On Nov 05, major Wall Street analysts update their ratings for $IQVIA Holdings (IQV.US)$, with price targets ranging from $240 to $273.

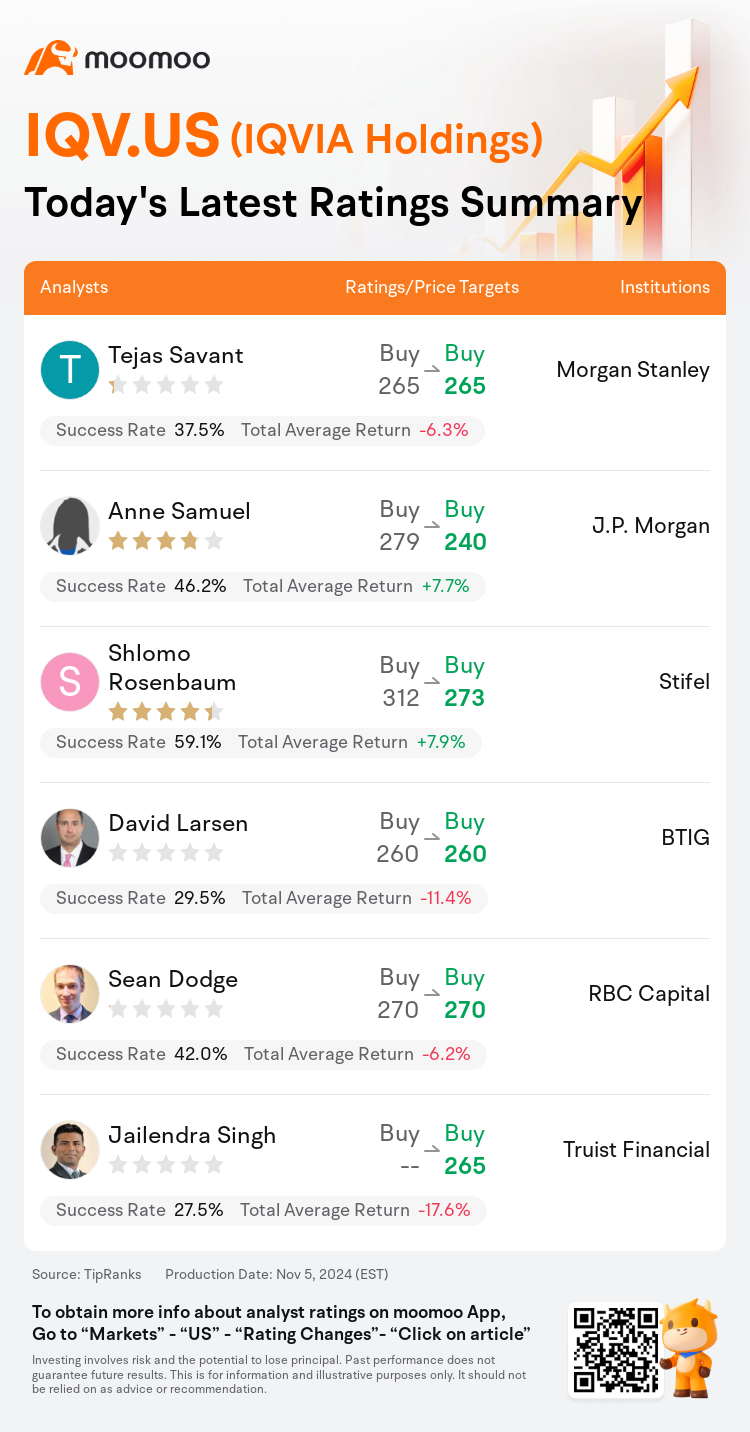

Morgan Stanley analyst Tejas Savant maintains with a buy rating, and maintains the target price at $265.

J.P. Morgan analyst Anne Samuel maintains with a buy rating, and adjusts the target price from $279 to $240.

Stifel analyst Shlomo Rosenbaum maintains with a buy rating, and adjusts the target price from $312 to $273.

Stifel analyst Shlomo Rosenbaum maintains with a buy rating, and adjusts the target price from $312 to $273.

BTIG analyst David Larsen maintains with a buy rating, and maintains the target price at $260.

RBC Capital analyst Sean Dodge maintains with a buy rating, and maintains the target price at $270.

Furthermore, according to the comprehensive report, the opinions of $IQVIA Holdings (IQV.US)$'s main analysts recently are as follows:

Iqvia's third quarter saw a 'modest beat' primarily due to strong performance in TAS, yet this positive development is currently being overshadowed by challenges in R&DS. These include a significant cancellation and the postponement of two 'mega trials' to 2025. Despite these headwinds, the risk/reward proposition is considered favorable following the recent decline in share value.

Following Iqvia's Q3 report, the market appears relatively stable, although the company is experiencing challenges with bookings due to delays and drug failures, rather than significant effects from pipeline rationalization.

The company has encountered a challenging industry operating environment. Comments from the company suggest that adjustments related to pharma portfolio reprioritizations connected with the IRA may be coming to a conclusion, and it appears the company could benefit from the pharmaceutical industry's trend towards vendor consolidation.

Iqvia's overall revenue, adjusted EBITDA, and adjusted EPS surpassed consensus expectations. Nevertheless, the company has scaled back its projections for 2024 across all metrics. This revision is largely attributed to the Inflation Reduction Act and broader economic challenges. Additionally, the guidance for R&DS has been adjusted downward, stemming from delays and the cancellation of two substantial trials.

The firm expressed concerns regarding near-term CRO marketplace dynamics. With the majority of the company exhibiting a slow or weakening trend, there is skepticism about whether the improving segment of the company will contribute significantly more than just providing balance.

Here are the latest investment ratings and price targets for $IQVIA Holdings (IQV.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月5日,多家華爾街大行更新了$艾昆緯 (IQV.US)$的評級,目標價介於240美元至273美元。

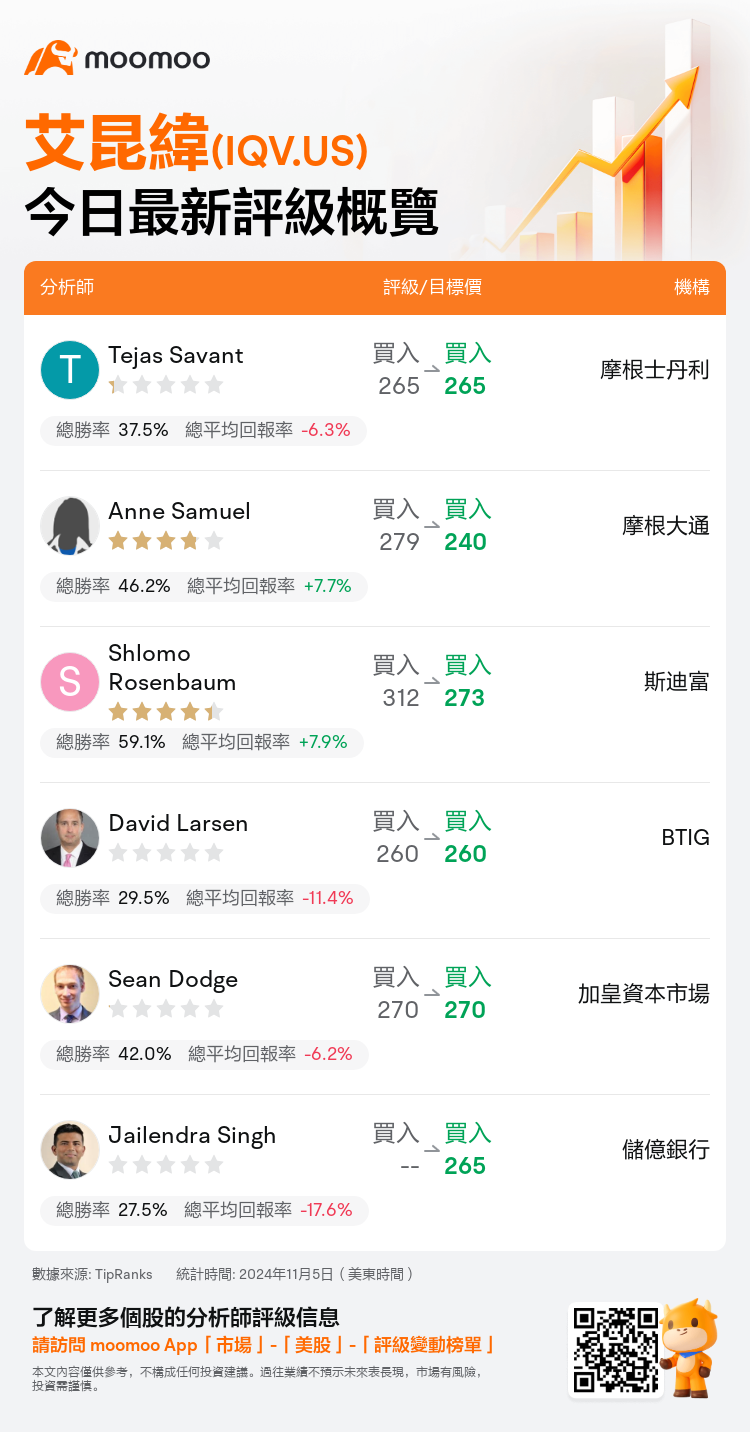

摩根士丹利分析師Tejas Savant維持買入評級,維持目標價265美元。

摩根大通分析師Anne Samuel維持買入評級,並將目標價從279美元下調至240美元。

斯迪富分析師Shlomo Rosenbaum維持買入評級,並將目標價從312美元下調至273美元。

斯迪富分析師Shlomo Rosenbaum維持買入評級,並將目標價從312美元下調至273美元。

BTIG分析師David Larsen維持買入評級,維持目標價260美元。

加皇資本市場分析師Sean Dodge維持買入評級,維持目標價270美元。

此外,綜合報道,$艾昆緯 (IQV.US)$近期主要分析師觀點如下:

艾偉公司第三季度取得了一些"適度的超額"成績,主要是由於TAS表現強勁,然而,這一積極發展目前正被研發領域的挑戰所掩蓋。這些挑戰包括一項重大取消和將兩項"巨無霸試驗"推遲至2025年。儘管存在這些阻力,但考慮到股價最近下跌,風險/回報比被認爲是有利的。

在艾偉公司Q3報告發布後,市場似乎相對穩定,儘管公司由於延遲和藥物失敗而遇到預訂方面的挑戰,而非來自管線優化所帶來的顯著影響。

公司遇到了具有挑戰性的行業經營環境。公司的評論表明,與藥品組合重新優先排序相關的IRA調整可能即將結束,並且公司似乎能夠從藥品行業向供應商整合的趨勢中受益。

艾偉公司的整體營收、調整後的EBITDA和調整後的EPS超過了共識預期。然而,公司已經削減了在所有指標上對2024年的預測。這一修訂主要歸因於通貨膨脹削減法案和更廣泛的經濟挑戰。此外,R&DS的指導方針已經下調,原因是由於延遲和兩項重大試驗的取消。

該公司表達了對近期CRO市場動態的擔憂。隨着公司的大部分部分呈現緩慢或下降趨勢,人們對於公司的改善部分是否將爲公司做出重大貢獻產生懷疑。

以下爲今日6位分析師對$艾昆緯 (IQV.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

斯迪富分析師Shlomo Rosenbaum維持買入評級,並將目標價從312美元下調至273美元。

斯迪富分析師Shlomo Rosenbaum維持買入評級,並將目標價從312美元下調至273美元。

Stifel analyst Shlomo Rosenbaum maintains with a buy rating, and adjusts the target price from $312 to $273.

Stifel analyst Shlomo Rosenbaum maintains with a buy rating, and adjusts the target price from $312 to $273.