On Nov 05, major Wall Street analysts update their ratings for $KinderCare Learning Companies (KLC.US)$, with price targets ranging from $30 to $36.

Morgan Stanley analyst Toni Kaplan initiates coverage with a hold rating, and sets the target price at $31.

J.P. Morgan analyst Andrew Steinerman initiates coverage with a buy rating, and sets the target price at $31.

UBS analyst Joshua Chan initiates coverage with a buy rating, and sets the target price at $36.

UBS analyst Joshua Chan initiates coverage with a buy rating, and sets the target price at $36.

Deutsche Bank analyst Faiza Alwy initiates coverage with a hold rating, and sets the target price at $31.

Baird analyst Jeffrey Meuler initiates coverage with a hold rating, and sets the target price at $30.

Furthermore, according to the comprehensive report, the opinions of $KinderCare Learning Companies (KLC.US)$'s main analysts recently are as follows:

As the largest provider of early childhood education in the U.S., KinderCare stands to gain from the rising need for quality childcare. The current valuation of the shares is seen as reflecting their fair value.

KinderCare Learning, as the largest provider in the U.S. for early childhood education, is considered to be at a pivotal moment where the focus can shift towards future growth. It is perceived to have a more advantageous position in attracting and retaining educators compared to smaller entities.

The expectations for KinderCare Learning include a steady rise in enrollments, tuition hikes surpassing wage inflation, and a slight boost from acquisitions, which could lead to an annual EBITDA growth of 13%-14% through 2026. During this period, the EBITDA margins are anticipated to enhance from 10.6% in 2024 to 12.0% in 2026, indicating a potential 20%-25% appreciation in the company's share value over the forthcoming year.

KinderCare Learning, as a prominent provider of early childcare education, is poised to gain from the distinct childcare requirements in the U.S. market. With a significant total addressable market valued at $76B and the ability to set prices, the company is on course for a profitable growth trajectory.

The company's standing as the most prominent day-care center provider in the U.S., coupled with mid-single-digit revenue growth, is admired. Nevertheless, the current stock valuation is perceived as reasonable.

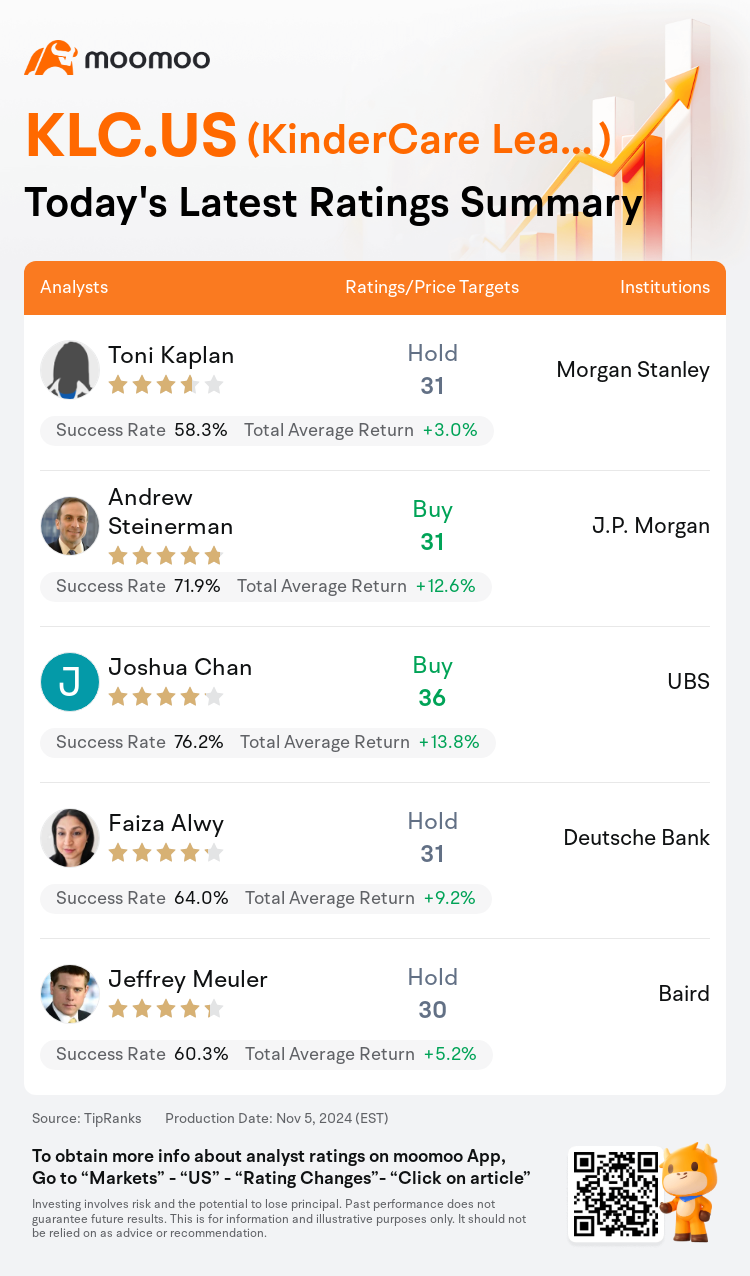

Here are the latest investment ratings and price targets for $KinderCare Learning Companies (KLC.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月5日,多家華爾街大行更新了$KinderCare Learning Companies (KLC.US)$的評級,目標價介於30美元至36美元。

摩根士丹利分析師Toni Kaplan首次給予持有評級,目標價31美元。

摩根大通分析師Andrew Steinerman首次給予買入評級,目標價31美元。

瑞士銀行分析師Joshua Chan首次給予買入評級,目標價36美元。

瑞士銀行分析師Joshua Chan首次給予買入評級,目標價36美元。

德意志銀行分析師Faiza Alwy首次給予持有評級,目標價31美元。

貝雅分析師Jeffrey Meuler首次給予持有評級,目標價30美元。

此外,綜合報道,$KinderCare Learning Companies (KLC.US)$近期主要分析師觀點如下:

作爲美國最大的幼兒教育提供商,KinderCare有望從對優質托兒需求的增長中獲益。目前股份的估值被視爲反映了其公平價值。

KinderCare Learning作爲美國最大的早期教育提供商,正處於一個關鍵時刻,焦點可以轉向未來增長。與規模較小的實體相比,它被認爲在吸引和留住教育者方面具有更有利的位置。

對KinderCare Learning的預期包括學生人數的穩步增長,學費漲幅超過工資通脹,以及從收購中略微提振,有望導致2026年的年度EBITDA增長率達到13%-14%。在此期間,預計EBITDA邊際將從2024年的10.6%提高到2026年的12.0%,表明公司股價在未來一年內有望增值20%-25%。

作爲傑出的早期兒童教育提供商,KinderCare Learning有望從美國市場特殊的兒童托育需求中受益。公司面臨着價值760億美元的巨大總可達市場和定價能力,正在走向盈利增長軌道。

作爲美國最重要的托兒中心提供商,加上中位數位數的營業收入增長,備受讚賞。然而,目前股價估值被視爲合理。

以下爲今日5位分析師對$KinderCare Learning Companies (KLC.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

瑞士銀行分析師Joshua Chan首次給予買入評級,目標價36美元。

瑞士銀行分析師Joshua Chan首次給予買入評級,目標價36美元。

UBS analyst Joshua Chan initiates coverage with a buy rating, and sets the target price at $36.

UBS analyst Joshua Chan initiates coverage with a buy rating, and sets the target price at $36.