Fujian Green Pine's (SZSE:300132) Earnings Offer More Than Meets The Eye

Fujian Green Pine's (SZSE:300132) Earnings Offer More Than Meets The Eye

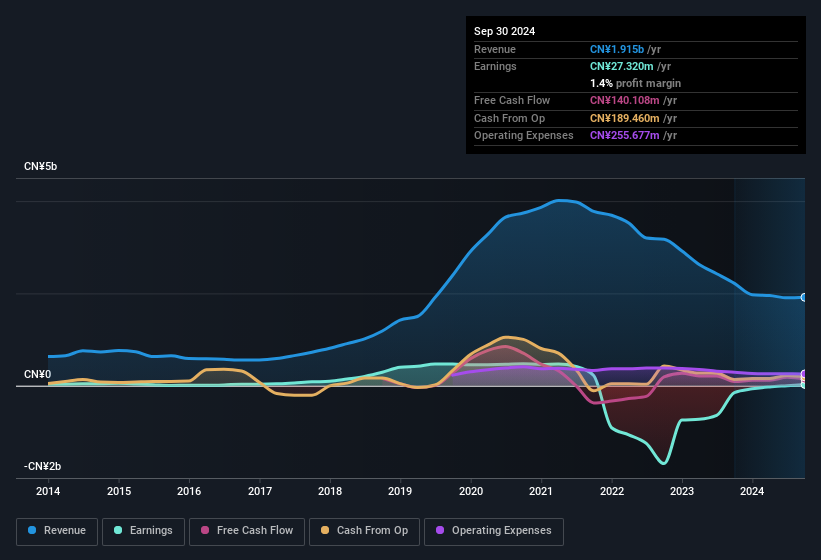

The market seemed underwhelmed by last week's earnings announcement from Fujian Green Pine Co., Ltd. (SZSE:300132) despite the healthy numbers. We did some analysis to find out why and believe that investors might be missing some encouraging factors contained in the earnings.

市場似乎對上週福建青松股份有限公司(SZSE:300132)的業績公告感到不滿,儘管數字健康。 我們進行了一些分析,找出原因,並認爲投資者可能忽略了業績中包含的一些令人鼓舞的因素。

The Impact Of Unusual Items On Profit

除了稀釋之外,還應該注意的是,萬集科技在過去12個月中因不尋常項目獲得了價值人民幣3.5萬元的利潤。雖然我們希望看到利潤增加,但當這些不尋常項目對利潤做出重大貢獻時,我們會更加謹慎。我們對全球大部分上市公司的數據進行了分析,發現不尋常項目往往是一次性的。這正如我們所期望的那樣,因爲這些提升被描述爲"不尋常"。相對於其利潤而言,萬集科技在2021年12月前的不尋常項目貢獻大。因此,我們可以推斷出,這些不尋常項目正在使其財務利潤顯著增強。

Importantly, our data indicates that Fujian Green Pine's profit was reduced by CN¥40m, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. In the twelve months to September 2024, Fujian Green Pine had a big unusual items expense. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

重要的是,我們的數據顯示,由於飛凡的非常規項目,過去一年裏減少了4000萬元人民幣的利潤。 雖然由於非常規項目而扣除的部分令人失望,但也有一線希望。 我們研究了數千家上市公司,發現非常規項目往往是一次性的。 鑑於這些項目被視爲異常,這並不奇怪。 截至2024年9月的十二個月裏,青松股份有一個大額的非常規項目支出。 因此,我們可以推斷,非常規項目使其法定利潤明顯較之前更加脆弱。

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

這可能會讓您想知道分析師對未來盈利能力的預測。幸運的是,您可以單擊此處查看基於其估計的未來盈利能力的互動圖表。

An Unusual Tax Situation

一種不尋常的稅務情況

Just as we noted the unusual items, we must inform you that Fujian Green Pine received a tax benefit which contributed CN¥6.4m to the bottom line. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

正如我們注意到非常規項目一樣,我們必須通知您,青松股份獲得了貢獻640萬元人民幣的稅收收益。 這當然有點不尋常,因爲公司更常見的是繳納稅款而不是獲得稅收益! 我們相信公司對其稅收收益感到高興。 既然它以前虧損,很可能僅僅表明了過去稅收虧損的實現。 然而,我們的數據顯示,稅收收益可能會在確認賬務年度暫時提高法定利潤,但隨後利潤可能會下降。 假設稅收收益每年不重複,我們可能會看到其盈利能力明顯下降,其他條件保持不變。 因此,雖然我們認爲獲得稅收收益很好,但它確實意味着法定利潤過高估計了企業的持續盈利能力。

Our Take On Fujian Green Pine's Profit Performance

我們對青松股份的盈利表現進行分析。

In its last report Fujian Green Pine received a tax benefit which might make its profit look better than it really is on a underlying level. Having said that, it also had a unusual item reducing its profit. Considering all the aforementioned, we'd venture that Fujian Green Pine's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Case in point: We've spotted 1 warning sign for Fujian Green Pine you should be aware of.

在最近的報告中,青松股份獲得了稅收減免,這可能使其利潤在基礎水平上看起來比實際情況要好。 話雖如此,它也有一項不同尋常的項目減少了利潤。 考慮到前述所有情況,我們認爲青松股份的利潤結果是對其真實盈利能力的一個相當不錯的指導,儘管有些保守。 請記住,在分析股票時值得注意涉及的風險。 舉例來說:我們發現了青松股份的1個警示信號,您應該注意。

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

在本文中,我們已經審視了很多可能影響財務數據作爲企業指標的因素。但是還有很多其他方法可以了解公司的信譽。有些人認爲,高淨資產收益率是高質量企業的良好標誌。因此,您可能希望查看這個免費列表,其中包括許多淨資產收益率高的公司,或這個擁有高內部持股的股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

Just as we noted the unusual items, we must inform you that Fujian Green Pine received a tax benefit which contributed CN¥6.4m to the bottom line. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Just as we noted the unusual items, we must inform you that Fujian Green Pine received a tax benefit which contributed CN¥6.4m to the bottom line. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.