Abbott Laboratories' (NYSE:ABT) Share Price Not Quite Adding Up

Abbott Laboratories' (NYSE:ABT) Share Price Not Quite Adding Up

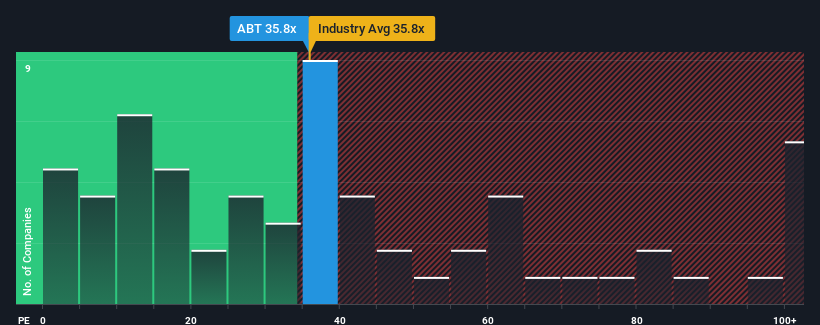

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider Abbott Laboratories (NYSE:ABT) as a stock to avoid entirely with its 35.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been pleasing for Abbott Laboratories as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Is There Enough Growth For Abbott Laboratories?

The only time you'd be truly comfortable seeing a P/E as steep as Abbott Laboratories' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a decent 12% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen an unpleasant 18% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Retrospectively, the last year delivered a decent 12% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen an unpleasant 18% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 12% per annum during the coming three years according to the analysts following the company. That's shaping up to be similar to the 11% per year growth forecast for the broader market.

In light of this, it's curious that Abbott Laboratories' P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Abbott Laboratories currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Abbott Laboratories with six simple checks.

If these risks are making you reconsider your opinion on Abbott Laboratories, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.