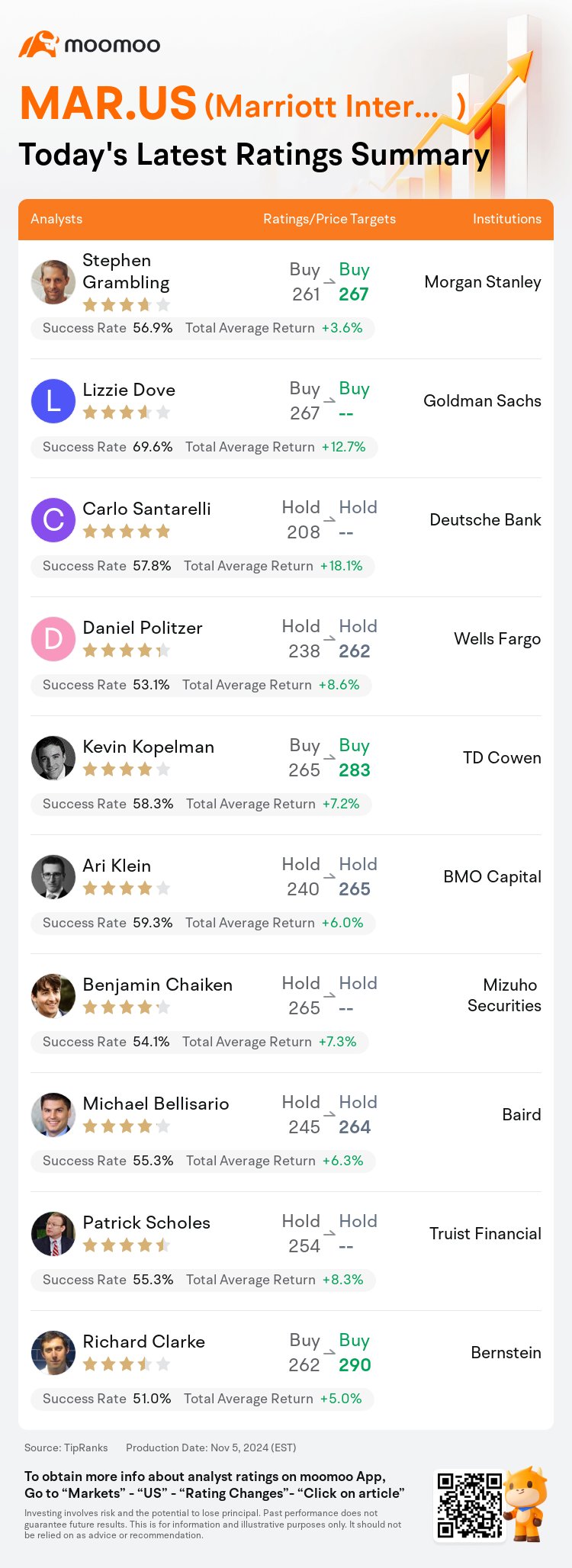

On Nov 05, major Wall Street analysts update their ratings for $Marriott International (MAR.US)$, with price targets ranging from $262 to $290.

Morgan Stanley analyst Stephen Grambling maintains with a buy rating, and adjusts the target price from $261 to $267.

Goldman Sachs analyst Lizzie Dove maintains with a buy rating.

Deutsche Bank analyst Carlo Santarelli maintains with a hold rating.

Deutsche Bank analyst Carlo Santarelli maintains with a hold rating.

Wells Fargo analyst Daniel Politzer maintains with a hold rating, and adjusts the target price from $238 to $262.

TD Cowen analyst Kevin Kopelman maintains with a buy rating, and adjusts the target price from $265 to $283.

Furthermore, according to the comprehensive report, the opinions of $Marriott International (MAR.US)$'s main analysts recently are as follows:

Following the Q3 report, it was observed that the company experienced a modest deceleration in RevPAR and fee growth. This slowdown was largely counterbalanced by the implementation of a cost savings program.

Marriott's shares experienced a slight dip on Monday, attributed to a Q3 performance that didn't quite meet expectations and a subsequent reduction in Q4 forecasts. However, this was somewhat anticipated following reports from peers, resulting in a relatively subdued market response to the financial updates. Adjusted EBITDA expectations have been slightly raised in relation to reductions in Selling, General & Administrative (SG&A) expenses.

The ongoing issue with Marriott has been the discrepancy between the growth of fees and the expectations set by the algorithm. This concern, however, is now considered to be a thing of the past.

The firm expressed a gradually more favorable perspective on the company's shares, alongside optimism regarding the company's short-term fundamental prospects and growth catalysts.

The company's Q3 earnings and EBITDA fell short, largely due to one-time expenditures, and the guidance for Q4 appeared tempered, impacted by various factors. It is noted that despite a varied broader RevPAR environment, the company's performance is 'relatively steady' with group bookings performing well whereas leisure bookings are not as strong, a trend that is anticipated to continue into 2025. The current stock valuation is perceived as reasonable.

Here are the latest investment ratings and price targets for $Marriott International (MAR.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月5日,多家華爾街大行更新了$萬豪酒店 (MAR.US)$的評級,目標價介於262美元至290美元。

摩根士丹利分析師Stephen Grambling維持買入評級,並將目標價從261美元上調至267美元。

高盛集團分析師Lizzie Dove維持買入評級。

德意志銀行分析師Carlo Santarelli維持持有評級。

德意志銀行分析師Carlo Santarelli維持持有評級。

富國集團分析師Daniel Politzer維持持有評級,並將目標價從238美元上調至262美元。

TD Cowen分析師Kevin Kopelman維持買入評級,並將目標價從265美元上調至283美元。

此外,綜合報道,$萬豪酒店 (MAR.US)$近期主要分析師觀點如下:

在Q3報告發布之後,公司的RevPAR和費用增長略有放緩。這種減速在很大程度上被成本節約計劃的實施所抵消。

萬豪的股價在週一出現輕微下跌,原因是Q3的表現未能達到預期,隨後Q4預期有所降低。然而,這在同行發佈報告後有些被預期,導致市場對財務更新做出相對冷淡的反應。調整後的EBITDA預期略有提高,與銷售、總務和管理(SG&A)費用的降低相關。

萬豪目前面臨的問題是費用增長與算法設定的預期之間存在差異。然而,這種擔憂現在被視爲已成過去。

公司對公司股票持有逐漸更加樂觀的看法,同時對公司短期基本前景和增長動力持樂觀態度。

由於一次性支出,公司的Q3收益和EBITDA未能達到預期,Q4的指引也顯得溫和,受到各種因素的影響。儘管整體RevPAR的環境參差不齊,公司的表現仍然「相對穩定」,團體預訂表現良好,但休閒預訂不及預期,這一趨勢預計會持續到2025年。目前的股票估值被認爲是合理的。

以下爲今日10位分析師對$萬豪酒店 (MAR.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

德意志銀行分析師Carlo Santarelli維持持有評級。

德意志銀行分析師Carlo Santarelli維持持有評級。

Deutsche Bank analyst Carlo Santarelli maintains with a hold rating.

Deutsche Bank analyst Carlo Santarelli maintains with a hold rating.