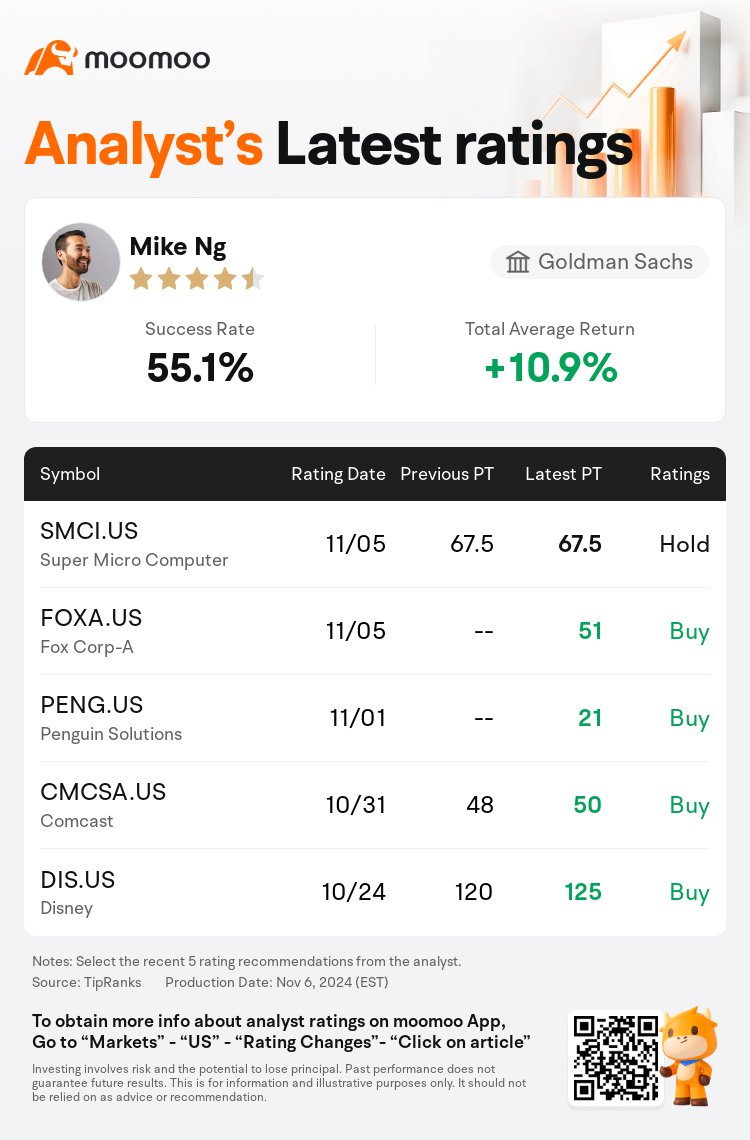

Goldman Sachs analyst Mike Ng maintains $Super Micro Computer (SMCI.US)$ with a hold rating, and maintains the target price at $67.5.

According to TipRanks data, the analyst has a success rate of 55.1% and a total average return of 10.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Super Micro Computer (SMCI.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Super Micro Computer (SMCI.US)$'s main analysts recently are as follows:

The adjustment in the target is indicative of heightened risks to future financial projections following Supermicro's postponement of its annual report and the resignation of its auditor. The analysts note that the company's preliminary results for the first quarter and the forecast for the second quarter fell short due to revenues not meeting expectations. Furthermore, the lack of reaffirmation of revenue guidance suggests that Supermicro could be facing some operational difficulties.

Supermicro's recent performance indicates a miss on September quarter revenue, and expectations suggest a marginal sequential decline in revenue for the December quarter. The company has yet to announce a schedule for filing its annual report as it searches for a new auditor. This absence of clear financial reporting timelines may exert near-term pressure on the stock, alongside the growing concern that Supermicro may not fulfill Nasdaq's listing criteria.

Following Supermicro's announcement about their auditor's resignation, the stock has seen a significant decrease in value. Prevailing concerns over the rationale behind the auditor's decision, the company's capability to submit its 10K, and a rumored investigation by the Department of Justice are likely to overshadow the details of Supermicro's quarterly report and future guidance.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

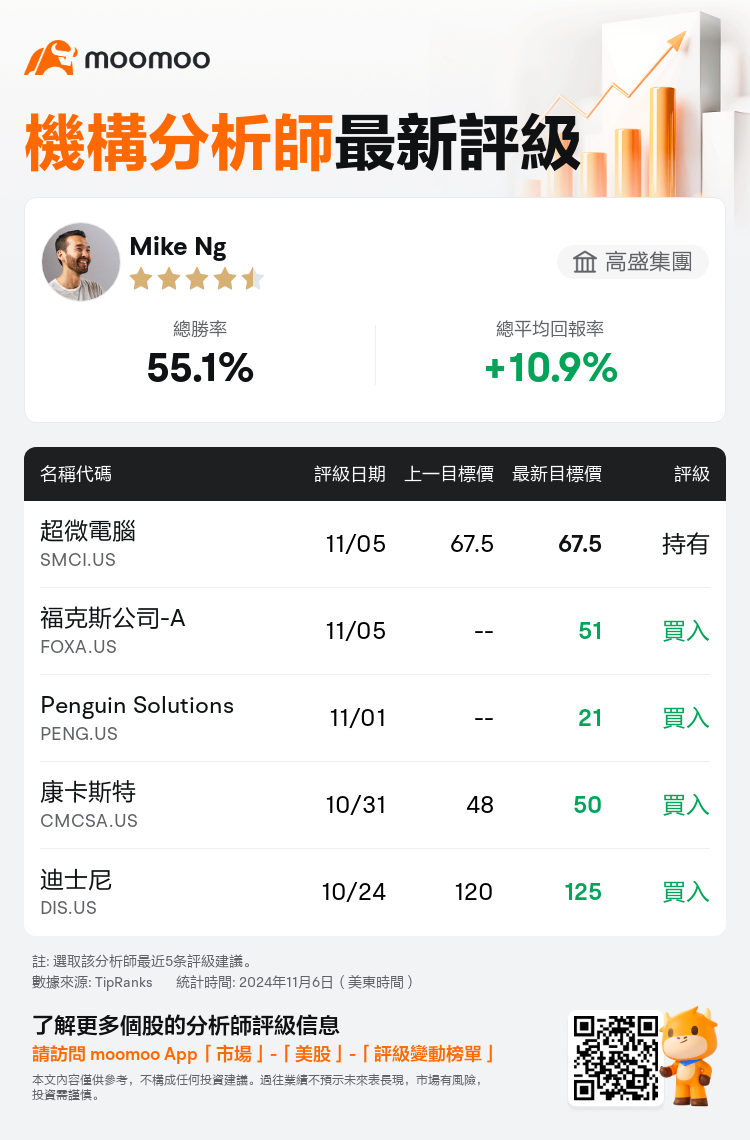

高盛集團分析師Mike Ng維持$超微電腦 (SMCI.US)$持有評級,維持目標價67.5美元。

根據TipRanks數據顯示,該分析師近一年總勝率為55.1%,總平均回報率為10.9%。

此外,綜合報道,$超微電腦 (SMCI.US)$近期主要分析師觀點如下:

此外,綜合報道,$超微電腦 (SMCI.US)$近期主要分析師觀點如下:

目標的調整表明,在Supermicro推遲年度報告和核數師辭職之後,未來財務預測的風險增加。分析師指出,由於收入未達到預期,該公司第一季度的初步業績和第二季度的預測均未達預期。此外,收入指導缺乏重申表明Supermicro可能面臨一些運營困難。

Supermicro最近的表現表明9月份的季度收入有所下降,預期表明12月季度的收入將略有連續下降。該公司在尋找新的核數師時尚未公佈提交年度報告的時間表。這種缺乏明確的財務報告時間表可能會給該股帶來短期壓力,同時人們越來越擔心Supermicro可能無法滿足納斯達克的上市標準。

在Supermicro宣佈其核數師辭職後,該股的價值大幅下跌。對核數師決定背後的理由、該公司提交1萬的能力以及司法部傳聞中的調查的普遍擔憂可能會給Supermicro的季度報告和未來指導的細節蒙上陰影。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$超微電腦 (SMCI.US)$近期主要分析師觀點如下:

此外,綜合報道,$超微電腦 (SMCI.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of