annum over the last five years.

業務具有強勁增長前景的公司通常是最佳的分紅支付者,因爲當每股收益改善時,增加分紅更容易。如果企業陷入衰退並削減分紅,公司的價值可能會急劇下跌。這就是爲什麼看到南州的每股收益在過去五年中年均增長5.9%是一種寬慰。

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. SouthState has delivered an average of 11% per year annual increase in its dividend, based on the past 10 years of dividend payments. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

大多數投資者評估公司的分紅前景的主要方式是檢查分紅增長的歷史速度。南州公司根據過去10年的分紅支付數據,每年平均實現11%的分紅增長。我們很高興看到多年來分紅與收益同步增長,這可能表明公司打算與股東分享增長。

Final Takeaway

最後的結論

Is SouthState worth buying for its dividend? SouthState has seen its earnings per share grow slowly in recent years, and the company reinvests more than half of its profits in the business, which generally bodes well for its future prospects. In summary, SouthState appears to have some promise as a dividend stock, and we'd suggest taking a closer look at it.

南州股票值得購買嗎?南州近年來每股收益增長緩慢,公司將一半以上的利潤重新投資到業務中,這通常對未來前景是一個好兆頭。總之,南州似乎有一些作爲分紅股票的潛力,我們建議您更加仔細地研究一下。

So while SouthState looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. For example, we've found 1 warning sign for SouthState that we recommend you consider before investing in the business.

因此,儘管從分紅角度來看南州看起來不錯,但隨時了解涉及此股票的風險是值得的。例如,我們發現了南州的1個警示標誌,建議您在投資該業務之前考慮。

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

一個常見的投資錯誤是購買你看到的第一個有趣的股票。在這裏,您可以找到高股息股票的完整列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.