Market Mover | Palantir Shares Surge 12% After Q3 Earnings Release, Reporting Revenue Growth of 30%

Market Mover | Palantir Shares Surge 12% After Q3 Earnings Release, Reporting Revenue Growth of 30%

November 4, 2024 - $Palantir (PLTR.US)$ shares surged 12.80% to $46.71 in post-market trading on Monday. Palantir reports revenue growth of 30% y/y, U.S. revenue growth of 44% y/y, GAAP EPS of $0.06; raises full year guidance on revenue, U.S. Comm revenue, adj. free cash flow, adj. Op. income above consensus estimates on “AI demand that won’t slow down”.

2024年11月4日 - $Palantir (PLTR.US)$ 股價在週一的美股盤後交易中飆升了12.80%,至46.71美元。palantir報告營業收入同比增長30%,美國營業收入同比增長44%,GAAP每股收益爲0.06美元;並提高了全年營收、美國通訊營收、調整後自由現金流、調整後營運利潤的指導,超過共識預期,理由是「AI需求不會減速」。

Q3 2024 Highlights

2024年第三季度亮點

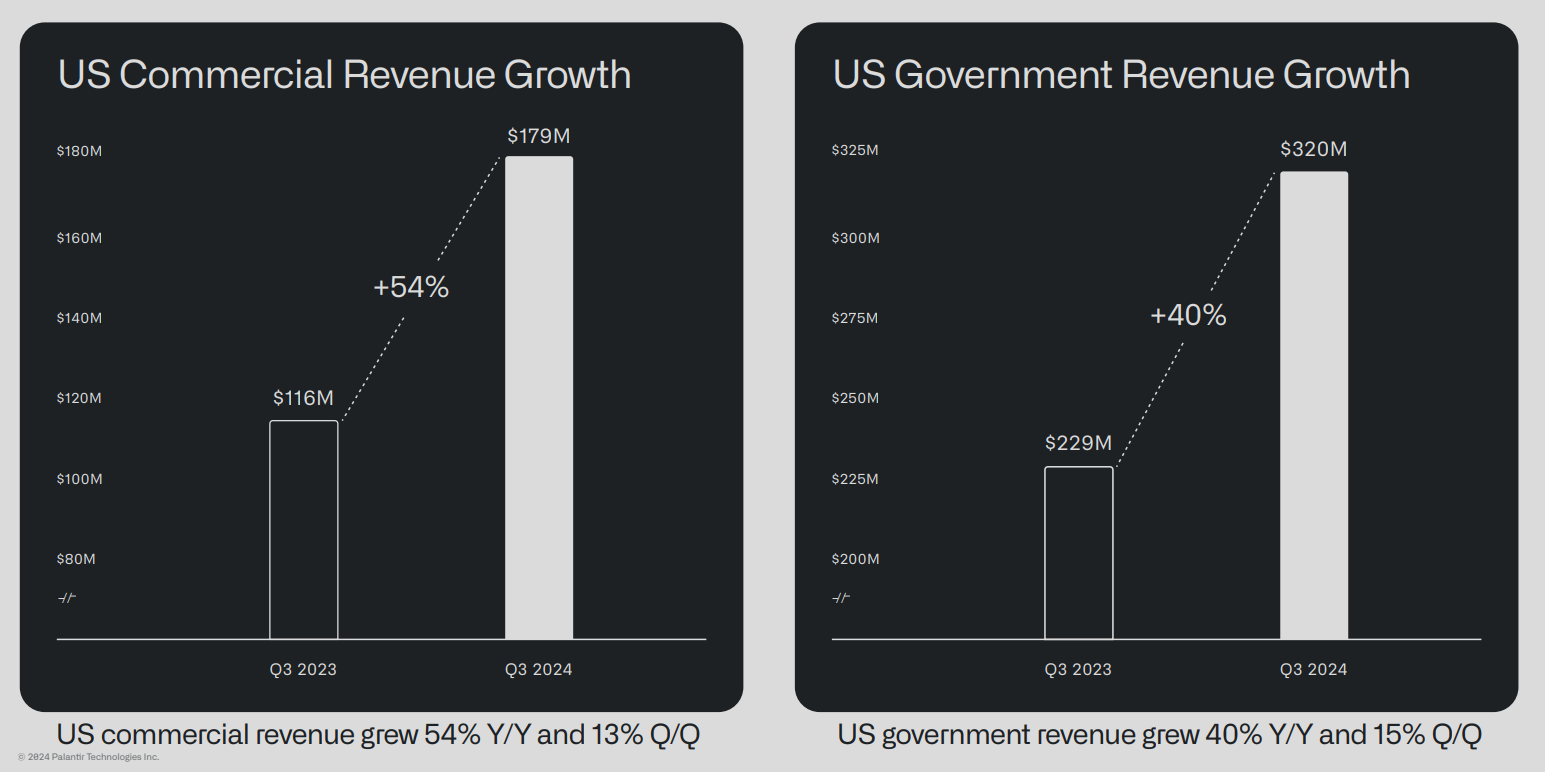

U.S. revenue grew 44% year-over-year and 14% quarter-over-quarter to $499 million

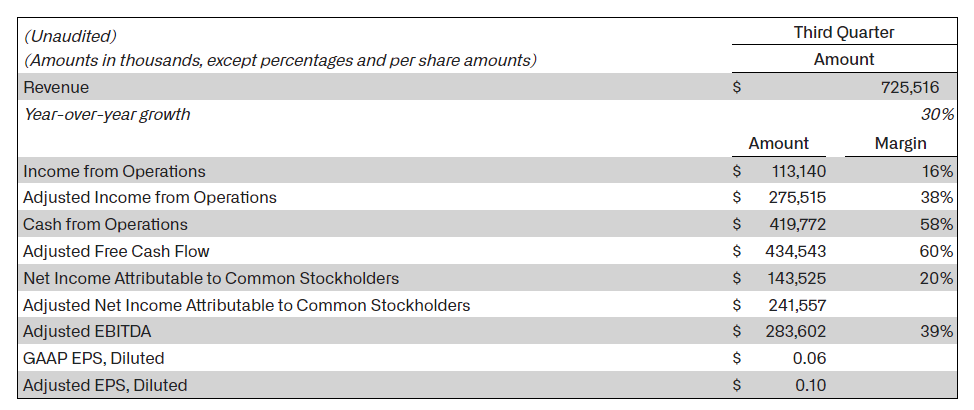

Revenue grew 30% year-over-year and 7% quarter-over-quarter to $726 million

Closed 104 deals over $1 million

Customer count grew 39% year-over-year and 6% quarter-over-quarter

GAAP net income of $144 million, representing a 20% margin

GAAP income from operations of $113 million, representing a 16% margin

Adjusted income from operations of $276 million, representing a 38% margin

Rule of 40 score of 68%

GAAP earnings per share (“EPS”) grew 100% year-over-year to $0.06

Adjusted EPS grew 43% year-over-year to $0.10

Cash, cash equivalents, and short-term U.S. Treasury securities of $4.6 billion

Cash from operations of $420 million, representing a 58% margin and $995 million on a trailing twelve month basis

Adjusted free cash flow of $435 million, representing a 60% margin and over $1 billion on a trailing twelve month basis

美國營收同比增長44%,環比增長14%,達到$49900萬

營收同比增長30%,環比增長7%,達72600萬美元

完成了104筆超過100萬的交易

客戶數量同比增長39%,環比增長6%

14400萬美元的GAAP淨利潤,佔20%的利潤率

按照通用會計準則,運營收入爲11300萬美元,代表16%的利潤率

調整後的營業收入爲27600萬美元,代表38%的利潤率

40規則得分爲68%

按照通用會計準則,每股收益(EPS)同比增長100%至0.06美元

調整後的每股收益同比增長43%至0.10美元

現金、現金等價物和短期美國國債總額爲46億美元

營業現金流爲42000萬美元,代表58%的利潤率,過去12個月爲99500萬美元

調整後的自由現金流爲43500萬美元,代表60%的利潤率,在過去12個月超過10億美元

Q3 2024 Financial Summary

2024年第三季度財務摘要

Outlook

展望

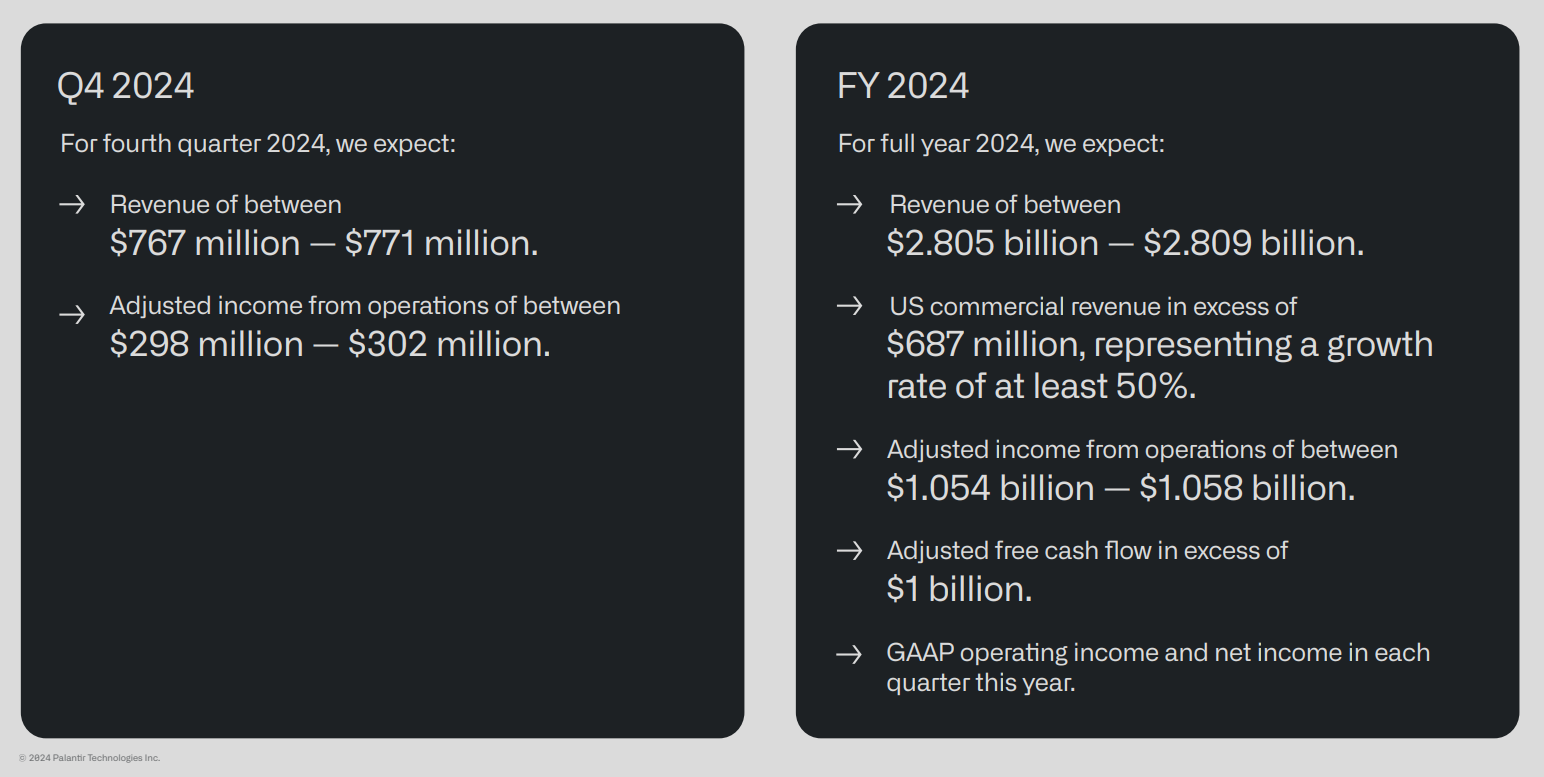

For Q4 2024, it expect:

2024年第四季度,預計:

Revenue of between $767 - $771 million.

Adjusted income from operations of between $298 - $302 million.

營業收入在767萬美元至77100萬美元之間。

調整後的營業收入在298萬美元至30200萬美元之間。

For full year 2024:

2024財年:

The company is raising its revenue guidance to between $2.805 billion and $2.809 billion.

It is raising its U.S. commercial revenue guidance to in excess of $687 million, representing a growth rate of at least 50%.

The company is raising its adjusted income from operations guidance to between $1.054 billion and $1.058 billion.

It is raising its adjusted free cash flow guidance to in excess of $1 billion.

And it continues to expect GAAP operating income and net income in each quarter of this year.

該公司將其營業收入指引提高到28.05億至28.09億美元。

它將其美國商業營收指引提高至超過68700萬美元,增長率至少爲50%。

公司將其經營活動收入調整指引提高到10.54億至10.58億美元。

它將調高自由現金流調整後指引,超過10億美元。

並且繼續預期本年度每個季度的GAAP營業收入和淨利潤。

Closed 104 deals over $1 million

Closed 104 deals over $1 million