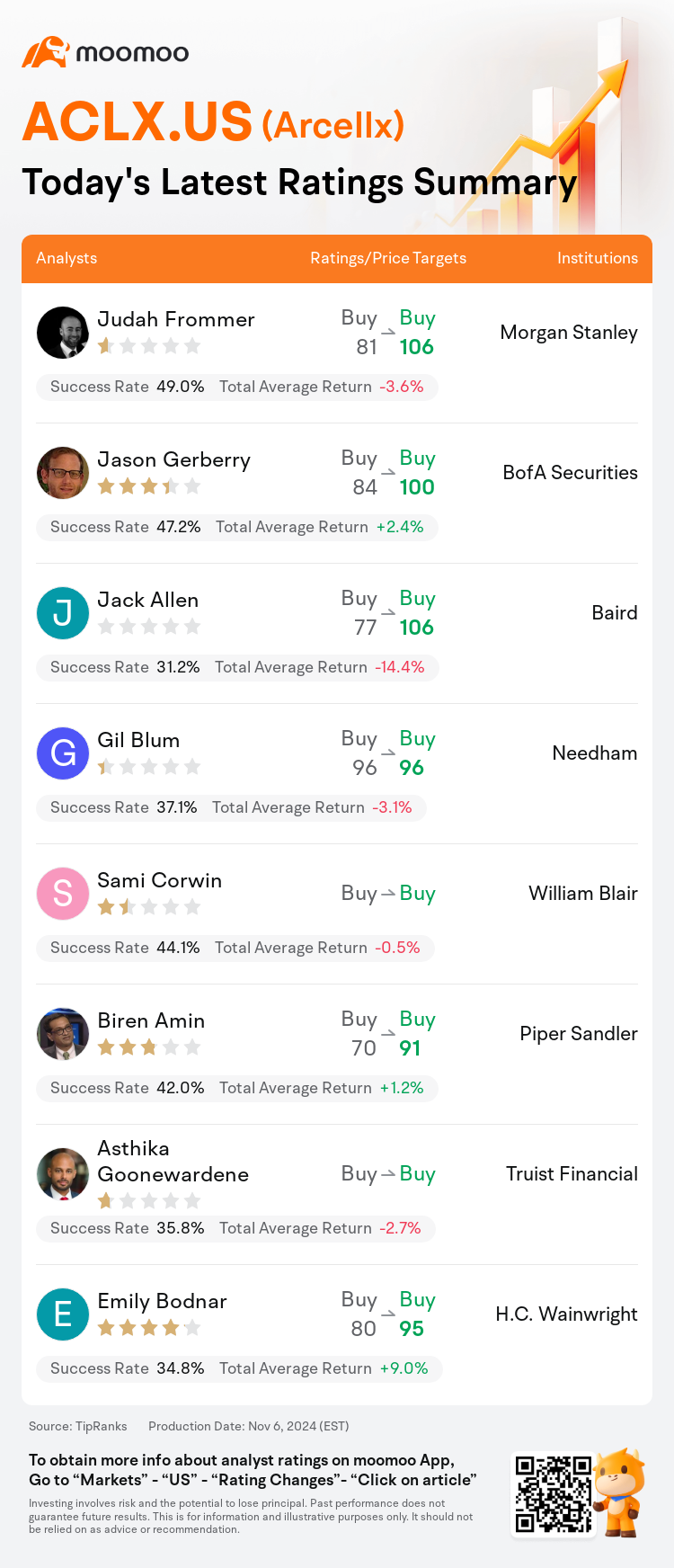

On Nov 06, major Wall Street analysts update their ratings for $Arcellx (ACLX.US)$, with price targets ranging from $91 to $106.

Morgan Stanley analyst Judah Frommer maintains with a buy rating, and adjusts the target price from $81 to $106.

BofA Securities analyst Jason Gerberry maintains with a buy rating, and adjusts the target price from $84 to $100.

Baird analyst Jack Allen maintains with a buy rating, and adjusts the target price from $77 to $106.

Baird analyst Jack Allen maintains with a buy rating, and adjusts the target price from $77 to $106.

Needham analyst Gil Blum maintains with a buy rating, and maintains the target price at $96.

William Blair analyst Sami Corwin maintains with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $Arcellx (ACLX.US)$'s main analysts recently are as follows:

The expectations for Arcellx's anito-cel have been enhanced due to the promising initial results from the iMMagine-1 Phase 2 trial involving relapsed/refractory multiple myeloma patients. There is a considerable opportunity for market share capture, starting with treatment in later-stage patients and potentially extending to earlier stages if the current clinical outcomes are maintained.

Recent abstracts presenting initial Phase 2 data and extended Phase 1 data reinforce the pivotal-stage anito-cel's solid profile and its regulatory standing in the treatment of multiple myeloma. Despite a dip in share value, this could be interpreted as a 'sell the news' reaction following a substantial pre-abstract appreciation. It is now anticipated that anito-cel will secure a more significant share of the peak market and has increased chances of success.

The firm expressed incremental optimism following the release of updated clinical data. The publication of ASH abstracts, which included initial data from the registrational IMMagine-1 study, contributed to this positive outlook.

Here are the latest investment ratings and price targets for $Arcellx (ACLX.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

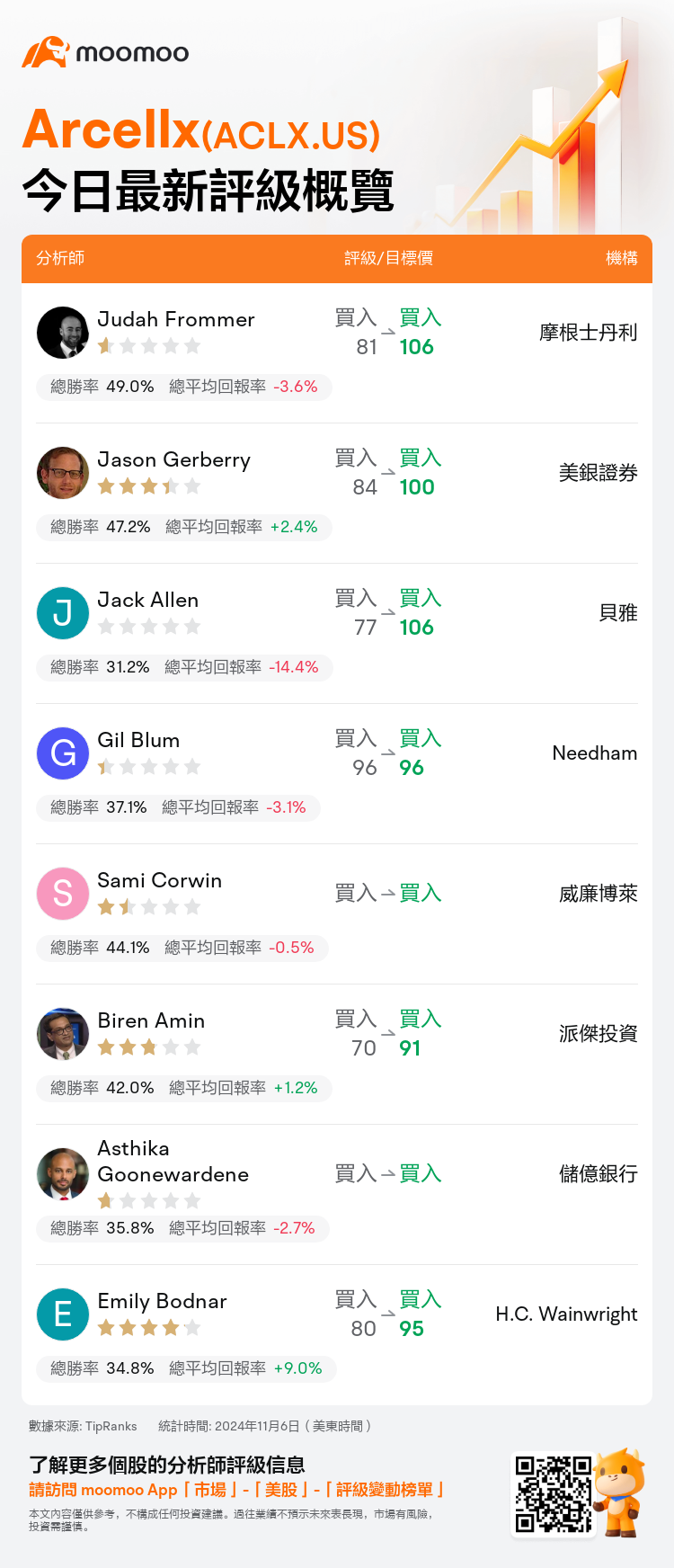

美東時間11月6日,多家華爾街大行更新了$Arcellx (ACLX.US)$的評級,目標價介於91美元至106美元。

摩根士丹利分析師Judah Frommer維持買入評級,並將目標價從81美元上調至106美元。

美銀證券分析師Jason Gerberry維持買入評級,並將目標價從84美元上調至100美元。

貝雅分析師Jack Allen維持買入評級,並將目標價從77美元上調至106美元。

貝雅分析師Jack Allen維持買入評級,並將目標價從77美元上調至106美元。

Needham分析師Gil Blum維持買入評級,維持目標價96美元。

威廉博萊分析師Sami Corwin維持買入評級。

此外,綜合報道,$Arcellx (ACLX.US)$近期主要分析師觀點如下:

Arcellx的anito-cel的預期受到了iMMagine-1第2階段試驗中復發/難治性多發性骨髓瘤患者的有希望的初步結果的提升。從治療晚期患者開始,有很大機會佔領市場份額,如果當前的臨床結果得到保持,還有可能延伸到早期階段。

最近的摘要展示了初步第2階段數據和擴展第1階段數據,進一步強化了關鍵階段的anito-cel的可靠性以及在多發性骨髓瘤治療中的監管地位。儘管股價出現下跌,這可能被解釋爲在實質性摘要之前有所漲價後的「賣出資訊」反應。現在預計anito-cel將佔據更大的市場份額並且成功機會增加。

該公司在更新的臨床數據發佈後表示了增量樂觀。包括來自注冊IMMagine-1研究的初步數據在內的ASH摘要的發表 contributed to this positive outlook.

以下爲今日8位分析師對$Arcellx (ACLX.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

貝雅分析師Jack Allen維持買入評級,並將目標價從77美元上調至106美元。

貝雅分析師Jack Allen維持買入評級,並將目標價從77美元上調至106美元。

Baird analyst Jack Allen maintains with a buy rating, and adjusts the target price from $77 to $106.

Baird analyst Jack Allen maintains with a buy rating, and adjusts the target price from $77 to $106.