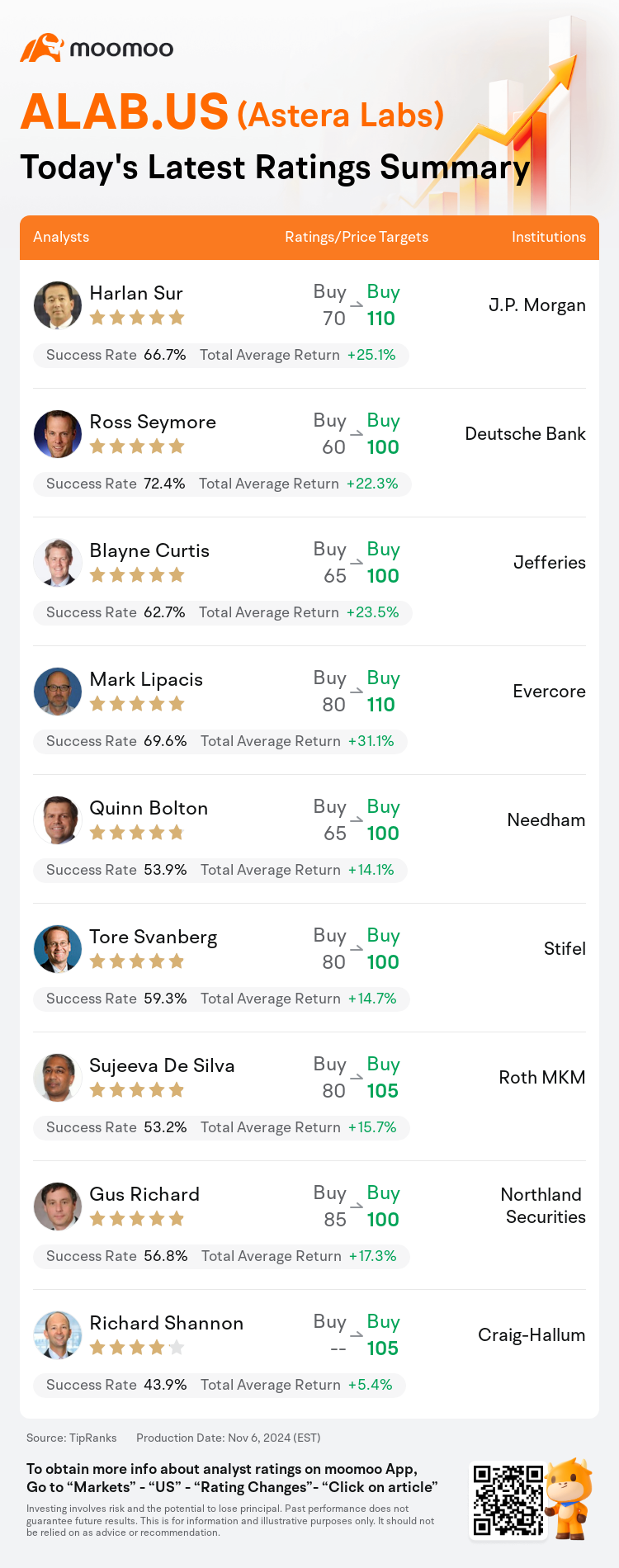

On Nov 06, major Wall Street analysts update their ratings for $Astera Labs (ALAB.US)$, with price targets ranging from $100 to $110.

J.P. Morgan analyst Harlan Sur maintains with a buy rating, and adjusts the target price from $70 to $110.

Deutsche Bank analyst Ross Seymore maintains with a buy rating, and adjusts the target price from $60 to $100.

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $65 to $100.

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $65 to $100.

Evercore analyst Mark Lipacis maintains with a buy rating, and adjusts the target price from $80 to $110.

Needham analyst Quinn Bolton maintains with a buy rating, and adjusts the target price from $65 to $100.

Furthermore, according to the comprehensive report, the opinions of $Astera Labs (ALAB.US)$'s main analysts recently are as follows:

Astera Labs has exhibited a robust increase in revenue this quarter, surpassing the performance in the initial two quarters post-IPO. This uptick is credited to strong sales from GPU platforms, augmented by new ASIC processors and the growth of its second product line. Additionally, there is increasing clarity regarding the anticipated advancements of the third and fourth product lines slated for the latter half of 2025.

Astera Labs has seen another quarter of positive performance attributed to Aries, setting the stage for a promising year ahead, which is expected to be led by Scorpio and Gen 6 developments.

Following 'another impressive beat and raise' in the fourth quarter, analysts continue to recommend buying, as estimates have been increased due to sustained momentum for Aries retimers across both GPU and ASIC programs. The acceleration of 400G deployments for Taurus and the expected ramp-up of Scorpio switch revenues in the second half of 2025, contributing to 10% of overall revenues next year, are also highlighted.

Astera Labs has been recognized for its robust performance in Q3 and an optimistic projection for Q4. The company's revenue trajectory is expected to diversify and maintain high visibility into the year 2025, bolstered by a range of products and increasing content with a diverse customer base.

Here are the latest investment ratings and price targets for $Astera Labs (ALAB.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

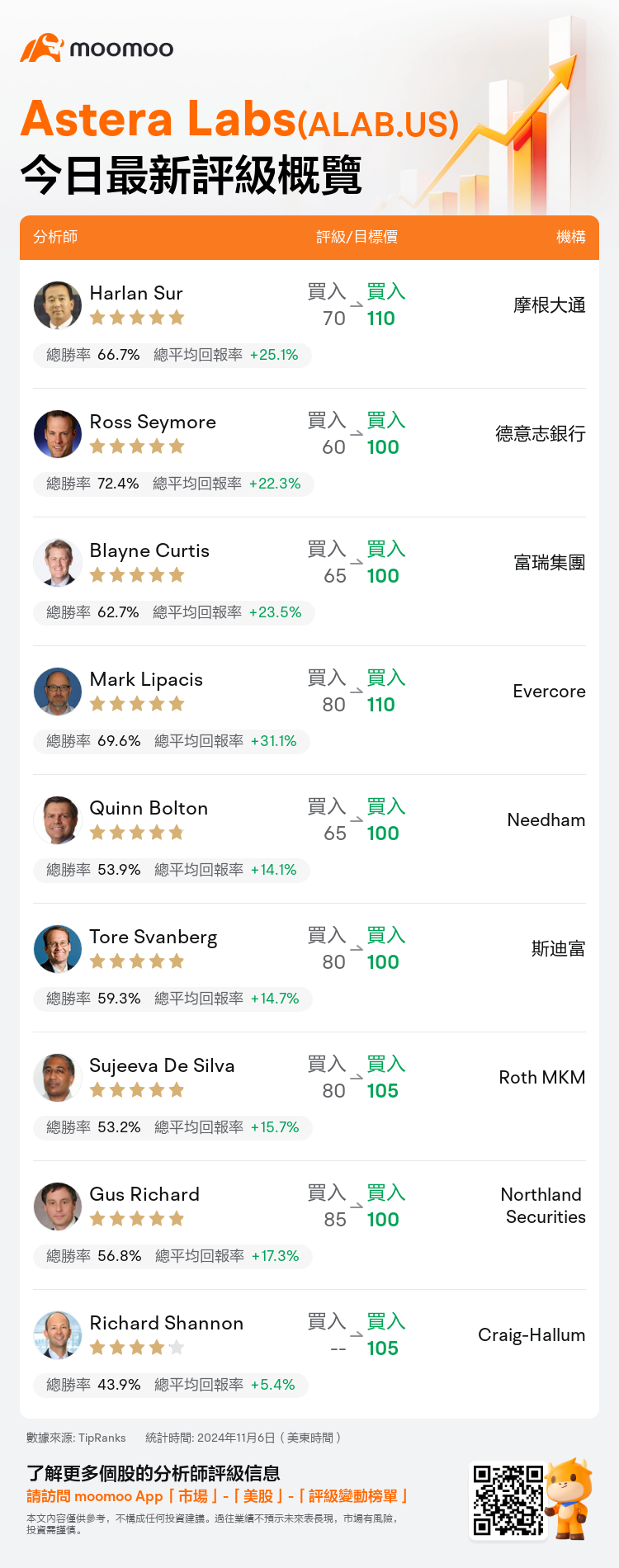

美東時間11月6日,多家華爾街大行更新了$Astera Labs (ALAB.US)$的評級,目標價介於100美元至110美元。

摩根大通分析師Harlan Sur維持買入評級,並將目標價從70美元上調至110美元。

德意志銀行分析師Ross Seymore維持買入評級,並將目標價從60美元上調至100美元。

富瑞集團分析師Blayne Curtis維持買入評級,並將目標價從65美元上調至100美元。

富瑞集團分析師Blayne Curtis維持買入評級,並將目標價從65美元上調至100美元。

Evercore分析師Mark Lipacis維持買入評級,並將目標價從80美元上調至110美元。

Needham分析師Quinn Bolton維持買入評級,並將目標價從65美元上調至100美元。

此外,綜合報道,$Astera Labs (ALAB.US)$近期主要分析師觀點如下:

Astera Labs在本季度的營業收入大幅增長,超過了上市後最初兩個季度的表現。這一增長歸功於gpu芯片-雲計算平台的銷售增長,得益於新的ASIC處理器和第二產品線的增長。此外,對於預期中的2025年下半年的第三和第四產品線的預期進展有了更清晰的認識。

Astera Labs在另一個季度取得了正面業績,這要歸功於Aries,爲預期領先的Scorpio和Gen 6發展奠定了基礎,展望未來一年充滿了希望。

在第四季度取得'另一個令人印象深刻的超預期'後,分析師繼續推薦購買,因爲由於Aries retimers在gpu芯片-雲計算和ASIC項目中持續增長,預測已經提高。Taurus的400G部署加速和預期中Scorpio交換機的營收在2025年下半年增長,貢獻了明年整體營收的10%。

Astera Labs在Q3表現出色,並對Q4持樂觀態度。公司的收入軌跡預計將多樣化,並保持對2025年的高度可見性,得益於一系列產品和與不斷增長的多樣化客戶群之間內容的增加。

以下爲今日9位分析師對$Astera Labs (ALAB.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富瑞集團分析師Blayne Curtis維持買入評級,並將目標價從65美元上調至100美元。

富瑞集團分析師Blayne Curtis維持買入評級,並將目標價從65美元上調至100美元。

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $65 to $100.

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $65 to $100.