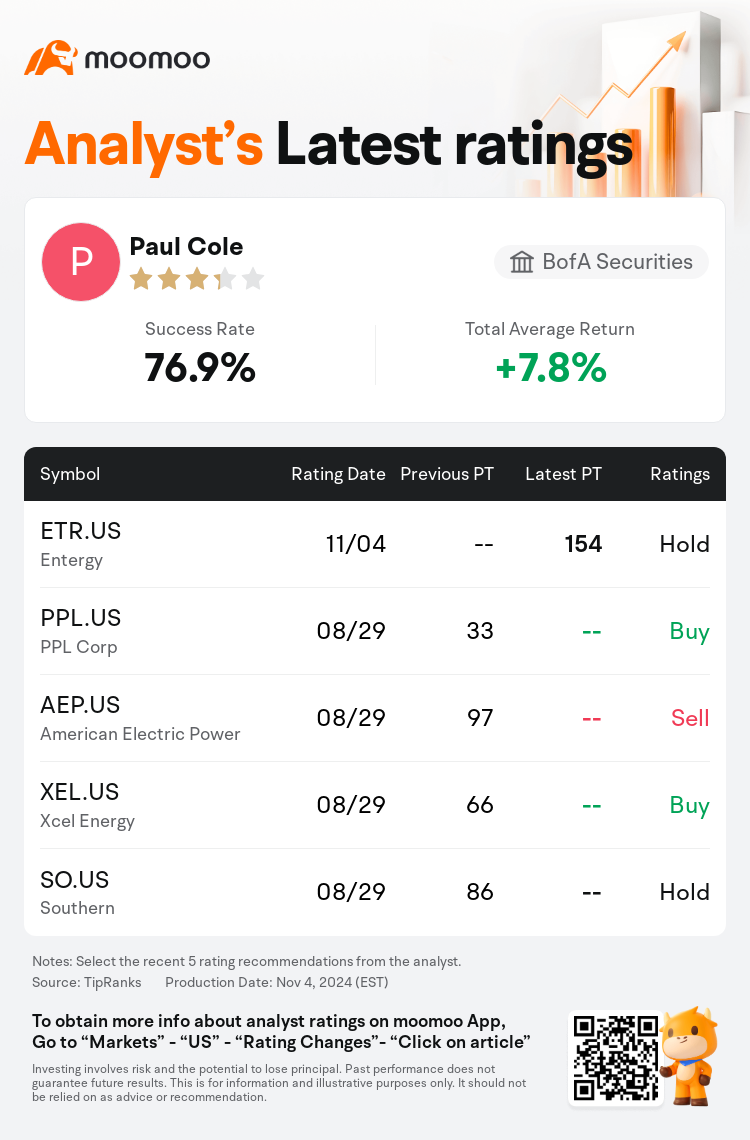

BofA Securities analyst Paul Cole downgrades $Entergy (ETR.US)$ to a hold rating, and sets the target price at $154.

According to TipRanks data, the analyst has a success rate of 76.9% and a total average return of 7.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Entergy (ETR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Entergy (ETR.US)$'s main analysts recently are as follows:

Entergy's recent announcement alongside its Q3 earnings highlighted an updated strategic business plan which includes a higher forecast for capital expenditures, increased sales growth expectations, enhanced EPS guidance, and an accelerated EPS growth rate. Additionally, the company has revealed a service agreement with a significant customer in Louisiana necessitating the construction of three new combined cycle units, and it is exploring the development of nuclear units. While the strategic update is acknowledged for its value creation, there is also an acknowledgment of the execution risks associated with these ambitious plans.

Entergy's prospects for growth and risk have improved, with industrial sales contributing to an earnings increase that is projected to surpass peers at a rate of 8%-9%. Additionally, regulatory issues in Louisiana have been addressed in a more constructive manner than anticipated. Although the risk associated with hurricanes remains a structural challenge, the shares now present a more balanced risk/reward scenario.

Entergy's recent report exceeding third quarter EPS expectations, coupled with an updated EPS guidance that raises the lower end for 2024, has been acknowledged. The company also offered several fundamental updates which have led to an early projection for the 2026-2028 EPS growth target to increase to 8%-9%. The company's continuous fundamental performance and above-average EPS growth coupled with a conservative approach have transformed Entergy's investment narrative into a notably premium one.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美銀證券分析師Paul Cole下調$安特吉 (ETR.US)$至持有評級,目標價154美元。

根據TipRanks數據顯示,該分析師近一年總勝率為76.9%,總平均回報率為7.8%。

此外,綜合報道,$安特吉 (ETR.US)$近期主要分析師觀點如下:

此外,綜合報道,$安特吉 (ETR.US)$近期主要分析師觀點如下:

安特吉最近的公告與其第三季度盈利一起突出了一項更新的戰略業務計劃,其中包括較高的資本支出預測、增加的銷售增長預期、增強的每股收益指引,以及加快的每股收益增長率。此外,該公司透露了與路易斯安那州一位重要客戶的服務協議,需要施工三個新的聯合循環機組,並正在探索核能機組的發展。儘管戰略更新因其價值創造而受到肯定,但也承認了與這些雄心勃勃的計劃相關的執行風險。

安特吉的增長前景和風險已經得到改善,工業銷售爲盈利增長做出了貢獻,預計將超過同行公司的速度達到8%-9%。此外,路易斯安那州的監管問題以比預期更建設性的方式得到了解決。儘管颶風帶來的風險仍然是一個結構性挑戰,但股票現在呈現出更加平衡的風險/回報情景。

安特吉最近的報告超過了第三季度每股收益預期,加上更新的每股收益指引將2024年底提高,已得到承認。公司還提供了幾項基本更新,導致2026-2028年每股收益增長目標的早期預測增加到8%-9%。公司持續的基本業績和高於平均水平的每股收益增長,加上審慎的做法,將安特吉的投資敘事轉變爲一個顯著優質的敘事。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$安特吉 (ETR.US)$近期主要分析師觀點如下:

此外,綜合報道,$安特吉 (ETR.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of