On Nov 05, major Wall Street analysts update their ratings for $Fidelity National Information Services (FIS.US)$, with price targets ranging from $94 to $104.

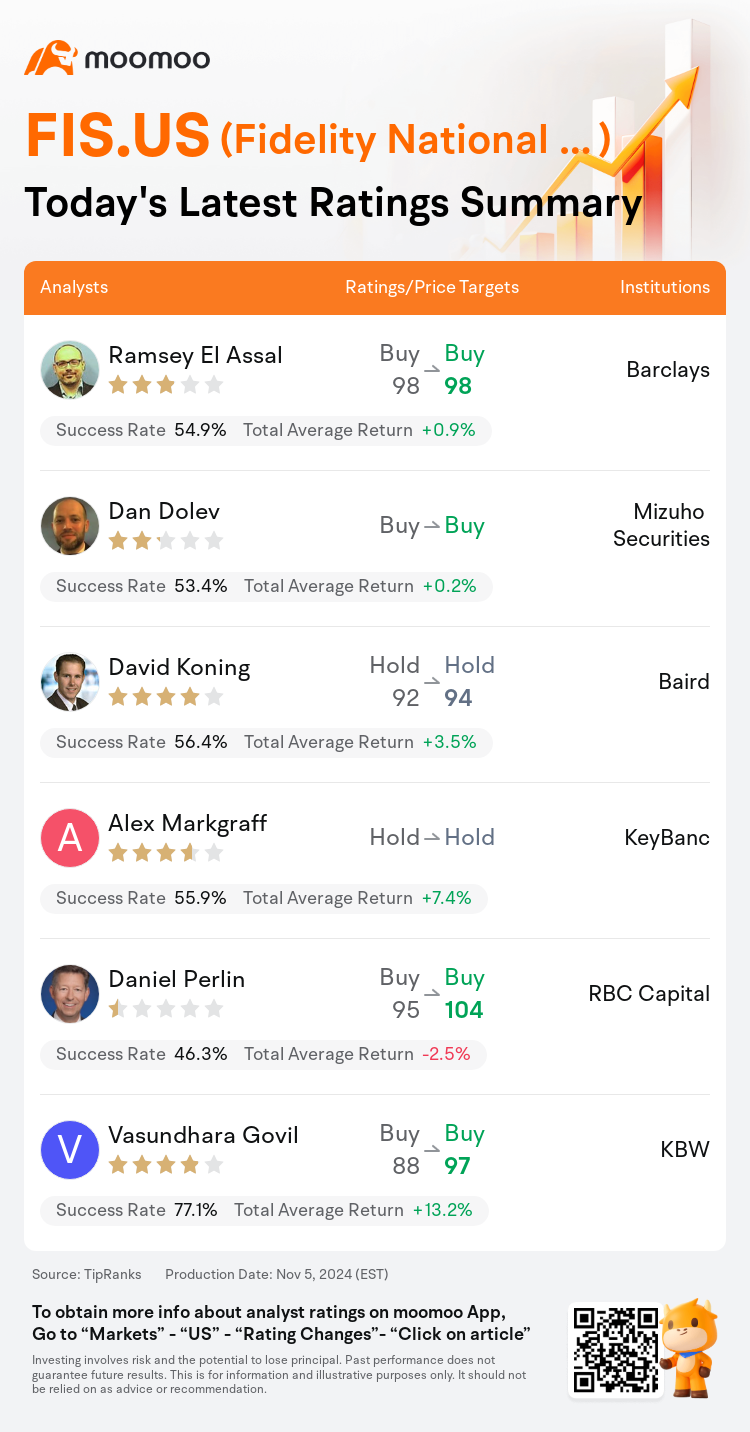

Barclays analyst Ramsey El Assal maintains with a buy rating, and maintains the target price at $98.

Mizuho Securities analyst Dan Dolev maintains with a buy rating.

Baird analyst David Koning maintains with a hold rating, and adjusts the target price from $92 to $94.

Baird analyst David Koning maintains with a hold rating, and adjusts the target price from $92 to $94.

KeyBanc analyst Alex Markgraff maintains with a hold rating.

RBC Capital analyst Daniel Perlin maintains with a buy rating, and adjusts the target price from $95 to $104.

Furthermore, according to the comprehensive report, the opinions of $Fidelity National Information Services (FIS.US)$'s main analysts recently are as follows:

Banking and Capital Markets displayed robust underlying trends in the third quarter, with earnings outperformance still benefitting from contributions by Worldpay. However, potential challenges are anticipated in the upcoming year due to rising operational expenses. The valuation is considered fair, but it is believed that there are more advantageous risk/reward opportunities within the Payments sector.

FIS has reported another robust quarter, characterized by an acceleration in Banking recurring revenue growth. The outlook remains positive, with expectations that the portfolio will increasingly shift towards recurring revenue over time.

The company is performing as expected, presenting solid third-quarter results without any unexpected developments. The growth was fueled by an uptick in Banking recurring revenue, and temporary advantages contributed to earnings per share improvements, courtesy of interest and operational expenditure timing in Worldpay.

The firm acknowledged that FIS experienced a positive third quarter outcome and anticipates an increase in 2024 EPS guidance, primarily due to WP contribution and interest expenses. However, there is a note of caution as potential EPS headwinds may arise in the forthcoming quarters.

Here are the latest investment ratings and price targets for $Fidelity National Information Services (FIS.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月5日,多家華爾街大行更新了$繁德信息技術 (FIS.US)$的評級,目標價介於94美元至104美元。

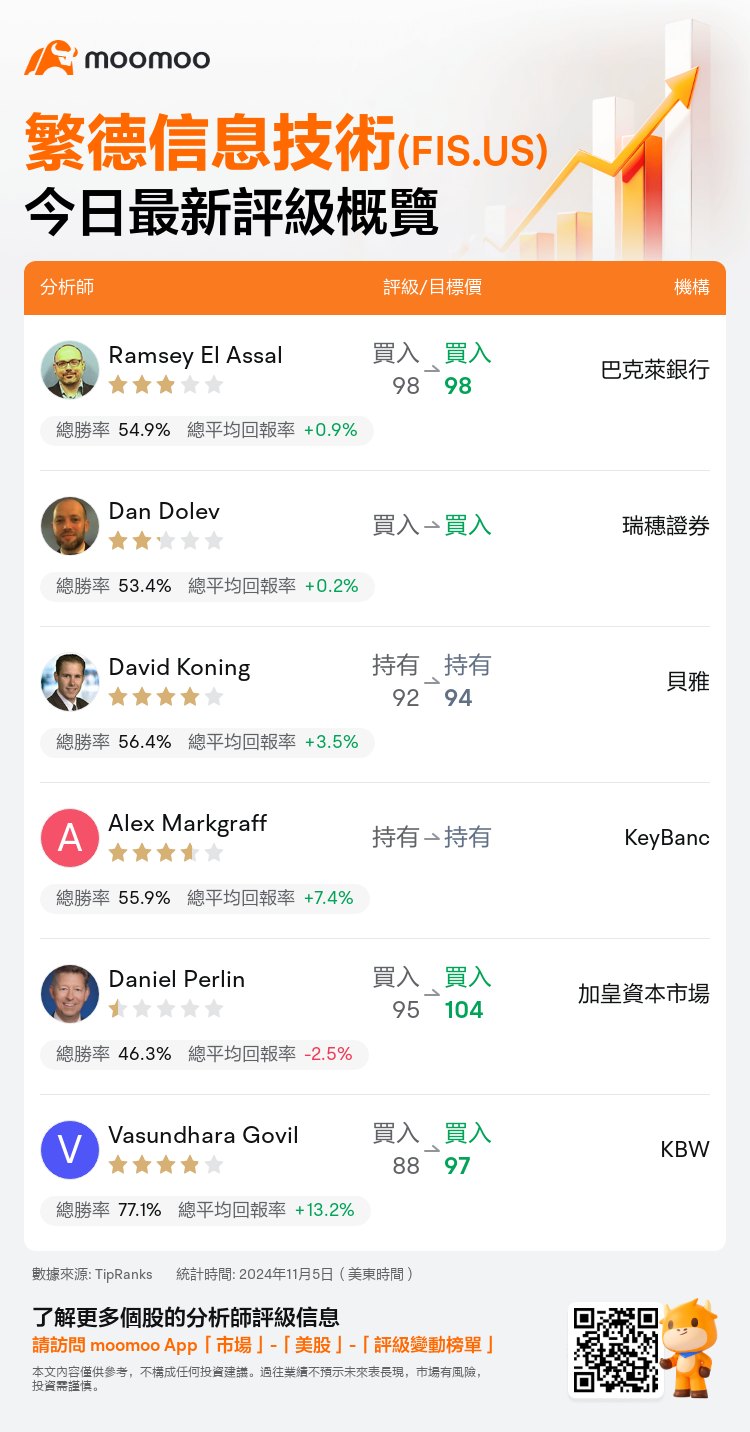

巴克萊銀行分析師Ramsey El Assal維持買入評級,維持目標價98美元。

瑞穗證券分析師Dan Dolev維持買入評級。

貝雅分析師David Koning維持持有評級,並將目標價從92美元上調至94美元。

貝雅分析師David Koning維持持有評級,並將目標價從92美元上調至94美元。

KeyBanc分析師Alex Markgraff維持持有評級。

加皇資本市場分析師Daniel Perlin維持買入評級,並將目標價從95美元上調至104美元。

此外,綜合報道,$繁德信息技術 (FIS.US)$近期主要分析師觀點如下:

第三季度,銀行和資本市場顯示出強勁的基本趨勢,盈利表現優異,仍然受益於Worldpay的貢獻。然而,由於運營費用上升,預計未來一年可能面臨潛在挑戰。估值被認爲是公平的,但有信念認爲在支付領域有更有利的風險/回報機會。

FIS報告了又一個強勁的季度,以銀行業可持續營收增長加速爲特徵。展望仍然積極,預計組合將隨時間逐漸向可持續收入轉變。

該公司表現符合預期,展示了紮實的第三季度業績,沒有出現任何意外情況。增長得益於銀行可持續收入的提升,並臨時優勢促成了每股收益的改善,感謝Worldpay利息和運營支出安排。

該公司承認FIS在第三季度取得了積極的成果,並預計2024年EPS指引將增加,主要是由於WP的貢獻和利息支出。然而,值得注意的是,可能會在未來幾個季度出現潛在的EPS逆風。

以下爲今日6位分析師對$繁德信息技術 (FIS.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

貝雅分析師David Koning維持持有評級,並將目標價從92美元上調至94美元。

貝雅分析師David Koning維持持有評級,並將目標價從92美元上調至94美元。

Baird analyst David Koning maintains with a hold rating, and adjusts the target price from $92 to $94.

Baird analyst David Koning maintains with a hold rating, and adjusts the target price from $92 to $94.