Should You Be Adding Ferretti (HKG:9638) To Your Watchlist Today?

Should You Be Adding Ferretti (HKG:9638) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

對於一些投機商來說,投資一家可以扭轉命運的公司是非常具有吸引力的,因此即使是沒有營收、沒有盈利和一再受挫的公司,也能夠找到投資者。但正如彼得·林奇在《華爾街上的勝者》中所說的,『冤大頭幾乎從來不會得到回報。』一個虧損的公司尚未通過盈利證明自己,最終外部資本的流入可能會乾涸。

In contrast to all that, many investors prefer to focus on companies like Ferretti (HKG:9638), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

與此形成鮮明對比的是,許多投資者更喜歡關注像法拉帝(HKG:9638)這樣不僅有營業收入,還有利潤的公司。現在並不是說該公司提供了最佳的投資機會,但盈利能力是業務成功的關鍵組成部分。

How Quickly Is Ferretti Increasing Earnings Per Share?

法拉帝每股收益增長多快?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that Ferretti's EPS has grown 17% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

如果一家公司能夠持續增長每股收益(EPS)足夠長的時間,其股價最終應該會跟隨。這使得EPS增長成爲任何公司吸引人的品質。股東們會很高興地得知,法拉帝的EPS每年以複合增長率17%增長,累計三年。如果這樣的增長繼續下去,那麼股東們將有很多事情可以開心。

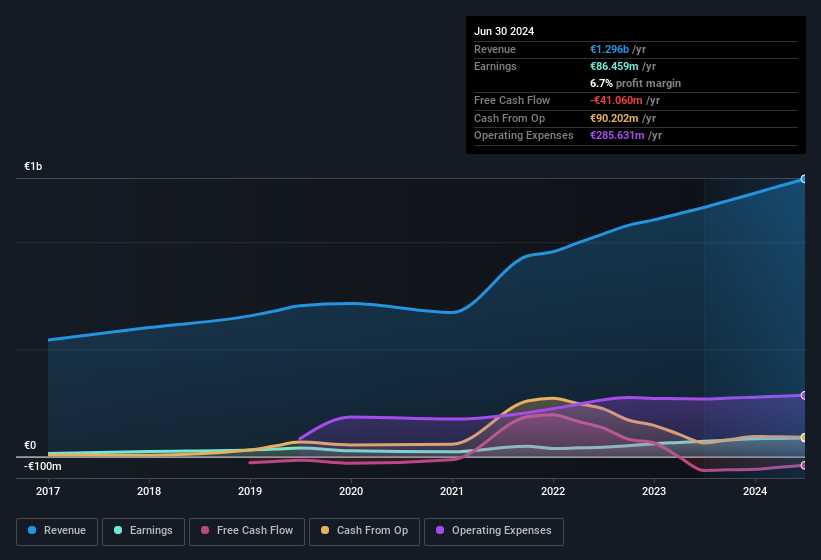

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Ferretti remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to €1.3b. That's progress.

經常有助於查看利息和稅前盈利(EBIT)利潤率,以及營業收入增長,另一個方法來評估公司成長質量。法拉帝的EBIT利潤率在過去一年裏基本保持不變,然而,該公司應該高興地宣佈其營業收入在12%到€13億之間的增長。這是進步。

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

在下面的圖表中,您可以看到公司的盈利和收入隨着時間的推移而增長。要獲得更精細的詳細信息,請單擊圖像。

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Ferretti's future profits.

你不會開車盯着後視鏡,所以你可能更感興趣這份免費報告,展示法拉帝未來利潤的分析師預測。

Are Ferretti Insiders Aligned With All Shareholders?

法拉帝內部人員是否與所有股東一致?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

一家公司的內部關注總是引發一些興趣,許多投資者正在尋找那些內部人士正在將資金投入到實際行動中的公司。因爲內部人士的買入通常意味着那些與公司最親近的人對股價表現充滿信心。但是,內部人士有時也會犯錯,我們並不知道他們購買背後的確切考慮。

The good news for Ferretti is that one insider has illustrated their belief in the company's future with a huge purchase of shares in the last 12 months. In one fell swoop, company insider Karel Komarek, spent HK$15m, at a price of HK$24.49 per share. Seeing such high conviction in the company is a huge positive for shareholders and should instil confidence in their mission.

對於法拉帝來說,一個內部人員在過去12個月大舉購入股份,標誌着他們對公司未來的信心。公司內部人員卡雷爾·科馬雷克一口氣花費了1500萬港幣,以每股24.49港幣的價格購入。看到公司高度信心,這對股東來說是一個巨大的正面信號,並應該在他們的使命中注入信心。

On top of the insider buying, it's good to see that Ferretti insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth €1.4b. That equates to 18% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

除了內部人員的購買,看到法拉帝內部人員在公司有重要投資是件好事。值得注意的是,他們在公司擁有令人羨慕的股份,價值14億歐元。這相當於公司的18%,使內部人員變得強大且與其他股東保持一致。非常令人鼓舞。

Is Ferretti Worth Keeping An Eye On?

法拉帝值得關注嗎?

You can't deny that Ferretti has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. Astute investors will want to keep this stock on watch. Still, you should learn about the 2 warning signs we've spotted with Ferretti (including 1 which is significant).

您不能否認,法拉帝的每股收益增長速度非常令人印象深刻。這很吸引人。此外,在公司股票方面,內部人士擁有重要的股份,其中一位一直在增持。精明的投資者會希望留意這隻股票。不過,您應該了解我們發現的法拉帝的2個警示信號(其中1個很重要)。

The good news is that Ferretti is not the only stock with insider buying. Here's a list of small cap, undervalued companies in HK with insider buying in the last three months!

好消息是,法拉帝不是唯一一家有內部人士買入的股票。以下是在過去三個月內有內部人士買入的港股小盤、被低估的公司列表!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文討論的內部交易是指在相關司法管轄區中報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Ferretti remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to €1.3b. That's progress.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Ferretti remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to €1.3b. That's progress.