Chewy Unusual Options Activity For November 04

Chewy Unusual Options Activity For November 04

High-rolling investors have positioned themselves bullish on Chewy (NYSE:CHWY), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CHWY often signals that someone has privileged information.

高風險投資者已經看好Chewy(紐交所:CHWY),對零售交易者來說這很重要。\ 通過Benzinga跟蹤公開可用的期權數據,我們今天注意到了這一活動。 這些投資者的身份尚不確定,但CHWY的如此重大舉動通常意味着某人掌握了內幕信息。

Today, Benzinga's options scanner spotted 9 options trades for Chewy. This is not a typical pattern.

今天,Benzinga的期權掃描器發現了9筆Chewy的期權交易。這不是一個典型的模式。

The sentiment among these major traders is split, with 77% bullish and 22% bearish. Among all the options we identified, there was one put, amounting to $39,610, and 8 calls, totaling $386,090.

這些主要交易者中情緒分化,77%看好,22%看淡。在我們識別的所有期權中,有一筆看跌,金額達39610美元,以及8筆看漲,總計386090美元。

Expected Price Movements

預期價格波動

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $2.5 and $40.0 for Chewy, spanning the last three months.

在評估交易量和未平倉合約後,顯而易見,主要市場推動者正在關注Chewy的價格區間,介於2.5美元至40.0美元之間,跨過了過去三個月。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

In terms of liquidity and interest, the mean open interest for Chewy options trades today is 978.5 with a total volume of 3,700.00.

就流動性和興趣而言,Chewy期權交易的平均未平倉合約爲978.5,總成交量爲3700.00。

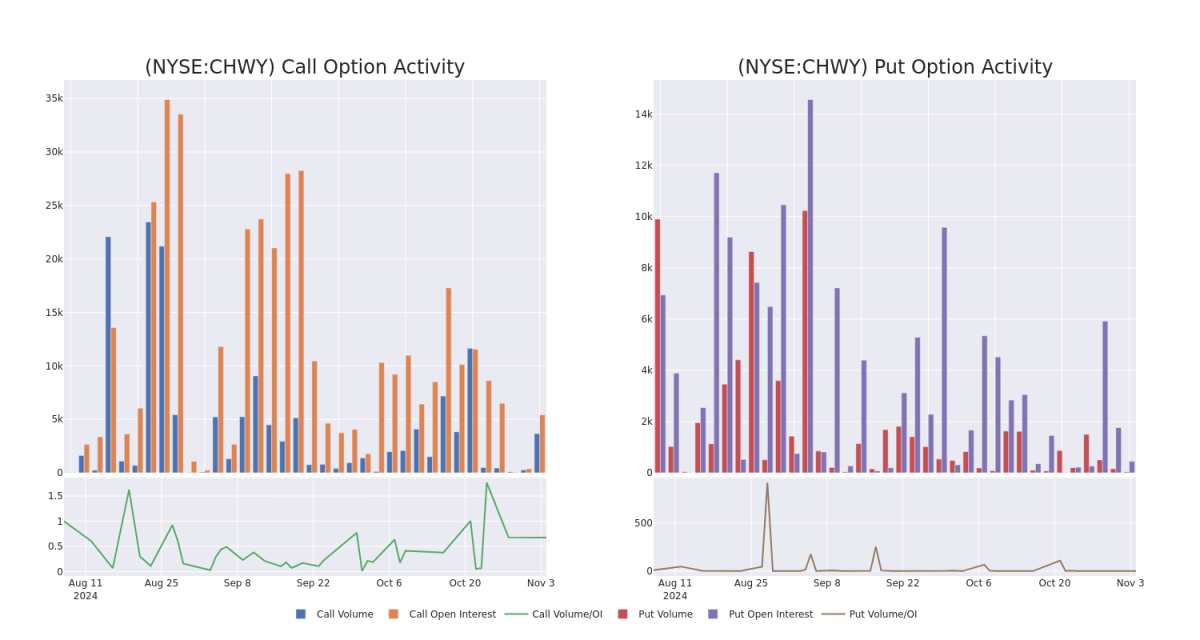

In the following chart, we are able to follow the development of volume and open interest of call and put options for Chewy's big money trades within a strike price range of $2.5 to $40.0 over the last 30 days.

在以下圖表中,我們可以追蹤Chewy的大手交易的成交量和未平倉合約的發展情況,該交易涉及2.5美元至40.0美元的執行價格範圍,時間跨度爲過去30天。

Chewy Call and Put Volume: 30-Day Overview

chewy看漲和看跌成交量:30天概覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CHWY | CALL | SWEEP | BULLISH | 11/15/24 | $2.0 | $1.99 | $2.0 | $27.50 | $64.8K | 3.5K | 334 |

| CHWY | CALL | SWEEP | BEARISH | 11/15/24 | $1.98 | $1.96 | $1.98 | $27.50 | $63.5K | 3.5K | 738 |

| CHWY | CALL | TRADE | BULLISH | 11/08/24 | $3.1 | $3.05 | $3.1 | $26.50 | $56.1K | 271 | 262 |

| CHWY | CALL | SWEEP | BEARISH | 11/15/24 | $2.13 | $1.97 | $1.97 | $27.50 | $52.0K | 3.5K | 747 |

| CHWY | CALL | SWEEP | BULLISH | 12/20/24 | $2.3 | $2.13 | $2.3 | $30.00 | $49.1K | 1.3K | 509 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CHWY | 看漲 | SWEEP | 看好 | 11/15/24 | $2.0 | $1.99 | $2.0 | $27.50 | $64.8K | 3.5K | 334 |

| CHWY | 看漲 | SWEEP | 看淡 | 11/15/24 | $1.98 | 1.96美元 | $1.98 | $27.50 | $63.5K | 3.5K | 738 |

| CHWY | 看漲 | 交易 | 看好 | 11/08/24 | $3.1 | $3.05 | $3.1 | $26.50 | $56.1K | 271 | 262 |

| CHWY | 看漲 | SWEEP | 看淡 | 11/15/24 | $2.13 | $1.97 | $1.97 | $27.50 | $52000 | 3.5K | 747 |

| CHWY | 看漲 | SWEEP | 看好 | 12/20/24 | $2.3 | $2.13 | $2.3 | $30.00 | $49.1K | 1.3K | 509 |

About Chewy

關於Chewy

Chewy is the largest e-commerce pet care retailer in the US, generating $11.2 billion in 2023 sales across pet food, treats, hard goods, and pharmacy categories. The firm was founded in 2011, acquired by PetSmart in 2017, and tapped public markets as a stand-alone company in 2019 after spending a couple of years developing under the aegis of the pet superstore chain. The firm generates sales from pet food, treats, over-the-counter medications, medical prescription fulfillment, and hard goods, like crates, leashes, and bowls.

Chewy是美國最大的電子商務寵物用品零售商,在寵物食品、零食、硬件產品和藥房類別中,2023年銷售額達112億美元。該公司成立於2011年,於2017年由PetSmart收購,並在經過幾年的Pet超市連鎖店支持後,於2019年作爲獨立公司進入公開市場。該公司從寵物食品、零食、非處方藥、醫療處方實現銷售,以及像狗籠、狗鏈和狗碗之類的硬件產品。

Following our analysis of the options activities associated with Chewy, we pivot to a closer look at the company's own performance.

根據我們對Chewy相關期權交易活動的分析,我們轉而更近距離地觀察該公司的表現。

Current Position of Chewy

Chewy的當前位置

- With a trading volume of 7,598,046, the price of CHWY is up by 6.42%, reaching $28.86.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 30 days from now.

- 成交量爲7,598,046,CHWY的價格上漲了6.42%,達到28.86美元。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一個業績發佈日期爲30天后。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Chewy options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。 精明的交易者通過不斷教育自己、調整策略、監控多個因子,並密切關注市場走勢來管理這些風險。 通過Benzinga Pro的實時警報及時了解最新的chewy期權交易。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $2.5 and $40.0 for Chewy, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $2.5 and $40.0 for Chewy, spanning the last three months.