Market Might Still Lack Some Conviction On Gaia, Inc. (NASDAQ:GAIA) Even After 27% Share Price Boost

Market Might Still Lack Some Conviction On Gaia, Inc. (NASDAQ:GAIA) Even After 27% Share Price Boost

Despite an already strong run, Gaia, Inc. (NASDAQ:GAIA) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 138% in the last year.

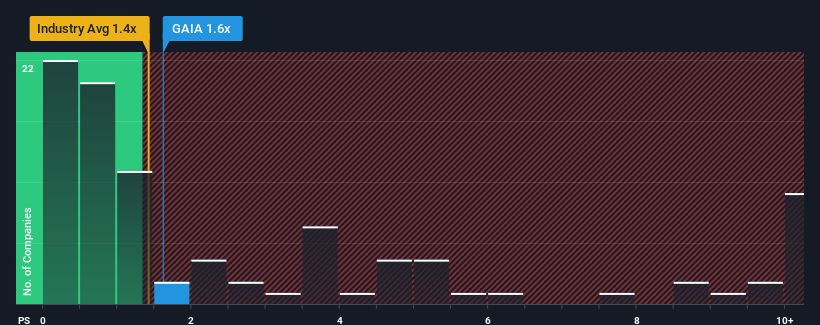

In spite of the firm bounce in price, it's still not a stretch to say that Gaia's price-to-sales (or "P/S") ratio of 1.6x right now seems quite "middle-of-the-road" compared to the Entertainment industry in the United States, where the median P/S ratio is around 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Gaia Has Been Performing

With revenue growth that's inferior to most other companies of late, Gaia has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Gaia will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Gaia?

The only time you'd be comfortable seeing a P/S like Gaia's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Gaia's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 9.3%. The latest three year period has also seen a 12% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 18% over the next year. With the industry only predicted to deliver 12%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Gaia is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Gaia appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Gaia's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Gaia is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.