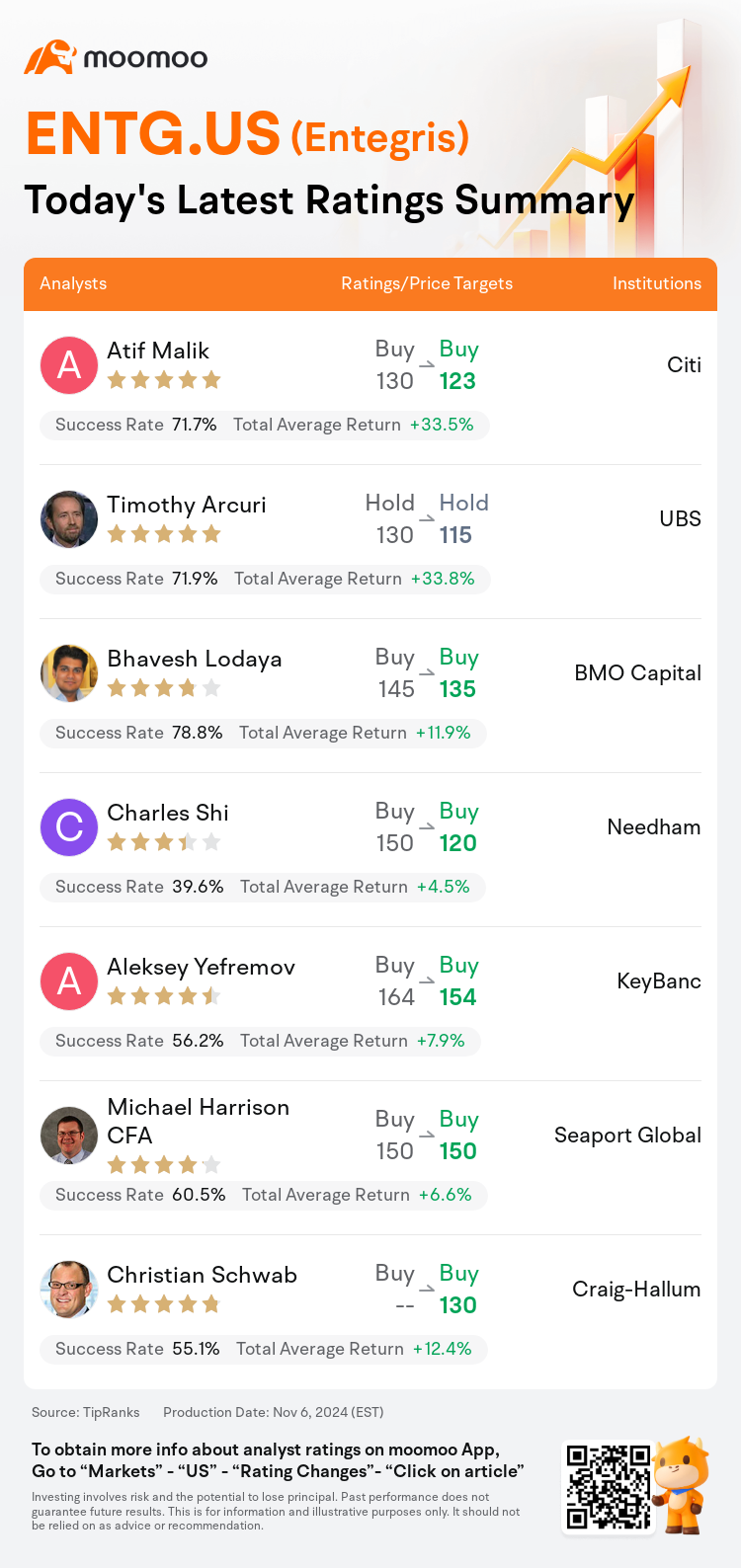

On Nov 06, major Wall Street analysts update their ratings for $Entegris (ENTG.US)$, with price targets ranging from $115 to $154.

Citi analyst Atif Malik maintains with a buy rating, and adjusts the target price from $130 to $123.

UBS analyst Timothy Arcuri maintains with a hold rating, and adjusts the target price from $130 to $115.

BMO Capital analyst Bhavesh Lodaya maintains with a buy rating, and adjusts the target price from $145 to $135.

BMO Capital analyst Bhavesh Lodaya maintains with a buy rating, and adjusts the target price from $145 to $135.

Needham analyst Charles Shi maintains with a buy rating, and adjusts the target price from $150 to $120.

KeyBanc analyst Aleksey Yefremov maintains with a buy rating, and adjusts the target price from $164 to $154.

Furthermore, according to the comprehensive report, the opinions of $Entegris (ENTG.US)$'s main analysts recently are as follows:

Entegris reported softer results than anticipated in mainstream logic, 3D NAND, and discrete supply chain restraints. While estimates have been reduced, the stock retains a 'defensive appeal' according to the analysis.

The recent quarter and outlook for Entegris were deemed generally unsatisfactory, which has prompted a revision of future estimates by approximately 8%-12%. Despite this adjustment reflecting another cyclical reset, which is less than optimal, it is anticipated that investors may not find this update unexpected, considering the context of reports from peers.

The company's Q3 earnings did not meet expectations, and the forward-looking projections also fell short of consensus. Its recent performance mirrors the general state of the semiconductor industry. The anticipated slower pace of outperformance in 2024 is linked to postponed technological/node transitions and the adoption of new materials. However, these factors are likely to come into play by 2025. Alongside anticipated year-over-year improvements in fundamentals, these elements are expected to fuel robust earnings growth for the company.

The company's guidance for EBITDA in the December quarter falls short of the consensus, with the robustness of artificial intelligence-related business being counterbalanced by a softness in the semiconductor sector, according to an analyst.

Entegris's performance in the second half of the year did not meet expectations, primarily due to diminished demand in 3D NAND and mainstream logic. Overall, this year has been characterized as 'fairly disappointing' for the industry, with ongoing revisions to growth expectations from various quarters.

Here are the latest investment ratings and price targets for $Entegris (ENTG.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

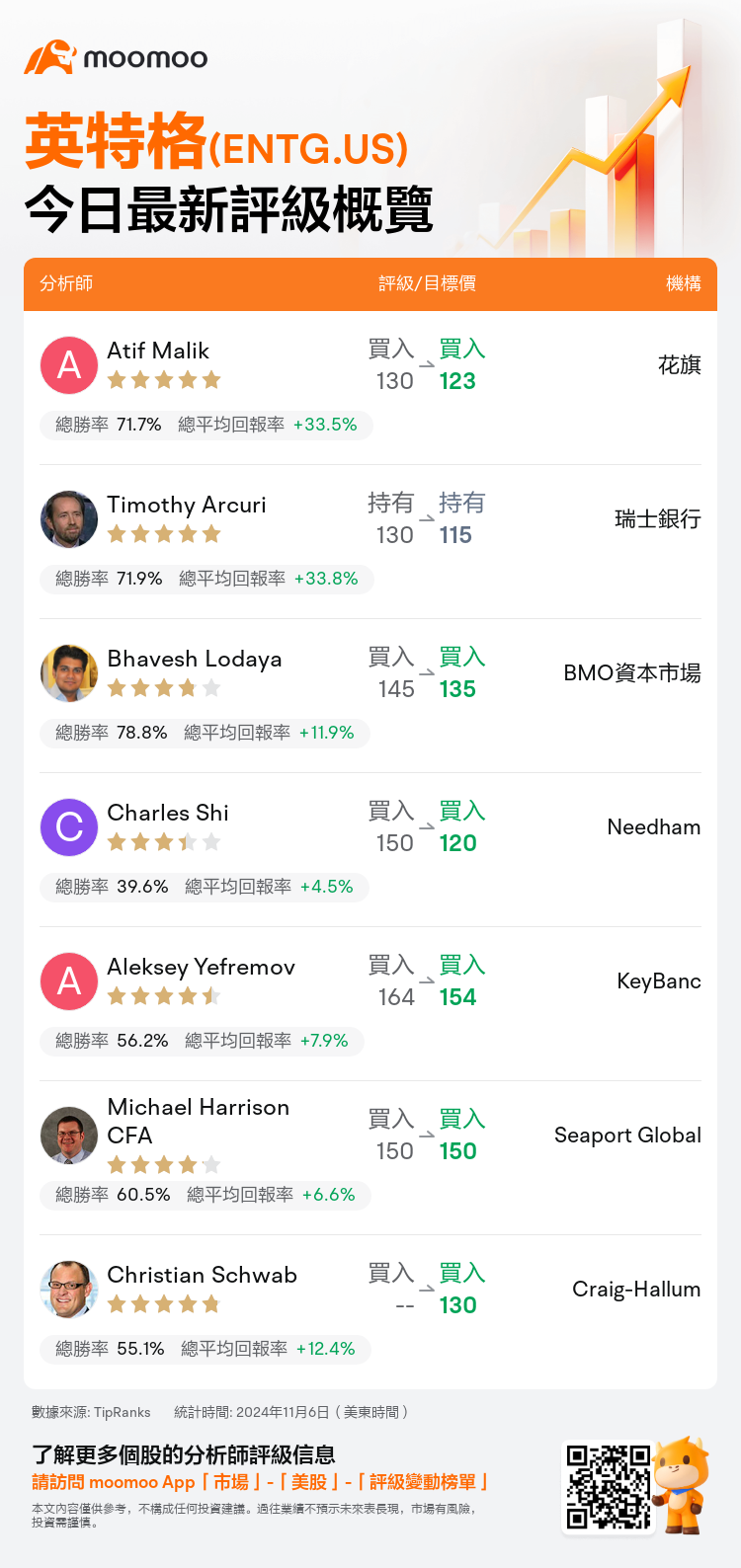

美東時間11月6日,多家華爾街大行更新了$英特格 (ENTG.US)$的評級,目標價介於115美元至154美元。

花旗分析師Atif Malik維持買入評級,並將目標價從130美元下調至123美元。

瑞士銀行分析師Timothy Arcuri維持持有評級,並將目標價從130美元下調至115美元。

BMO資本市場分析師Bhavesh Lodaya維持買入評級,並將目標價從145美元下調至135美元。

BMO資本市場分析師Bhavesh Lodaya維持買入評級,並將目標價從145美元下調至135美元。

Needham分析師Charles Shi維持買入評級,並將目標價從150美元下調至120美元。

KeyBanc分析師Aleksey Yefremov維持買入評級,並將目標價從164美元下調至154美元。

此外,綜合報道,$英特格 (ENTG.US)$近期主要分析師觀點如下:

英特格的業績較預期表現較弱,主流邏輯、3D NAND和分立供應鏈受到限制。儘管預估已經下調,但根據分析,該股仍具有「防禦吸引力」。

英特格最近的季度業績和展望被普遍視爲不盡如人意,這促使未來預估大約調整了8%-12%。儘管這一調整反映了另一次週期性重置,不太理想,但預計投資者可能不會對這一更新感到意外,考慮到同行報告的背景。

該公司第三季度的盈利未達預期,並且前瞻性預測也遜於共識。其最近的表現反映了半導體行業的整體狀態。預計2024年超越表現速度的放緩與技術/節點轉換的延遲和新材料的採用有關。然而,這些因素可能在2025年前後開始發揮作用。除了預期的基本面年度改善外,這些因素預計將推動該公司強勁的盈利增長。

該公司在12月季度的EBITDA指導不及共識,人工智能相關業務的強勁性被一位分析師認爲是半導體行業板塊疲軟的平衡因素。

英特格今年下半年的表現未達預期,主要是由於3D NAND和主流邏輯需求減弱。總體而言,今年被描述爲行業「相當令人失望」,各方對增長預期持續修訂。

以下爲今日7位分析師對$英特格 (ENTG.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

BMO資本市場分析師Bhavesh Lodaya維持買入評級,並將目標價從145美元下調至135美元。

BMO資本市場分析師Bhavesh Lodaya維持買入評級,並將目標價從145美元下調至135美元。

BMO Capital analyst Bhavesh Lodaya maintains with a buy rating, and adjusts the target price from $145 to $135.

BMO Capital analyst Bhavesh Lodaya maintains with a buy rating, and adjusts the target price from $145 to $135.