Earnings Troubles May Signal Larger Issues for YD Electronic TechnologyLtd (SZSE:301123) Shareholders

Earnings Troubles May Signal Larger Issues for YD Electronic TechnologyLtd (SZSE:301123) Shareholders

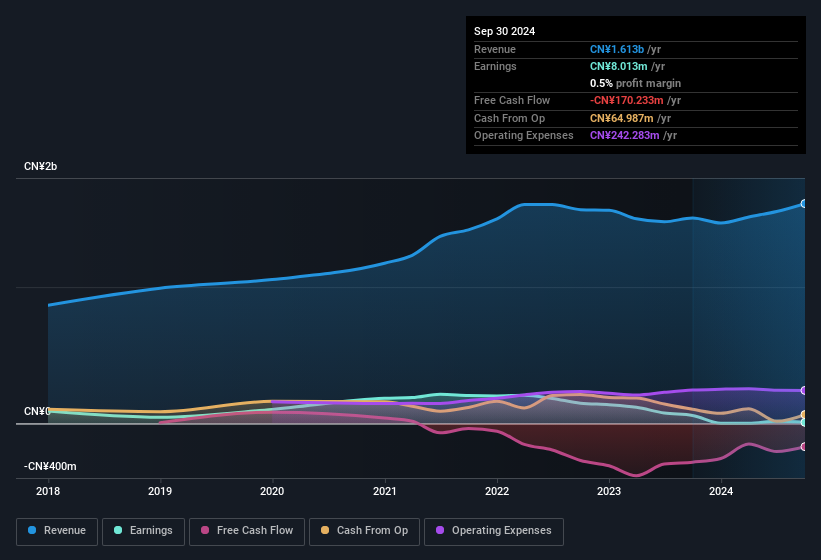

Investors were disappointed by YD Electronic Technology Co.,Ltd.'s (SZSE:301123 ) latest earnings release. Our analysis has found some reasons to be concerned, beyond the weak headline numbers.

The Impact Of Unusual Items On Profit

To properly understand YD Electronic TechnologyLtd's profit results, we need to consider the CN¥2.9m gain attributed to unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. If YD Electronic TechnologyLtd doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On YD Electronic TechnologyLtd's Profit Performance

Arguably, YD Electronic TechnologyLtd's statutory earnings have been distorted by unusual items boosting profit. Therefore, it seems possible to us that YD Electronic TechnologyLtd's true underlying earnings power is actually less than its statutory profit. Sadly, its EPS was down over the last twelve months. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Our analysis shows 3 warning signs for YD Electronic TechnologyLtd (1 is a bit concerning!) and we strongly recommend you look at them before investing.

Arguably, YD Electronic TechnologyLtd's statutory earnings have been distorted by unusual items boosting profit. Therefore, it seems possible to us that YD Electronic TechnologyLtd's true underlying earnings power is actually less than its statutory profit. Sadly, its EPS was down over the last twelve months. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Our analysis shows 3 warning signs for YD Electronic TechnologyLtd (1 is a bit concerning!) and we strongly recommend you look at them before investing.

Today we've zoomed in on a single data point to better understand the nature of YD Electronic TechnologyLtd's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.