Is Motorcomm Electronic Technology (SHSE:688515) A Risky Investment?

Is Motorcomm Electronic Technology (SHSE:688515) A Risky Investment?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Motorcomm Electronic Technology Co., Ltd. (SHSE:688515) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

霍華德·馬克斯很好地表達了這一點,他說,與其擔心股價波動,不如擔心永久性損失的可能性...我認識的每個實際投資者都會擔心這一點。因此,明智的投資者知道,債務 - 通常與破產有關 - 是評估公司風險時非常重要的因素。我們注意到,Motorcomm Electronic Technology Co.,Ltd.(SHSE:688515)的資產負債表中確實有債務。但股東們是否應該擔心公司使用債務?

What Risk Does Debt Bring?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

債務在企業遇到支付困難時提供幫助,無論是通過新資本還是通過自由現金流。在最壞的情況下,如果公司無法償還債權人,公司可能會破產。雖然這並不太常見,但我們經常看到負債累累的公司因債權人強迫其以處於困境價格的方式籌集資本而永久性地稀釋股東利益。當然,許多公司利用債務進行增長資金,而沒有任何負面後果。考慮一個企業使用多少債務時,首先要做的是看現金和債務共同構成的情況。

What Is Motorcomm Electronic Technology's Debt?

摩托康電子科技的債務情況如何?

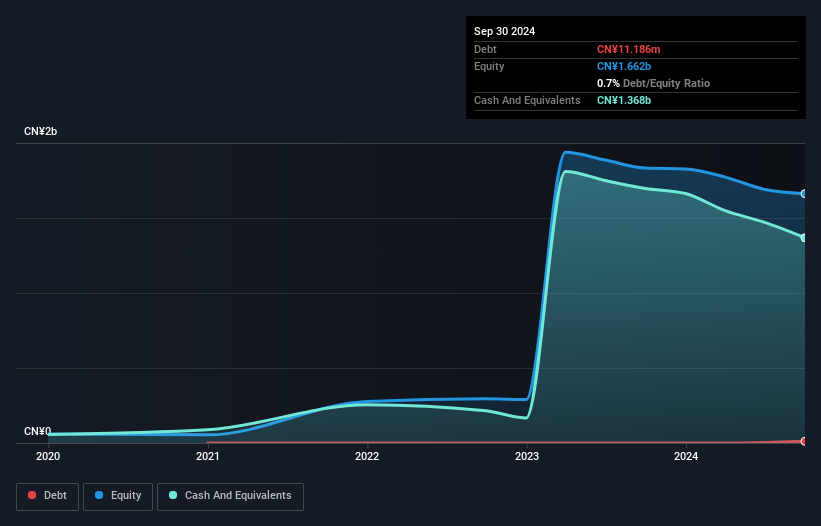

As you can see below, at the end of September 2024, Motorcomm Electronic Technology had CN¥11.2m of debt, up from none a year ago. Click the image for more detail. But it also has CN¥1.37b in cash to offset that, meaning it has CN¥1.36b net cash.

正如您在下文所看到的,截至2024年9月底,摩托康電子科技的債務爲1120萬人民幣,較一年前增加。點擊圖片以獲取更多詳細信息。但它也有13.7億人民幣的現金來抵消,這意味着它有13.6億人民幣的淨現金。

How Healthy Is Motorcomm Electronic Technology's Balance Sheet?

摩托康秒電子科技的資產負債表如何?

We can see from the most recent balance sheet that Motorcomm Electronic Technology had liabilities of CN¥113.4m falling due within a year, and liabilities of CN¥9.46m due beyond that. On the other hand, it had cash of CN¥1.37b and CN¥77.7m worth of receivables due within a year. So it can boast CN¥1.32b more liquid assets than total liabilities.

我們可以從最近的資產負債表中看到,摩托康秒電子科技有1年內到期的負債爲11340萬人民幣,以及超過1年到期的946萬人民幣的負債。另一方面,它擁有13.7億人民幣的現金和7770萬人民幣的應收賬款。因此,它可以誇口擁有13.2億人民幣的流動資產超過總負債。

This surplus suggests that Motorcomm Electronic Technology is using debt in a way that is appears to be both safe and conservative. Due to its strong net asset position, it is not likely to face issues with its lenders. Simply put, the fact that Motorcomm Electronic Technology has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Motorcomm Electronic Technology can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

這一盈餘表明摩托康秒電子科技正在以一種看似安全和謹慎的方式利用債務。由於其良好的淨資產狀況,它不太可能遇到與債權人的問題。簡單來說,摩托康秒電子科技擁有比債務更多的現金,這可以被認爲是它能夠安全地管理債務的一個很好跡象。在分析債務水平時,資產負債表是顯而易見的起點。但最終,業務未來的盈利能力將決定摩托康秒電子科技是否可以隨着時間加強其資產負債表。因此,如果您想了解專業人士的看法,您可能會發現對分析師盈利預測的這份免費報告很有趣。

In the last year Motorcomm Electronic Technology wasn't profitable at an EBIT level, but managed to grow its revenue by 40%, to CN¥375m. Shareholders probably have their fingers crossed that it can grow its way to profits.

在過去一年裏,摩托康秒電子科技在EBIt水平上沒有盈利,但其營業收入增長了40%,達到了37500萬人民幣。股東們可能滿懷期待地期待它能夠通過增長實現盈利。

So How Risky Is Motorcomm Electronic Technology?

摩托康秒電子科技有多大風險?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Motorcomm Electronic Technology had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of CN¥309m and booked a CN¥150m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of CN¥1.36b. That kitty means the company can keep spending for growth for at least two years, at current rates. With very solid revenue growth in the last year, Motorcomm Electronic Technology may be on a path to profitability. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 2 warning signs we've spotted with Motorcomm Electronic Technology (including 1 which doesn't sit too well with us) .

從統計學角度來看,虧損的公司比賺錢的公司風險更高。我們注意到,摩托康秒電子科技在過去一年裏有着利息和稅前利潤(EBIT)虧損。在同一時期,它看到了30900萬人民幣的負自由現金流和記載了15000萬人民幣的會計虧損。雖然這使得該公司有點風險,但重要的是要記住它淨現金達到了13.6億人民幣。這筆現金意味着公司至少可以按照當前速度繼續爲增長支出兩年。在過去一年裏,摩托康秒電子科技有非常可觀的營業收入增長,可能正在走向盈利。通過在這些利潤之前進行投資,股東們承擔更多風險,希望獲得更大的回報。在分析債務水平時,資產負債表是顯而易見的起點。但最終,每家公司都可能存在超過資產負債表以外的風險。爲此,您應該了解我們發現的摩托康秒電子科技的2個警示信號(包括1個讓我們感覺不太舒服的信號)。

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

每天結束時,通常更好地關注那些沒有淨債務的公司。您可以查看我們特別名單上的這些公司(所有這些公司都有盈利增長記錄)。這是免費的。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

We can see from the most recent balance sheet that Motorcomm Electronic Technology had liabilities of CN¥113.4m falling due within a year, and liabilities of CN¥9.46m due beyond that. On the other hand, it had cash of CN¥1.37b and CN¥77.7m worth of receivables due within a year. So it can boast CN¥1.32b more liquid assets than

We can see from the most recent balance sheet that Motorcomm Electronic Technology had liabilities of CN¥113.4m falling due within a year, and liabilities of CN¥9.46m due beyond that. On the other hand, it had cash of CN¥1.37b and CN¥77.7m worth of receivables due within a year. So it can boast CN¥1.32b more liquid assets than